We all have that one friend who insists on reminding us of every little favor they’ve done for us—kind of like your payment history with NJMCDirect. But unlike that friend, understanding your payment history with NJMCDirect can actually save you from getting a ticket (or a guilt trip). So buckle up, because we’re about to take a ride through the wildly entertaining world of paying your traffic fines online!

Payment History Overview

So, you wanna know about your payment history? Well, buckle up because we’re about to take a wild ride through the ups and downs of your financial past!

First things first, let’s talk about those on-time payments. You’ve been knocking it out of the park with those timely transactions. Your credit score is probably giving you a standing ovation right about now!

Now, onto the not-so-great news. **Late payments**. We’ve all been there, staring at that bill in disbelief as the due date zips past like a fiery comet. But hey, we won’t dwell on the past. Let’s learn from those mistakes and make sure they don’t happen again!

And finally, let’s take a moment to appreciate those **perfect payment streaks**. You know, those months when you paid every bill on time, in full, like a boss. Give yourself a pat on the back and maybe even treat yourself to a little something special. You’ve earned it!

Viewing Your Payment Records

So you’ve got a curious itch to dive into the mesmerizing world of payment records, eh? Well, grab your detective hat and magnifying glass because we’re about to embark on a thrilling journey through the treasure trove of your payment history!

First things first, buckle up and prepare to uncover the mysteries of your past transactions. Your journey begins with a simple click on the “Payment Records” tab, where a magical portal to financial enlightenment awaits. It’s like stepping into a time machine, but instead of traveling through centuries, you’re voyaging through dollars and cents.

Once you’ve entered this enchanted realm of payment records, you’ll be greeted with a dazzling array of information laid out before you. Brace yourself for a whirlwind of dates, amounts, and transaction details that will make your head spin faster than a roulette wheel in Vegas.

But fear not, intrepid explorer! With a keen eye for detail and a touch of boldness, you’ll navigate through this maze of financial data like a seasoned pro. Who knew that viewing payment records could be such a riveting adventure? So go ahead, dive in, and uncover the secrets hidden within your payment history!

Understanding Payment Dates

Payment dates can be confusing, like trying to decipher an ancient hieroglyphic message from a mysterious civilization. But fear not, fellow humans, for I am here to shed some light on this dark and twisty path of financial jargon.

First things first, let’s talk about the due date. This is the day when your payment is DUE. It’s like a deadline, except instead of a school paper, it’s your hard-earned cash that’s on the line. And let’s be real, no one wants to incur those pesky late fees.

Next up, we have the processing date. This is the day when the financial wizardry happens behind the scenes. It’s like the sorting hat in Harry Potter, but instead of Gryffindor or Slytherin, it’s deciding if your payment goes through smoothly or gets stuck in some digital purgatory.

And finally, we come to the magical unicorn of payment dates – the early payment discount. Yes, you heard that right. Some companies actually reward you for being ahead of the game. So, if you’re feeling extra spicy and want to save some moolah, consider making that payment early and bask in the glow of financial responsibility.

Identifying Payment Methods

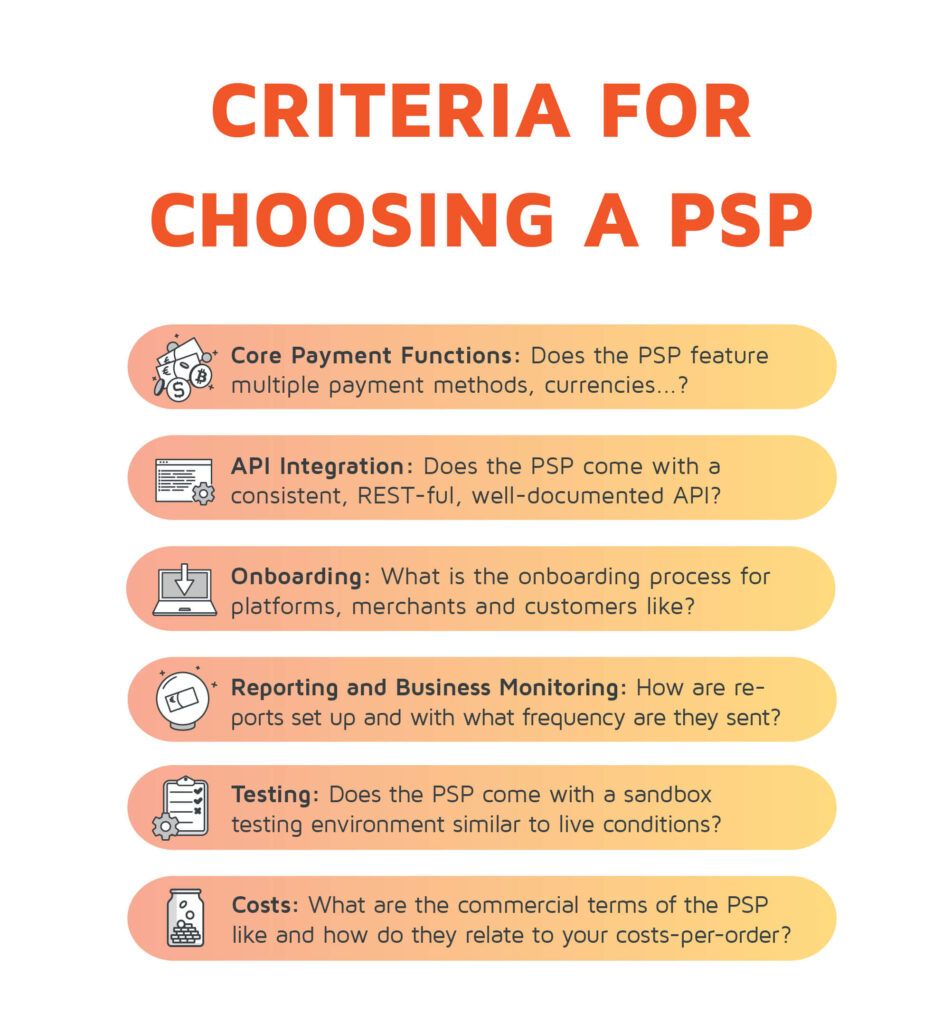

So, you’ve decided to launch your own online store and now you’re faced with the daunting task of . Don’t worry, we’ve got you covered with some amusing insights to help you navigate the digital payment world!

First things first, it’s important to consider what payment methods your target audience prefers. Are they all about the convenience of Apple Pay or do they prefer the old school method of mailing in a check? Remember, you want to make it as easy as possible for customers to give you their hard-earned cash!

Next, it’s time to get down to the nitty-gritty of payment processing fees. Those pesky fees can really add up, so make sure you shop around for the best rates. Whether you choose PayPal, Stripe, or good ol’ fashioned credit cards, it’s important to factor in these costs to ensure your bottom line remains healthy.

And last but not least, don’t forget about security! In this digital age, cyber thieves are lurking around every corner waiting to pounce on unsuspecting online businesses. Make sure your payment methods are secure and encrypted to protect both your customers and your precious profits. After all, you don’t want to wake up to find your bank account drained by a crafty hacker!

Reviewing Payment Statuses

So, you want to review payment statuses, huh? Buckle up, because this is where the real fun begins! First things first, let’s talk about those pesky “Pending” payments. They’re like that one friend who never quite commits to plans – you never know if they’re actually going to follow through.

Next up, we have the “Processing” payments. It’s like watching a loading bar that never seems to reach 100%. You’re left wondering if your money is trapped in some digital limbo, never to be seen again.

Oh, and let’s not forget about those glorious “Completed” payments. It’s like winning the lottery, except it’s just your regular paycheck. But hey, money is money, right?

Finally, we have the dreaded ”Failed” payments. They’re the ones that make you question every life decision you’ve ever made. Was it something you said? Did you offend the payment gods? Who knows, but now you’re back to square one.

Tracking Payment Confirmations

So, you’ve finally reached the point where you’re . Congratulations! You’re officially in the big leagues now. No more playing around with Monopoly money – you’re dealing with the real stuff.

But don’t worry, doesn’t have to be a daunting task. Just follow these simple steps:

- Check Your Email: The first place to look for payment confirmations is your email inbox. Sometimes they like to play hide and seek, so be sure to check your spam folder too.

- Refresh Your Bank Account: Log in to your bank account online and hit that refresh button like your life depends on it. The sooner you see that confirmation, the sooner you can breathe easy.

- Dance a Jig: Once you’ve received the payment confirmation, celebrate in style. Whether it’s a little shimmy at your desk or a full-on dance party in your living room, you deserve it.

Remember, is just one small step in the grand scheme of things. So don’t stress too much about it. As long as the money lands in your account, you’re golden!

Analyzing Payment Trends

When it comes to , there are a few key factors that we need to consider. First and foremost, let’s talk about the rise of contactless payments. With the ongoing pandemic, people are more wary about touching physical money, leading to a surge in contactless transactions. So, if you’re still carrying around a wad of cash, maybe it’s time to make the switch to tap and pay!

Another interesting trend that we’ve noticed is the increasing popularity of mobile wallets. Whether you’re team Apple Pay, Google Pay, or Samsung Pay, it’s clear that people are loving the convenience of paying with just a tap of their phone. Plus, who doesn’t want to feel like a spy whipping out their phone to make a payment?

And let’s not forget about the rise of buy now, pay later services. With companies like Afterpay and Klarna on the rise, it’s easier than ever to splurge on that designer handbag without feeling the pinch upfront. Sure, you might end up with a few extra payments to make, but hey, who needs savings anyway?

FAQs

What happens if I miss a payment on NJMCDirect?

Well, missing a payment on NJMCDirect is like missing a birthday party – your wallet might get a little lighter and you’ll probably feel a pang of regret. But fear not, you can always log back into NJMCDirect and make that payment before things get too out of hand.

Can I view my payment history on NJMCDirect?

Of course! Think of it like your personal financial time capsule – you can see all the times you’ve paid those pesky traffic tickets and maybe even relive the thrill of finally getting that parking ticket off your record. Just log in, click around, and voila - your payment history is right there for you to behold.

What do I do if I notice an error in my payment history on NJMCDirect?

Ah, the classic case of mistaken payment identity. If you spot an error in your payment history on NJMCDirect, don’t panic! Just reach out to their customer service team and let them know what’s up. They’ll help you sort it out faster than you can say “I swear I paid that ticket!”

How can understanding my payment history on NJMCDirect help me avoid future ticket mishaps?

Ah, a savvy shopper indeed! By keeping a close eye on your payment history with NJMCDirect, you can identify any recurring patterns or issues that might be causing those pesky parking tickets to stack up. Plus, you’ll have a solid record of your payments to show off to your friends – instant street cred!

Don’t Let Your Payment History Haunt You!

So there you have it, folks! Understanding your payment history with NJMCDirect doesn’t have to be a scary ordeal. Just remember to stay on top of your fines and fees, and you’ll be cruising down the road to financial freedom in no time.

So next time you log onto NJMCDirect to pay your tickets, just think of it as one small step towards keeping those pesky parking tickets from coming back to haunt you. And always remember, a clean payment history is a happy payment history!

Now go forth, dear readers, and conquer your payment history with confidence and a touch of humor. And remember, if all else fails, just blame it on the guy who parked too close to the curb. Happy paying!