Welcome to the wild and wacky world of New Jersey‘s Chapter 13 bankruptcy process. Picture this: you’re sailing through the stormy seas of debt, trying to navigate your way to financial freedom. But fear not, my friends, because we’re here to guide you through the murky waters of bankruptcy law with a sprinkle of humor and a dash of sarcasm. So buckle up, grab your life preserver (or calculator), and let’s set sail on this quirky adventure to debt relief in the Garden State.

Overview of Chapter 13 Bankruptcy in New Jersey

So, you’ve found yourself drowning in debt in the Garden State of New Jersey, huh? Well, lucky for you, there’s a light at the end of the tunnel in the form of Chapter 13 bankruptcy. Let’s break it down for you in a way that even those Jersey Shore cast members could understand.

First off, Chapter 13 bankruptcy is like a financial makeover for your wallet. It allows you to reorganize your debts and come up with a manageable payment plan over a period of 3-5 years. Think of it as the Snooki of bankruptcy options – loud, flashy, and surprisingly effective.

With Chapter 13 bankruptcy, you get to keep your house, car, and other assets while still getting a chance to pay off your debts. It’s like having your cake and eating it too, Jersey-style. Plus, you’ll have the court-appointed trustee to oversee your repayment plan, kind of like having your own personal financial coach (without all the hairspray).

So, if you’re feeling overwhelmed by your debts in New Jersey, don’t fret. Chapter 13 bankruptcy is here to save the day. Just remember, this is Jersey – we handle our money problems just like we handle our pizza slices: with confidence, determination, and maybe a little sprinkle of parmesan.

Eligibility Requirements for Filing Chapter 13 Bankruptcy in New Jersey

So you’re thinking about filing for Chapter 13 bankruptcy in the Garden State? Well, before you go ahead and make that big decision, let’s talk about some of the eligibility requirements you’ll need to meet first.

First off, you’ll need to have a steady income. This doesn’t mean you have to be rolling in the dough like a top hat-wearing Monopoly man, but you do need to show that you have enough income to make regular payments towards your debts. So if you’ve been living off ramen noodles and tap water for the past few years, you might want to reconsider.

Next up, you’ll need to have a manageable amount of debt. Sure, we all have our fair share of financial skeletons in the closet, but if your debt is so massive that it could rival the national debt, Chapter 13 might not be the best option for you. Remember, this isn’t a get-out-of-jail-free card…

Lastly, you’ll need to have completed credit counseling within 180 days before filing for bankruptcy. Think of it as a crash course in financial responsibility – just without the cap and gown. So make sure you brush up on your money management skills before diving headfirst into the world of Chapter 13 bankruptcy.

Understanding the Chapter 13 Repayment Plan Process

So, you’ve found yourself knee-deep in debt and thinking about Chapter 13 bankruptcy. Well, strap in, because you’re in for a wild ride through the repayment plan process! But fear not, my financially challenged friend, for I am here to guide you through this confusing maze of legal jargon and paperwork.

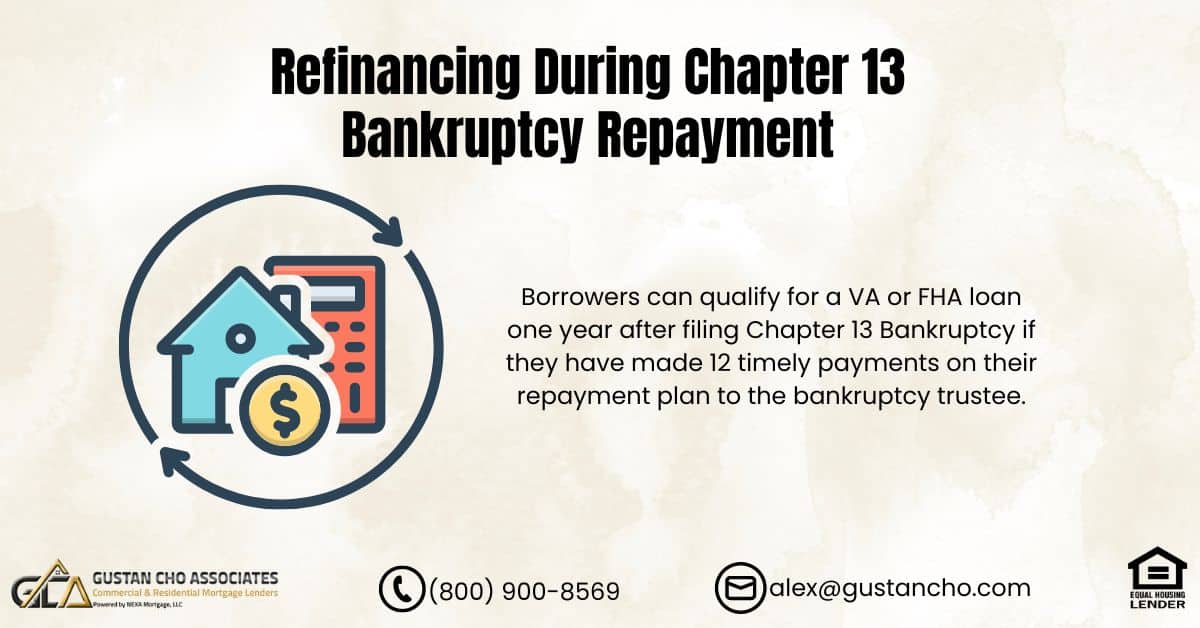

First things first, you’ll need to work with your bankruptcy attorney to create a repayment plan that suits your financial situation. This plan will outline how much you’ll be paying each month to your creditors over a 3 to 5-year period. It’s like creating a budget, but with a lot more legalese and less room for impulse buys.

Once your repayment plan is approved by the court, you’ll start making payments to a trustee, who will then distribute the funds to your creditors. It’s like having a financial middleman, but without the shady suit and briefcase full of cash (unfortunately).

Throughout this process, it’s important to stick to your repayment plan like glue (or like that stray piece of gum that somehow made its way onto your shoe). Missed payments could result in the court dismissing your case, leaving you back at square one. So, buckle up, stay organized, and keep your eyes on the prize of financial freedom at the end of this chaotic rollercoaster ride!

Working with a Bankruptcy Attorney in New Jersey

So you’ve found yourself in a bit of a financial pickle, huh? Not to worry, we’ve all been there. But before you start panic-eating ramen noodles for every meal, consider to help get you back on track.

Here are a few reasons why hiring a bankruptcy attorney is a good idea:

- Legal Expertise: Unless you’re a lawyer yourself (in which case, why are you reading this?), you probably don’t know the ins and outs of bankruptcy law. Let the professionals handle it.

- Peace of Mind: Trying to navigate the murky waters of bankruptcy on your own can be stressful. Letting a bankruptcy attorney take the reins can help ease your mind and allow you to focus on more important things, like planning your post-bankruptcy vacation to the Bahamas.

Plus, think of all the time you’ll save by not having to research bankruptcy laws and procedures yourself. You could use that time to finally finish that 1000-piece puzzle that’s been sitting on your dining room table for the past six months.

Dealing with Creditors and the Court during Chapter 13 Bankruptcy

When , it’s important to approach the situation with confidence and a sense of humor. Remember, you’re taking control of your finances and working towards a fresh start!

Here are some tips to navigate this process smoothly:

- Communication is key: Keep lines of communication open with your creditors and the court. Let them know your plan and stay in touch throughout the process.

- Stay organized: Keep track of all correspondence, paperwork, and deadlines. A well-organized filing system can save you a lot of headaches in the long run.

- Follow the rules: Make sure you comply with all court requirements and deadlines. By staying on top of tasks, you’ll show your commitment to the process and increase your chances of a successful outcome.

Remember, Chapter 13 bankruptcy is a tool to help you gain control of your financial situation. By approaching it with a positive attitude and a game plan, you can navigate this process successfully and emerge on the other side with a clean slate.

Successfully Completing Chapter 13 Bankruptcy and Rebuilding Credit in New Jersey

So, you’ve finally completed Chapter 13 bankruptcy in New Jersey, congratulations! Now it’s time to start rebuilding your credit and getting on the road to financial freedom.

Here are some tips to help you navigate the post-bankruptcy world:

- Check your credit report regularly: Make sure all your past debts are properly marked as discharged. Keep an eye out for any errors that could be dragging down your score.

- Start small: Consider getting a secured credit card to help rebuild your credit. Use it responsibly and pay off the balance in full each month to show creditors you can handle credit responsibly.

- Establish a budget: Get a handle on your finances and create a budget that works for you. This will help you avoid falling back into debt and stay on track with your financial goals.

Remember, rebuilding your credit after bankruptcy takes time and patience. But with some perseverance and smart financial decisions, you’ll be well on your way to a brighter financial future in no time!

FAQs

How long does the Chapter 13 bankruptcy process in New Jersey typically take?

Well, buckle up because it’s like a rollercoaster ride that you can’t get off until it’s over. On average, the process can take anywhere from 3 to 5 years. So, make sure you pack a good book or two!

What are the main steps involved in filing for Chapter 13 bankruptcy in New Jersey?

First, you’ll need to gather all your financial information, fill out some forms, and attend a credit counseling course. Then, you’ll need to propose a repayment plan to the court and wait for approval. Once that’s done, you’ll start making payments and eventually get that sweet, sweet discharge.

Can I keep my house and car if I file for Chapter 13 bankruptcy in New Jersey?

Absolutely! Well, as long as you keep up with your payments. Chapter 13 allows you to keep your assets and create a plan to repay your debts over time. So, as long as you stick to the plan, you can keep cruising in your car and chilling in your house.

What kind of debts can be discharged through Chapter 13 bankruptcy in New Jersey?

Most debts are fair game, except for things like child support, student loans, and some taxes. So, if you’re drowning in credit card debt or medical bills, Chapter 13 could be your saving grace.

What happens if I miss a payment during the Chapter 13 bankruptcy process in New Jersey?

Uh-oh, missing a payment is like missing a step while walking down the stairs. It’s not ideal, but it happens. If you miss a payment, you’ll need to figure out a way to make it up or risk having your case dismissed. So, stay on top of those payments like your life depends on it!

So You Think You Can Survive Chapter 13 in Jersey?

Phew, you made it through our crash course on navigating New Jersey’s Chapter 13 bankruptcy process! Hopefully, you now feel equipped and ready to take on the maze of paperwork, court hearings, and financial restraints that come with the territory. Just remember, even in the midst of financial turmoil, a little Jersey attitude and some good ol’ perseverance can go a long way. So strap in, channel your inner Tony Soprano, and get ready to ride the rollercoaster that is Chapter 13 bankruptcy in the Garden State. And who knows, maybe you’ll come out the other side with a new lease on life and a killer Jersey accent to match! Good luck, my friend. And remember, fist pump your way to financial freedom!