Ah, the wonderful world of New Jersey real estate deals – where liens lurk around every corner like pesky pigeons in a city park. Trying to navigate through the maze of liens can feel like trying to find your way out of a cornfield with a blindfold on. But fear not, brave homebuyers and sellers, for we are here to guide you through the tangled web of liens in the Garden State. So buckle up and get ready for a wild ride through the wild world of liens in NJ real estate deals!

Understanding Liens in New Jersey Real Estate Transactions

Liens in New Jersey real estate transactions can be as confusing as trying to navigate the Parkway during rush hour. But fear not, brave home buyers and sellers! We’re here to guide you through the treacherous waters of liens and help you steer clear of any potential pitfalls.

So, what exactly is a lien, you ask? Well, think of it as a sticky note that says, “Hey, I’ve got a claim on this property!” Liens can be put on a property by creditors, contractors, or even the government. They can make your real estate transaction as complicated as trying to make a left turn in downtown Newark.

Before you sign on the dotted line, it’s important to do your due diligence and make sure there are no liens lurking in the shadows. Here are a few tips to help you stay on the right path:

- Always get a title search done to uncover any hidden liens.

- Make sure all liens are paid off before closing to avoid any nasty surprises.

- Consider purchasing title insurance to protect yourself against any unforeseen liens.

Remember, knowledge is power when it comes to navigating the world of liens in New Jersey real estate transactions. So arm yourself with information, stay alert, and you’ll be well on your way to a smooth and successful closing!

Identifying Different Types of Liens

So you thought you could just buy that cute little house without a care in the world? Think again, my friend! There are all sorts of liens that could be lurking around, waiting to ruin your day. Let’s break down some of the most common ones:

- General Liens: These bad boys can attach to all of your property, whether it’s real estate, personal property, or even your firstborn child (just kidding…kind of). They usually arise from court judgments or unpaid taxes. Basically, they follow you around like a clingy ex.

- Specific Liens: Unlike general liens, these are a bit more focused. Specific liens attach to a particular piece of property, like that cool vintage car you just had to have. They’re like that annoying coworker who won’t leave you alone about borrowing your stuff.

- Voluntary Liens: These liens are like tattoos – you chose to get them. When you take out a mortgage or car loan, you’re voluntarily giving the lender a lien on the property as collateral. Just like a tattoo, it’s a decision you may or may not regret later on.

Remember, knowledge is power! Knowing the types of liens out there can help you navigate the murky waters of property ownership like a champ. So next time you’re about to make a big purchase, don’t forget to do your homework on those pesky liens.

Impact of Liens on Real Estate Transactions

Liens in real estate transactions can be as annoying as a leaky faucet. Just when you think you’ve got it all figured out, there’s a lien lurking in the background, ready to cause chaos. But fear not, dear reader, for I am here to shed some light on the .

First and foremost, a lien on a property can throw a wrench in your plans faster than you can say “foreclosure.” This legal claim by a creditor against a property can make it difficult to sell or refinance. It’s like trying to sell a car with a boot on the wheel – not exactly a smooth process.

But wait, there’s more! Liens can also affect the price of the property. Potential buyers might be hesitant to purchase a property with a lien attached, leading to lower offers and negotiations that feel like pulling teeth. It’s like trying to sell a mansion on a haunted hill – spooky and unpredictable.

And let’s not forget about the headache of trying to clear a lien. It can involve endless paperwork, phone calls, and meetings with lawyers – oh my! It’s like trying to navigate a maze blindfolded – confusing and frustrating. So next time you’re dealing with a lien in a real estate transaction, just remember: this too shall pass. Eventually.

Strategies for Resolving Liens in Real Estate Deals

So, you’ve found your dream property, but there’s just one tiny little problem – liens. Don’t panic! With the right strategies, you can resolve those pesky liens and seal the deal on your dream home.

First things first, do your homework. Research the property and find out exactly what liens are attached to it. Are they tax liens, mechanic’s liens, or something else? Knowing what you’re up against is half the battle.

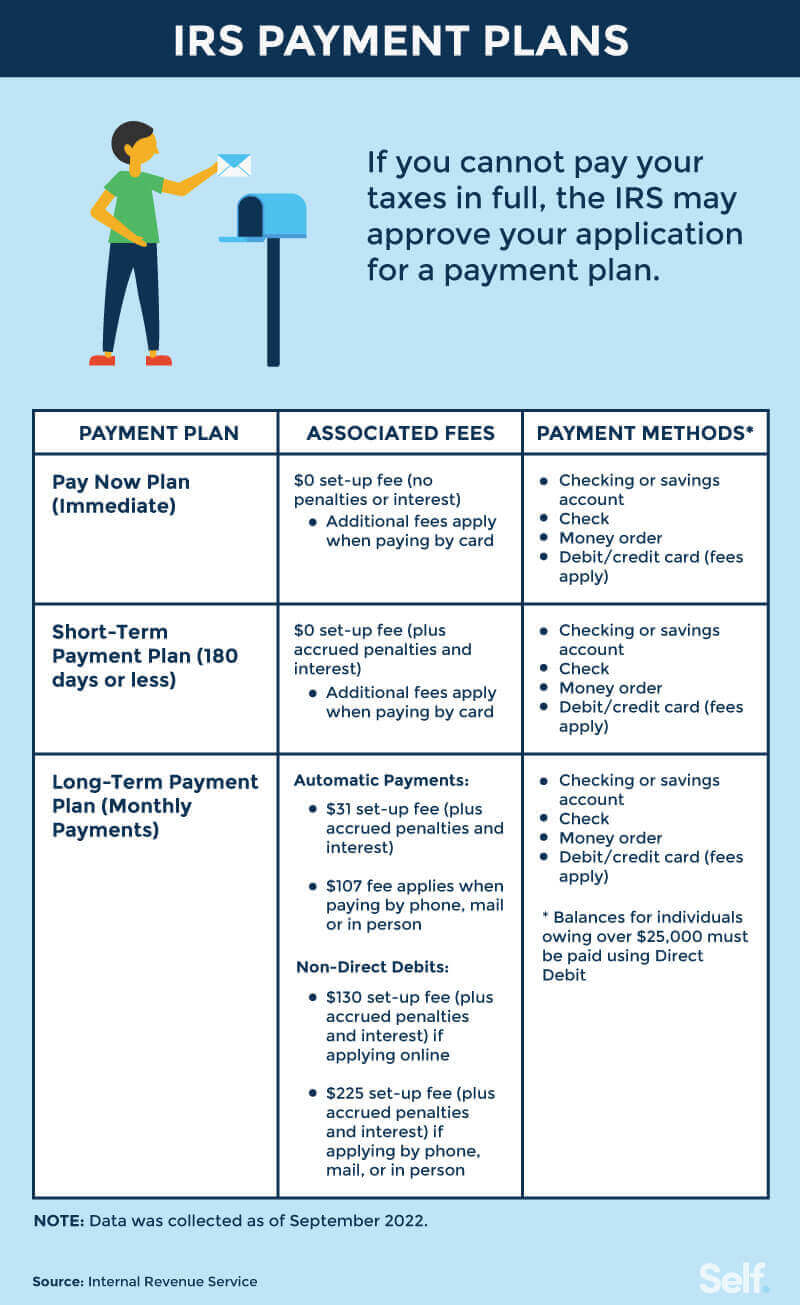

Next, negotiate like a pro. Don’t be afraid to haggle with the lien holder. Offer to pay a percentage of the lien amount or propose a payment plan. Remember, they want to get paid just as much as you want to buy the property.

Lastly, consider hiring a professional to help you navigate the murky waters of lien resolution. A real estate attorney or title company can provide valuable insight and assistance in clearing up any liens standing in your way. With a little persistence and the right strategies, you’ll be saying goodbye to those liens and hello to your new home in no time!

Navigating Liens during the Closing Process

So you’re nearing the end of the closing process and suddenly, the word “liens” pops up. Cue the dramatic music! But fear not, brave homebuyer, for navigating liens doesn’t have to be a treacherous journey. Here are some tips to help you navigate through the murky waters of liens:

First things first, do your research. Find out if there are any outstanding liens on the property you are interested in. This can usually be done through a title search. Think of it like Googling your home’s history – except the results can be a bit scarier than your embarrassing high school photos.

Next, if you do discover a lien on the property, don’t panic. Take a deep breath and assess the situation. Is the lien something that can be easily resolved? Is it a small speed bump or a giant roadblock? Consult with your real estate agent and lawyer to figure out the best course of action.

Remember, dealing with liens during the closing process is like playing a game of Monopoly. You might land on a property with a hefty mortgage, but with a little negotiation and strategy, you can come out on top. So roll the dice, trust your team of experts, and soon enough, you’ll be passing go and collecting your keys to a lien-free home!

Potential Risks Associated with Liens in Real Estate Transactions

When it comes to real estate transactions, liens can be like the pesky little sibling who always wants a piece of your pie. They can seriously mess up a deal if not handled properly, so it’s important to be aware of the potential risks associated with them.

One major risk is that a lien can tie up the property and prevent you from selling it. It’s like trying to take a vacation but your annoying neighbor insists on borrowing your car every weekend. Talk about a buzzkill!

Another risk is that a lien can affect the title of the property, making it more difficult to transfer ownership. It’s like trying to pass “Go” in a game of Monopoly, only to have someone slap a “do not pass go, do not collect $200” sticker on the board. Not cool, dude.

And let’s not forget about the financial risk – if a lien isn’t taken care of, you could end up owing a boatload of money. It’s like going to the ATM for a quick cash withdrawal, only to see your account balance flash zero dollars. Yikes!

FAQs

Can I add a lien to my neighbor’s property if they annoy me?

As tempting as it might be to slap a lien on your neighbor’s property for blasting music at all hours of the night, unfortunately, you can’t just do that willy-nilly. Liens in New Jersey are typically used to secure payment for work done on a property or to enforce judgments from court cases. So unless your neighbor owes you money for something related to their property, your vendetta will have to find another outlet.

What happens if I purchase a property with undisclosed liens?

Buying a property with undisclosed liens is like adopting a seemingly adorable puppy, only to find out it has a habit of chewing up all your shoes. In New Jersey, you could end up being responsible for paying off those liens, which could put a serious dent in your bank account. That’s why it’s crucial to do your due diligence and have a thorough title search done before closing the deal. It’s better to be safe than sorry – or shoeless.

Can a lien be placed on my property without my knowledge?

Imagine waking up one day to find a mysterious, uninvited guest has set up camp in your backyard. That’s kind of what it’s like to discover a lien has been placed on your property without your knowledge. In New Jersey, liens can be filed without notifying the property owner, which is a little unnerving. That’s why it’s important to stay on top of your property’s status and regularly check for any unexpected visitors in the form of sneaky liens.

What’s the best way to remove a lien from my property?

If you find yourself in the unfortunate situation of having a lien on your property, don’t panic. There are ways to remove it, like paying off the debt, negotiating with the lienholder, or filing a bond to release the lien. Just make sure to follow the proper procedures and seek legal advice if needed. And maybe consider installing a security system to prevent any future surprise liens from popping up uninvited.

Happy “Lean” Free Real Estate Hunting!

Congratulations on making it through the maze of liens in New Jersey real estate deals! Remember, just like a GPS helps you navigate the roads, knowledge and due diligence are your best tools for navigating liens in the world of property purchase. So, next time you’re hunting for your dream home, make sure to keep an eye out for those sneaky liens and steer clear of any potential roadblocks. Happy house hunting, and may your real estate deals always be lien-free!