Ah, New Jersey – the land of Taylor Ham, Bruce Springsteen, and of course, never-ending DMV surcharges. If you’ve ever ventured into the wonderful world of the Garden State‘s Department of Motor Vehicles, you’ve probably experienced the joy of being hit with unexpected fines and fees. But fear not, dear reader, for we are here to unravel the mystery of these pesky surcharges and help you navigate the treacherous waters of New Jersey’s DMV system. So buckle up (and make sure your seatbelt is securely fastened) as we dive into the wild and wacky world of understanding New Jersey DMV surcharges.

What are DMV Surcharges?

Ever wonder why your wallet feels a little lighter after a trip to the DMV? Well, blame it on those sneaky little things called DMV surcharges. These pesky fees are like the annoying little sibling you never asked for – always there, always taking your money.

So, what exactly are DMV surcharges, you ask? Think of them as the extra toppings on your pizza that you didn’t even know you ordered. They’re hidden fees that the DMV tacks on to your regular registration or license fees, just for funsies. Because who needs that extra $20 in their bank account, right?

These sneaky surcharges can range from a few bucks to a couple hundred, depending on what kind of DMV transaction you’re doing. Want to renew your license? That’ll be an extra $10, please. Oh, and if you want to personalize your license plate, that’s another $50 on top of the regular fee. Can’t catch a break, can we?

And the best part? There’s no escaping these DMV surcharges. They’re like that ex who won’t stop texting you – no matter how hard you try to ignore them, they always find a way to drain your bank account. So next time you’re at the DMV, just remember to bring a little extra cash for those pesky surcharges. Happy spending!

Types of Surcharges

When it comes to sneaky ways companies can squeeze a little extra cash out of you, surcharges take the cake. These pesky fees have a way of popping up when you least expect them, leaving you scratching your head and your wallet a little lighter. Let’s take a look at some of the most common that might have you seeing red:

- Convenience Fee: Ah, the convenience fee – because apparently, it’s more convenient to charge you extra for paying online or over the phone. Who knew that saving time and hassle could come with such a hefty price tag?

- Resort Fee: Planning a relaxing getaway? Don’t forget to budget for the resort fee, which covers all those “extras” like pool towels, Wi-Fi, and the privilege of breathing in that sweet, sweet tropical air.

- Airline Fee: Flying the friendly skies? Better brace yourself for a flurry of airline fees that add up faster than you can say “buh-bye budget.” From baggage fees to seat selection charges, flying is no longer just about getting from point A to point B.

So, the next time you’re hit with a mysterious surcharge, take a deep breath, count to ten, and remember that you’re not alone in the never-ending battle against hidden fees. Just think of them as a (not-so) friendly reminder that nothing in life is truly free – especially when it comes to those sneaky surcharges!

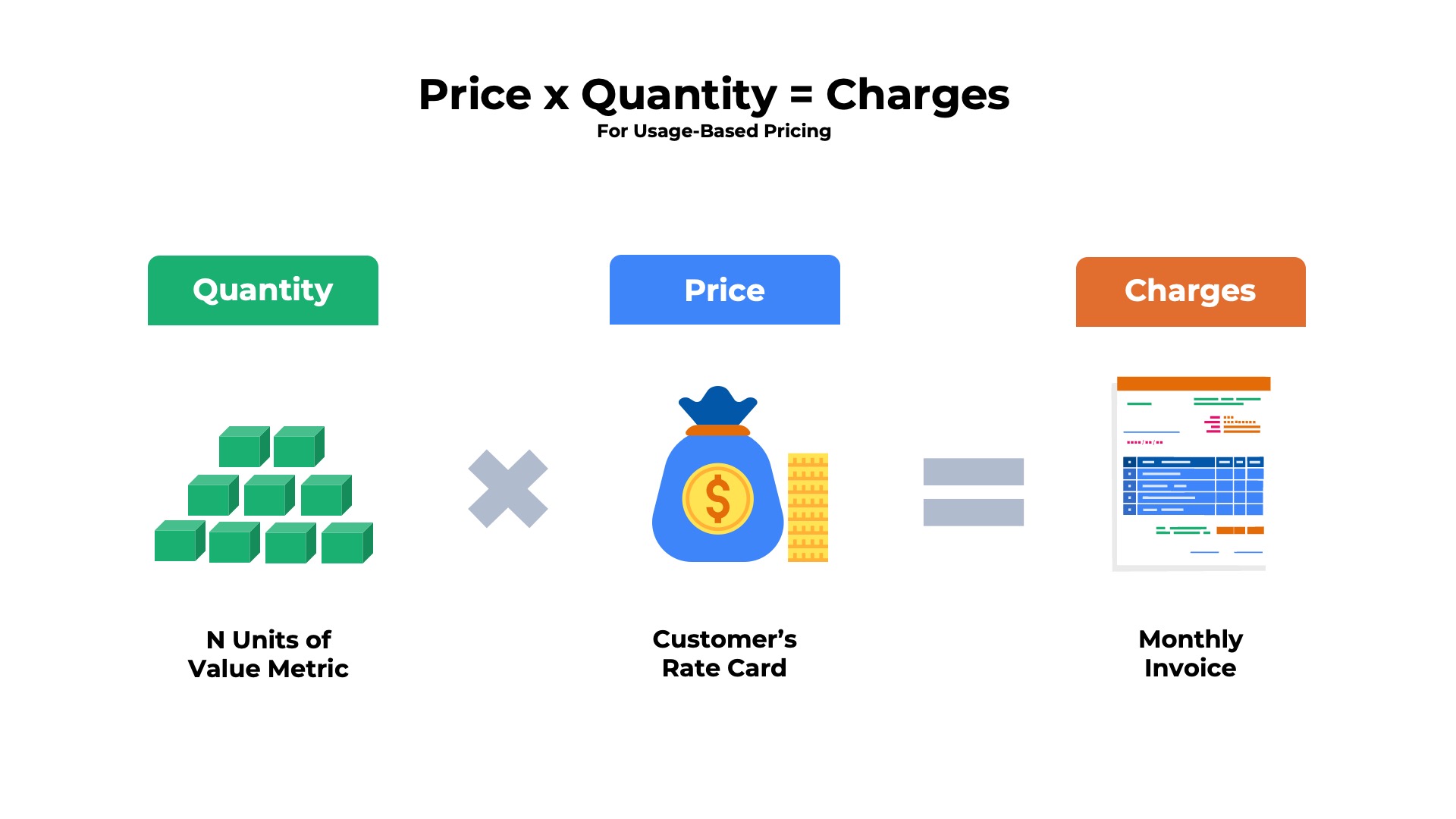

How are Surcharges Calculated?

Ever wondered how surcharges seem to magically appear on your bills? Well, let me demystify this sneaky little trick for you!

First off, surcharges are like little gremlins that sneak their way onto your bill when you least expect it. They can include everything from fees for using your credit card to extra charges for “peak” hours of usage. Basically, they’re the little creatures lurking in the dark corners of your bills, waiting to pounce.

So, how are these pesky surcharges calculated? It’s like a wizard’s spell – a mysterious combination of factors that may include the phase of the moon, the stock market index, and whether or not your favorite sports team won. It’s all very scientific, you see.

And just when you think you’ve figured out how surcharges work, they throw in a curveball like a “convenience fee” or a “processing charge”. It’s like they’re daring you to unravel their cryptic code. But fear not, brave bill-payer, for with a little bit of wit, a sprinkle of patience, and a dash of luck, you just might emerge victorious in your quest to conquer the surcharges!

Common Reasons for Surcharges

Ever wonder why you’re being hit with those pesky surcharges? Here are some common reasons that might just make you shake your head in disbelief:

- Peak Season Pricing: Yup, that’s right! Just like those overpriced holiday sweaters, some companies decide to jack up prices during peak seasons. Because who doesn’t love paying extra for the same old service?

- Convenience Fee: Because why make things easy when you can make them expensive? Want to pay your bill online? That’ll be an extra $5 for the convenience, thank you very much.

- Hidden Fees: Remember that time you thought you were getting a great deal, only to discover a bunch of surprise fees on your bill? Yeah, we’re pretty sure those were just sprinkled in there for fun.

So next time you find yourself scratching your head over a surcharge, just remember that there’s probably some ridiculous reason behind it. But hey, at least you can have a good laugh about it – right before you hand over your hard-earned cash!

Consequences of Non-payment

So, you forgot to pay your bills, huh? Well, buckle up because here come the !

First off, say goodbye to your daily latte. That’s right, no more fancy coffee for you. You’ll be sipping on some good ol’ tap water from now on. Oh, and don’t even think about ordering takeout. It’s ramen noodles for dinner every night from here on out.

Next up, get ready for those pesky late fees to start rolling in. You thought that $5 charge was bad? Try doubling it, tripling it, quadrupling it. Before you know it, you’ll be drowning in late fees faster than you can say “oops.”

And let’s not forget about the endless phone calls from creditors. They’ll be blowing up your phone more than your ex during a breakup. Except this time, they’re not calling to make amends, they’re calling to make sure you pay up or else.

How to Dispute a Surcharge

So, you’ve been hit with a sneaky surcharge on your bill and you’re not about to take it lying down. Here’s how you can dispute that pesky charge and come out victorious!

First things first, gather all the evidence you can get your hands on. Receipts, screenshots, witness testimonies – the more ammo you have, the better. You’re about to go into battle, after all.

Next, channel your inner detective and start digging for information. Is this surcharge even legal? Is the company known for pulling these shenanigans? **Knowledge is power**, my friend.

Now, it’s time to make your move. Contact the company directly and politely explain your case. If that doesn’t work, escalate to higher authorities. **Don’t be afraid to fight for what is rightfully yours!**

Tips for Avoiding Surcharges

So you want to avoid those pesky surcharges, eh? Well, fear not my friend, for I have some tips that’ll help you navigate those treacherous waters without breaking the bank!

First off, always be on the lookout for hidden fees. Those sneaky little charges can pop up when you least expect it, like a ninja in the night. Make sure to read the fine print and keep your eyes peeled for any surprises.

Next, don’t be afraid to negotiate with the service provider. Sometimes a simple, “Pretty please with a cherry on top” can work wonders in getting those extra charges waived. Remember, the squeaky wheel gets the grease!

Lastly, when all else fails, just channel your inner superhero and swoop in to save the day. Be bold, be brave, and be prepared to fight for your right to a surcharge-free existence. With a little determination and a lot of charm, you’ll be surcharge-free in no time!

FAQs

What are DMV surcharges?

Think of DMV surcharges as the extra toppings on your pizza – except in this case, you didn’t ask for them, and they’re definitely not delicious. These surcharges are additional fines imposed by the New Jersey Motor Vehicle Commission for various offenses.

How do I know if I have a DMV surcharge?

If you’ve received a traffic ticket or committed a serious violation on the road, chances are you’ll be slapped with a DMV surcharge. It’s like getting a surprise bill in the mail, except it’s not from your credit card company – it’s from the DMV.

Can I appeal a DMV surcharge?

Appealing a DMV surcharge is like trying to convince your dog to give back the sock it stole. It’s not impossible, but it’s definitely tricky. You’ll need to provide evidence and plead your case to the DMV – good luck!

How long do DMV surcharges stay on my record?

DMV surcharges are like that embarrassing photo from college – they’ll haunt you forever. These fines typically stay on your record for three years, so get ready to pay up and learn from your mistakes.

What happens if I don’t pay my DMV surcharges?

If you think ignoring your DMV surcharges is a good idea, think again. The DMV can suspend your license, slap you with even more fines, and make your life a living hell. So do yourself a favor and just pay up - your future self will thank you.

Happy Driving and Surcharging in New Jersey!

Congratulations on making it through the confusing world of New Jersey DMV surcharges! Remember, drive safely, be aware of your driving record, and never be afraid to ask questions if you’re unsure about any fees or penalties.

We hope this article has helped shed some light on the sometimes complicated world of DMV surcharges in the Garden State. But hey, if all else fails, just remember: at least you’re not stuck in traffic on the NJ Turnpike during rush hour!

Safe driving, New Jerseyans – and may your surcharges be few and far between!