Attention all non-resident sellers trying to navigate the treacherous waters of New Jersey tax laws! We know, we know - taxes can be about as fun as getting a root canal on a rollercoaster. But fear not, dear friends. In this article, we will break down the ins and outs of understanding tax requirements for non-resident sellers in the Garden State, so you can sell your goods without breaking the bank (or your sanity). So grab a cup of coffee (or something stronger, we won’t judge) and let’s dive into the confusing world of taxation with a touch of humor and a sprinkle of sarcasm. Let’s do this!

Tax Residency Status

Are you wondering about your ? Well, buckle up because we’re about to dive into the weird and wacky world of taxes!

First things first, to determine your , you need to consider a few key factors:

- Your physical presence in a country

- Your ties to that country (think property, family, and social connections)

- The number of days you spent in that country

Now, let’s talk about the fun part – being a tax resident in multiple countries! Yep, you heard that right. If you’re living that jet-setter life and splitting your time between two countries, you may find yourself dealing with the joys of double taxation. It’s like getting a two-for-one deal, except you’re losing money instead of saving it. How delightful!

But fear not, dear reader, for there are treaties in place to prevent this tax madness. These glorious tax treaties help determine which country has the right to tax your income, saving you from the headache of paying taxes in two places at once. Hooray for international diplomacy!

Tax Filing Obligations

So you thought you could escape the dreaded tax season, huh? Think again! Whether you’re a freelancer, business owner, or just a regular Joe, you’ve got to fulfill. But fear not, dear taxpayer, for I come bearing tips to help you navigate this treacherous terrain.

First and foremost, **don’t procrastinate**! The IRS doesn’t care that you were too busy binge-watching the latest Netflix series or perfecting your cat meme collection. Get those forms filled out and submitted on time, or you’ll be facing some hefty penalties.

Next, remember that ignorance is not bliss when it comes to taxes. Familiarize yourself with the various tax forms and deductions available to you. Do some research, consult a tax professional, or bribe your Uncle Larry who’s a retired accountant – just make sure you know what you’re doing.

Lastly, don’t try to pull a fast one on the IRS. They’ve seen every trick in the book, from claiming your pet iguana as a dependent to deducting your daily coffee habit as a business expense. Play by the rules, and you’ll save yourself a world of trouble (and potential audit nightmares).

Nexus and Economic Presence

Economic presence is a tricky concept, much like trying to balance a stack of pennies on the edge of a table. It requires finesse, strategy, and maybe a little bit of luck. Just like how a nexus can be hard to establish, especially when dealing with digital transactions in the vast world wide web.

It’s like trying to find a needle in a haystack, or a diamond in the rough. But fear not, brave entrepreneurs, for with the right guidance and a sprinkle of fairy dust, you too can navigate the murky waters of economic presence and come out on top.

Remember, a strong economic presence is like having a well-oiled machine – everything runs smoothly, efficiently, and you don’t have to worry about things breaking down when you least expect it. So buckle up, put on your thinking caps, and get ready to conquer the world of business with your newfound knowledge of .

Sales Tax Collection and Reporting

Are you ready to tackle the daunting task of ? Buckle up, because we’re about to dive into the wild world of taxes!

First things first, make sure you have all your ducks in a row when it comes to collecting sales tax. Use bold, flashy signs to remind your customers that Uncle Sam is always watching!

Next, it’s time to roll up your sleeves and get down to the nitty-gritty of reporting. Remember, accuracy is key here. Double-check those numbers and make sure everything adds up – we wouldn’t want the IRS coming after you!

And finally, pat yourself on the back for a job well done. may not be the most glamorous part of running a business, but hey, someone’s gotta do it. And hey, at least you can rest easy knowing you’re keeping the tax man happy!

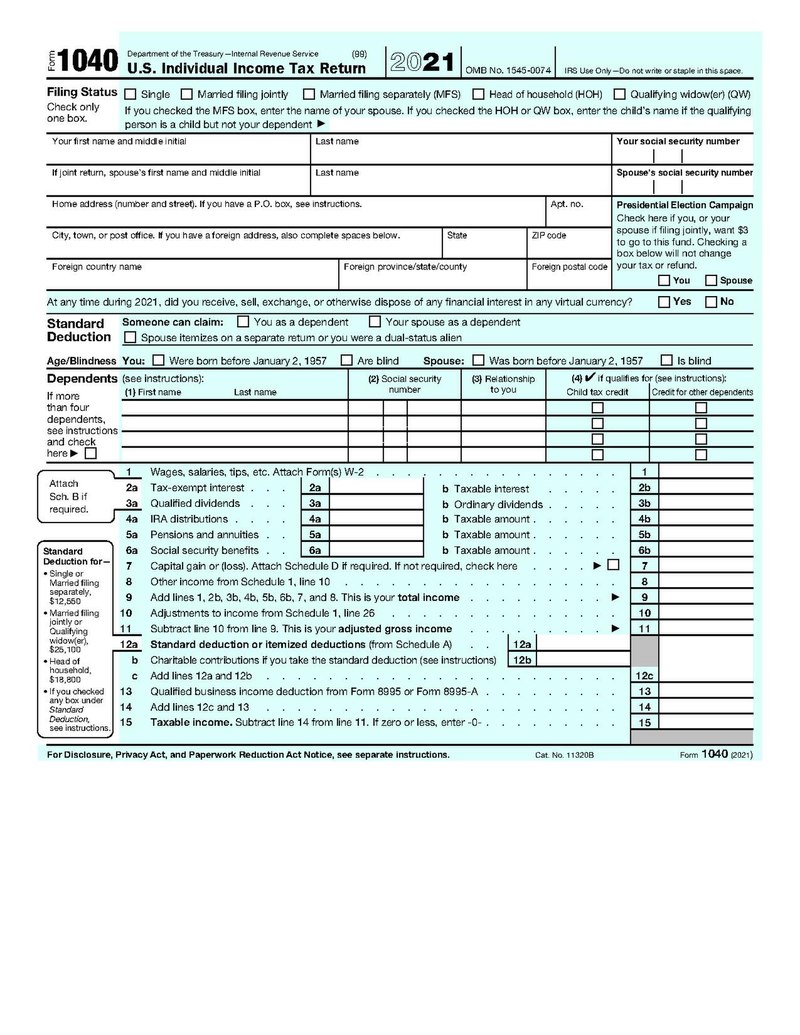

Income Tax Withholding Requirements

When it comes to , the IRS is like that strict teacher who won’t let you get away with anything!

Remember, Uncle Sam is always watching, especially when it comes to your paycheck. If you don’t have enough taxes withheld, you could end up owing the government big time. And nobody wants to owe money to the IRS…

So, make sure you fill out your W-4 form correctly. It’s like a secret code that tells your employer how much money to take out of your paycheck for taxes. And trust me, you don’t want to mess that up!

Keep in mind that there are different rules for different situations. Are you single? Married? Do you have kids? The IRS wants to know it all! It’s like a really invasive game of 20 questions, but with way higher stakes!

Tax Treaties and Exemptions

Do you dread tax season like a kid dreads broccoli? Well, fear not my friends! Let’s talk about , the magical unicorn that can save you from the jaws of the dreaded tax monster.

So, what exactly are tax treaties? They’re like the secret handshake between countries that determines how they will tax each other’s residents. It’s like making a deal with the tax devil, but in a good way. And the best part? You might be able to claim exemptions or credits on your taxes because of these treaties. It’s like finding a pot of gold at the end of a rainbow, except it’s actually real!

With tax exemptions, you can potentially avoid paying taxes on certain income or reduce the amount you owe. It’s like getting a coupon for tax season – who doesn’t love a good discount? Plus, navigating the murky waters of international tax law can be confusing, but with the right exemptions in your pocket, you’ll feel like a tax-savvy superhero.

So, next time you’re drowning in a sea of tax forms, remember the power of . They might just be your ticket to a stress-free tax season. Now go forth and conquer those taxes like the brave tax warrior you are!

Penalties for Non-Compliance

Non-compliance is no joke, folks! If you think you can skirt the rules and regulations, think again. There are consequences for those who choose not to play by the book. So, before you decide to bend the rules, here’s a glimpse of what you can expect:

First off, you might find yourself facing some hefty fines. We’re talking about a serious dent in your wallet, folks. And no, this isn’t Monopoly money we’re talking about. These fines can really add up, so it’s best to toe the line to avoid breaking the bank.

But wait, there’s more! If fines don’t scare you, maybe the idea of being publicly shamed will. That’s right, your name could end up on a list of shame for all to see. Imagine the horror of being known as the non-compliant troublemaker. It’s not a good look, folks.

And let’s not forget the possibility of some good old-fashioned community service. Picture yourself picking up trash on the side of the road or cleaning up graffiti in your neighborhood. A little bit of manual labor might just be the wake-up call you need to start following the rules like a responsible citizen.

FAQs

Do I really have to pay taxes if I’m not a resident of NJ?

Well, sorry to burst your non-resident bubble, but yes, you do have to pay taxes if you’re selling goods in the Garden State. The taxman doesn’t care where you’re from, he just wants his cut!

How do I register for a sales tax permit in NJ as a non-resident seller?

First, you’ll need to fill out Form NJ-REG to register for a sales tax permit. Then you’ll have to collect sales tax from your Jersey customers and remit it to the state. It’s like being a tax-collecting superhero, but with less spandex.

What’s the sales tax rate for non-resident sellers in NJ?

The sales tax rate in NJ is currently 6.625%. So every time you make a sale, just remember to tack on that extra bit of tax like a sneaky little Jersey surcharge.

Are there any exemptions for non-resident sellers in NJ?

There are some exemptions for certain goods and services in NJ, like groceries and prescription drugs. But if you’re selling anything else, you’re probably out of luck. The taxman giveth, and the taxman taketh away.

What happens if I don’t pay my taxes as a non-resident seller in NJ?

If you don’t pay your taxes in NJ, the state will come after you faster than a mob boss chasing down a snitch. So do yourself a favor and pay up, unless you want to end up in tax evasion jail.

In Conclusion: Don’t Let Taxes Be the Bane of Your Existence!

So, there you have it – the ins and outs of tax requirements for non-resident sellers in NJ. Remember, taxes may sometimes feel like the villain in your life story, but with the right knowledge and a sense of humor, you can take on the role of the hero and conquer them like a pro! Whether you’re selling goods online or in person, make sure you stay informed and compliant to avoid any tax-related pitfalls. And who knows, maybe one day you’ll even thank the tax man for keeping the roads paved and the lights on! Taxes, they’re not so bad after all – just ask Uncle Sam!