Are you drowning in debt faster than a bad reality TV show contestant spending their prize money? Well, fear not my financially floundering friends, because Chapter 13 bankruptcy may just be your ticket to financial freedom! In this detailed analysis, we’ll take a closer look at the ins and outs of Chapter 13 bankruptcy repayment plans in the Garden State – New Jersey. So grab your calculator and put on your best poker face, because we’re about to break down the numbers and laws like never before!

Overview of Chapter 13 Bankruptcy in NJ

So you’ve found yourself in a financial pickle, huh? Well, fear not my friend, for Chapter 13 bankruptcy in NJ could be your saving grace. Let’s dive into the nitty-gritty details of what Chapter 13 bankruptcy entails in the Garden State.

First things first, with Chapter 13 bankruptcy, you won’t have to say goodbye to all your assets like you would with Chapter 7. Instead, you’ll be able to create a repayment plan based on your income to gradually pay off your debts over the next 3-5 years. It’s like giving your finances a spa day and a fresh start all rolled into one.

But wait, there’s more! Not only does Chapter 13 bankruptcy allow you to keep your assets, but it also puts a stop to those pesky debt collectors from contacting you. Say goodbye to those late-night phone calls and aggressive letters – peace and quiet at last.

So, if you’re drowning in debt and need a lifeline, Chapter 13 bankruptcy in NJ might just be the solution you’ve been looking for. With a structured repayment plan and relief from debt collectors, you can finally breathe a sigh of relief and start on the path to financial freedom. Say goodbye to financial stress and hello to a brighter future!

Calculating Disposable Income for Repayment Plans

So you’ve decided to tackle your student loan debt head-on and are looking into repayment plans. But first, you need to figure out your disposable income to see how much you can realistically afford to pay each month. Here are some tips to help you calculate your disposable income:

- **Start with your gross income:** This includes your salary, wages, tips, and any other income you receive on a regular basis.

- **Deduct taxes:** Uncle Sam always wants his cut, so make sure to subtract federal, state, and local taxes from your gross income.

- **Subtract necessary expenses:** These are your fixed expenses like rent, utilities, groceries, and transportation costs. Basically, anything you can’t live without (like that daily latte).

- **Factor in discretionary expenses:** This includes things like dining out, shopping sprees, and weekend getaways. While these may not be necessary, they can still impact your disposable income.

Once you’ve crunched the numbers and determined your disposable income, you’ll have a better idea of how much you can afford to put towards your student loans each month. Remember, the goal is to find a balance between paying off your debt and still being able to enjoy life. So go ahead, calculate away and take that first step towards financial freedom!

Understanding Priority and Non-Priority Debts

So, you’ve found yourself drowning in debt and you’re not sure where to start. Don’t worry, we’ve got you covered! Let’s break down the difference between priority and non-priority debts to help you navigate through this financial mess.

Priority debts are like the VIPs of the debt world – they demand immediate attention and if you don’t pay up, you might face some serious consequences. Think of these debts as the popular kids in high school that everyone wants to be friends with. They include things like:

- Income tax debts

- Mortgage or rent arrears

- Court fines

On the other hand, non-priority debts are like the wallflowers at a high school dance – they’re still there, but nobody really pays them much attention. These debts are usually less urgent and don’t come with as many threats if left unpaid. Non-priority debts include things like:

- Credit card debts

- Personal loans

- Utility bills

Now that you have a better understanding of priority and non-priority debts, it’s time to come up with a game plan to tackle them. Remember, it’s always best to prioritize paying off your priority debts first to avoid any major consequences. And hey, don’t forget to pat yourself on the back for taking the first step towards financial freedom!

Negotiating with Creditors for Favorable Terms

So, you find yourself in a bit of a financial pickle, huh? Don’t worry, we’ve all been there. But fear not, negotiating with your creditors for favorable terms is not as daunting as it sounds. In fact, with a little charm, wit, and a sprinkle of pizzazz, you can turn that mountain of debt into a molehill.

First things first, do your homework. Research each creditor, know your rights, and understand your financial situation inside and out. Armed with this knowledge, you can confidently approach your creditors and show them that you mean business.

Next, it’s time to sweet talk your way to those favorable terms. Use your negotiation skills to your advantage and remember, confidence is key. Be persistent, yet polite, and don’t be afraid to throw in a joke or two to lighten the mood.

Lastly, seal the deal like a pro. Get everything in writing, make sure the terms are crystal clear, and don’t be afraid to walk away if the terms aren’t in your favor. Remember, you hold the power in this negotiation, so own it like the financial boss that you are.

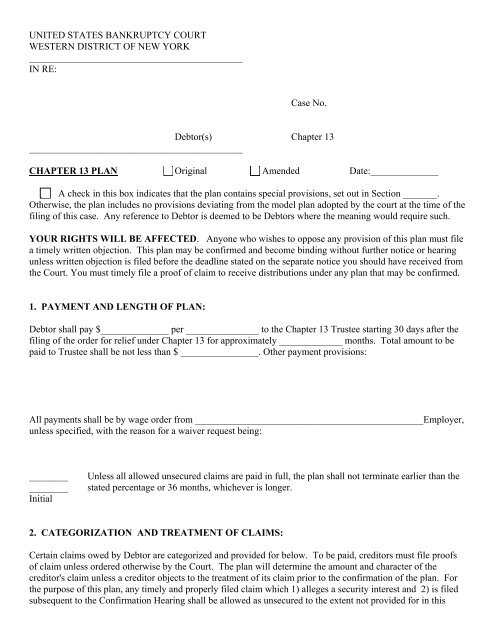

The Role of the Bankruptcy Trustee in Repayment Plans

When it comes to repayment plans, the bankruptcy trustee plays a crucial role in overseeing the process and ensuring that all parties involved adhere to the terms. Think of them as the referee in a chaotic game of financial chess, making sure that everyone plays by the rules and doesn’t try to pull any fast ones.

One of the trustee’s main responsibilities is to review the debtor’s proposed repayment plan and ensure that it is fair and feasible. They’re like the Simon Cowell of the bankruptcy world, giving their unfiltered opinion on whether the plan is a hit or a flop. If they think the plan is a total disaster, they have the power to reject it and send the debtor back to the drawing board.

Once the repayment plan is approved, the trustee is responsible for collecting payments from the debtor and distributing them to creditors. It’s like playing financial Santa Claus, making sure that everyone gets their fair share of the pie. And just like Santa, the trustee keeps track of who’s been naughty (not making payments) and nice (following the plan).

In the end, the bankruptcy trustee is like the unsung hero of the repayment plan process. They keep everything running smoothly, make sure that everyone plays fair, and ensure that creditors get what they’re owed. So next time you think about skipping a payment or trying to cheat the system, just remember that the trustee is watching, ready to swoop in and set things right!

Potential Pitfalls to Avoid in Chapter 13 Bankruptcy

So, you’ve decided to file for Chapter 13 bankruptcy, huh? Well, buckle up because there are definitely some potential pitfalls you’ll want to avoid along the way. Here are a few to keep an eye out for:

- Trying to hide assets: Look, we get it, you want to keep that vintage comic book collection under wraps. But trust us, the bankruptcy trustee will find it and you’ll be in a world of hurt. Just be honest about what you own, okay?

- Skipping payments: Uh oh, did you forget to make your Chapter 13 plan payments? That’s a big no-no. Your case could get dismissed and you’ll be right back where you started. Remember, paying on time is key.

Remember, Chapter 13 bankruptcy is a serious process, but that doesn’t mean you can’t have a little fun along the way. Just be sure to steer clear of these potential pitfalls and you’ll be on your way to a fresh financial start in no time!

Evaluating the Benefits of Chapter 13 Bankruptcy for NJ Residents

Benefits of Chapter 13 Bankruptcy for NJ Residents

So, you’re drowning in debt and feeling like you’re stuck in a never-ending cycle of financial woes. It’s time to consider Chapter 13 bankruptcy as a way to finally breathe a sigh of relief. Here are some of the perks of filing for Chapter 13 in the Garden State:

- Stop Foreclosure: If you’re at risk of losing your home, Chapter 13 can provide a lifeline by putting a halt to the foreclosure process. You’ll have the opportunity to catch up on missed mortgage payments and keep your castle safe and sound.

- Repayment Plan: With Chapter 13, you can work out a manageable repayment plan with your creditors over a period of 3-5 years. Say goodbye to those pesky debt collectors harassing you day and night!

- Debt Discharge: Once you successfully complete your repayment plan, any remaining unsecured debts will be discharged. That’s right – wipe the slate clean and start fresh with a clean financial slate.

So, don’t let financial troubles weigh you down any longer. Chapter 13 bankruptcy could be your ticket to a brighter, debt-free future in the great state of New Jersey!

FAQs

What is Chapter 13 bankruptcy and how does it work?

Ah, the age-old question! Chapter 13 bankruptcy is like a financial reset button for individuals with a regular income. It involves creating a repayment plan to pay off your debts over a period of three to five years, under the watchful eye of a bankruptcy trustee.

What types of debts can be included in a Chapter 13 repayment plan?

Well, pretty much any kind of debt you can think of - from credit card bills to medical expenses to that one time you borrowed $20 from your cousin and forgot to pay it back. However, some debts, like child support and alimony, must be paid in full.

What factors determine the length and amount of payments in a Chapter 13 plan?

Ah, the million-dollar question! The length and amount of your payments depend on your income, expenses, and the value of your non-exempt assets. Think of it like a complicated game of financial Tetris.

Can I keep my assets, like my house or car, during a Chapter 13 bankruptcy?

Yes, you can keep your assets – as long as you continue making payments as outlined in your repayment plan. It’s like having your cake and eating it too, just with a side of financial responsibility.

What happens if I can’t make my Chapter 13 plan payments?

Oh, that’s a tough one! If you can’t make your payments, your case could be dismissed, and you might find yourself back at square one. So, it’s important to be proactive and communicate with your bankruptcy trustee if you’re facing financial difficulties.

And that’s a wrap!

Well folks, we’ve delved into the nitty-gritty details of Chapter 13 bankruptcy repayment plans in NJ. From calculating disposable income to determining plan length, we’ve covered it all. So next time you find yourself in a financial pickle, just remember that Chapter 13 bankruptcy could be the solution you’ve been looking for.

Stay tuned for more riveting financial analysis, and remember: bankruptcy might not be the most glamorous topic, but it sure is fascinating!