Are you drowning in debt faster than you can say “I swear I’ll start saving money next month”? Fear not, my fellow New Jerseyans, for there is a light at the end of the debt tunnel – Chapter 13 bankruptcy! But before you break out the party hats and start celebrating, it’s important to craft a repayment plan that will have you saying “goodbye debt, hello financial freedom!” in no time. So grab your glitter glue and scissors, because we’re about to get crafty with our Chapter 13 repayment plan strategies!

Understanding Chapter 13 Bankruptcy in New Jersey

So you’ve found yourself in a bit of financial pickle, huh? Don’t worry, you’re not alone. Chapter 13 bankruptcy in New Jersey might just be the lifeline you need to get back on your feet. Here’s a crash course on what you need to know:

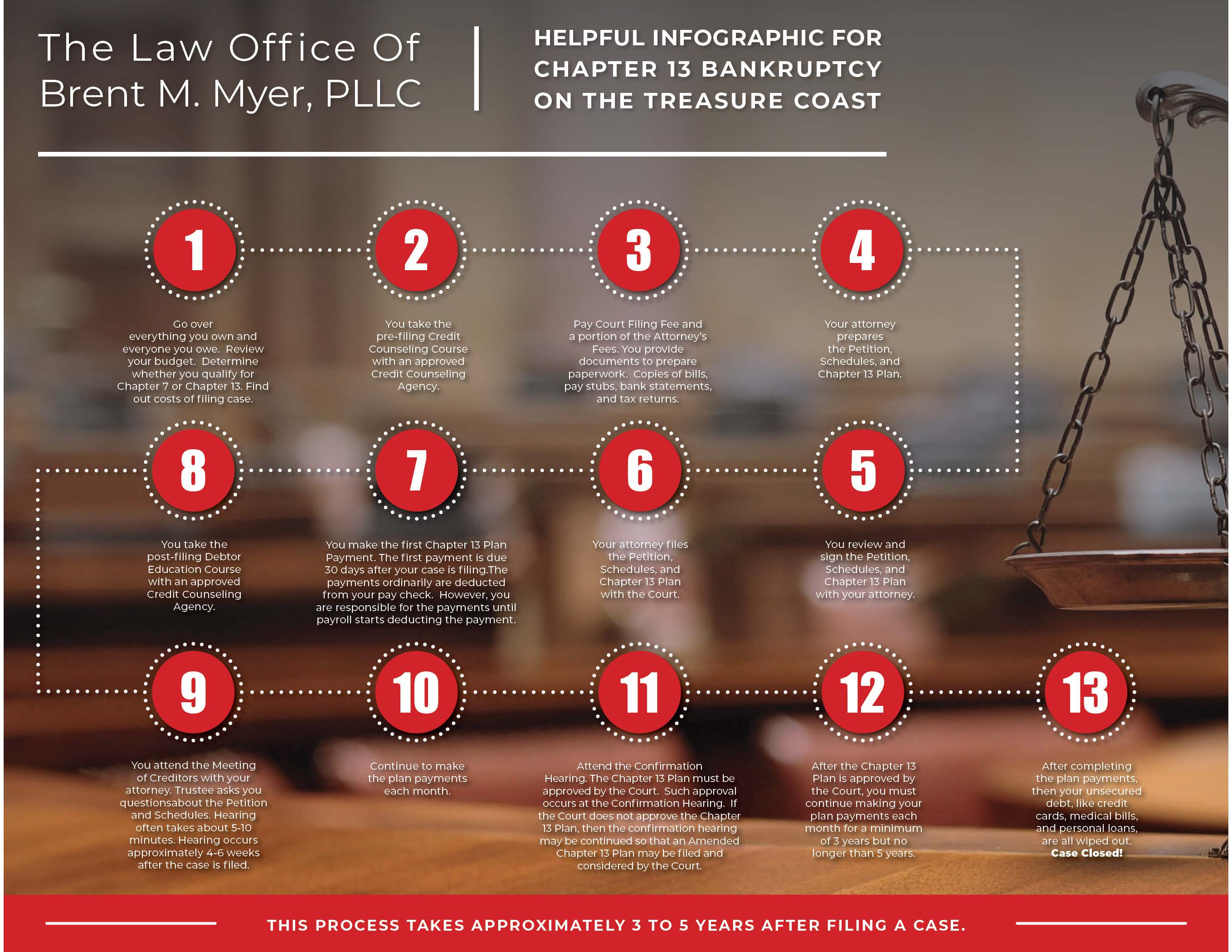

Payment Plans Galore: One of the perks of Chapter 13 bankruptcy is that it allows you to create a manageable payment plan to help you pay off your debts over a period of 3-5 years. It’s like having your very own financial coach, without the hefty price tag!

Asset Protection Magic: Worried about losing your prized possessions? Fear not! Chapter 13 bankruptcy allows you to keep your assets while still working to pay off your debts. It’s like having your cake and eating it too!

Credit Score TLC: Yes, filing for bankruptcy might ding your credit score a bit, but fear not! With some diligence and responsible financial habits, you can start rebuilding your credit in no time. It’s like hitting the reset button on your financial life!

Evaluating Your Financial Situation Before Creating a Repayment Plan

So, you’ve finally come to terms with the fact that you need to create a repayment plan for your finances. Good for you! But before you dive headfirst into crunching numbers and making spreadsheets, it’s important to evaluate your current financial situation first. After all, you can’t create a plan to get out of debt if you don’t even know how deep you are in it.

First things first, gather all your financial documents in one place – bank statements, credit card bills, loan statements, and anything else that gives you an overview of your financial health. Take a deep breath (or a shot of tequila, no judgment here) and brace yourself for the harsh reality of your spending habits.

Next, analyze your income versus your expenses. Create a list of all your sources of income (yes, even that $20 you make from selling homemade jam at the farmer’s market) and compare it to your monthly expenses. Are you spending more than you’re making? Are you surprised by how much you’re actually spending on avocado toast and soy lattes?

Once you have a clear picture of where your money is coming from and where it’s going, it’s time to take action. Cut back on unnecessary expenses (do you really need another subscription to a streaming service you never use?) and find ways to increase your income (hello, side hustle!). And remember, creating a repayment plan is like eating an elephant – you have to do it one bite at a time. Slow and steady wins the race, my friend!

Determining Eligibility for Chapter 13 Bankruptcy in New Jersey

So you find yourself drowning in debt in the Garden State, huh? It’s time to consider Chapter 13 bankruptcy in New Jersey. But before you start dreaming of debt freedom, you need to determine if you’re actually eligible. Here are some factors to consider:

First off, your debts must be within the allowable limits. In New Jersey, you can have no more than $394,725 in unsecured debts (like credit card debt) and no more than $1,184,200 in secured debts (like mortgage or car loans). So if you’re living in a mansion in Princeton with a Ferrari in the driveway, you might want to reconsider your bankruptcy dreams.

Next, you need to have a regular income to show that you can afford to make payments under a Chapter 13 repayment plan. This means having a steady job or some other form of consistent income. If your only source of income is from winning the lottery or selling homemade crafts on Etsy, you might have a tough time convincing the court that you’re a viable candidate for Chapter 13.

Lastly, you must have filed your tax returns for the past four years. If you’ve been slacking on your tax obligations, the court may question your financial responsibility and deny your bankruptcy petition. So dust off those W-2s and get those taxes filed, or you’ll be stuck in debt purgatory for the foreseeable future.

Negotiating with Creditors to Create a Realistic Repayment Plan

So you find yourself in a bit of a pickle with your creditors, huh? Fear not, my friend, for negotiating with them to create a realistic repayment plan is not as daunting as it may seem. Trust me, I’ve been there, done that, and got the t-shirt (which I couldn’t afford at the time, but that’s a story for another day).

First things first, gather all your relevant financial information. You know, like how much money you owe, what your current income is, and how much you spend on avocado toast each month (priorities, am I right?). Once you have all that handy, it’s time to don your negotiator hat (or, in my case, a snazzy fedora) and reach out to your creditors to start the conversation.

Remember, the key to successful negotiating is to be honest and transparent about your financial situation. Explain your circumstances clearly and propose a repayment plan that you can feasibly stick to. Offer to make regular payments that are manageable for you, even if it means cutting back on those daily venti lattes (sorry, Starbucks).

And hey, don’t be afraid to sweeten the deal for your creditors. Maybe throw in some extra goodies like a handwritten thank you note or a homemade batch of cookies (if you’re feeling extra generous). After all, a little charm goes a long way in the world of negotiations. And who knows, you might just end up with a repayment plan that works for both parties and a newfound appreciation for the art of negotiating with creditors. Cheers to financial freedom!

Submitting Your Chapter 13 Repayment Plan for Approval

So, you’ve finally finished putting together your Chapter 13 repayment plan – congratulations! Now comes the fun part - getting it approved. Here are some tips to help you navigate this process smoothly:

Double Check Everything: Before submitting your plan, make sure all the i’s are dotted and the t’s are crossed. The last thing you want is a pesky typo derailing your progress. Review your plan with a fine-tooth comb and make any necessary adjustments.

Communicate Clearly: When submitting your plan, be sure to clearly communicate your intentions and proposed repayment terms. Don’t leave any room for interpretation - spell it out in black and white so there’s no confusion.

Be Patient: The approval process can take some time, so don’t be surprised if you don’t hear back immediately. Use this time to practice your meditation skills and work on your patience – you’ll need it.

Celebrate (But Not Too Soon): Once your plan is approved, give yourself a pat on the back - you deserve it! Just remember, this is only the beginning of your journey to financial freedom, so don’t break out the champagne just yet. Keep up the hard work and stick to your repayment plan like glue.

Making Regular Payments to Successfully Complete Your Chapter 13 Plan

So you’ve taken the bold step to file for Chapter 13 bankruptcy, congrats! Now comes the hard part – actually sticking to your payment plan. But fear not, we’ve got some tips to help you successfully complete your Chapter 13 plan and emerge victorious on the other side.

First and foremost, **make sure you set up automatic payments**. Trust me, you do not want to risk forgetting to make your payments and ending up in hot water with the bankruptcy court. Set it and forget it, that’s the way to go.

Next, **create a budget and stick to it**. I know, I know, it’s not the most glamorous thing to do, but hey, sacrifices must be made. Cut back on those daily trips to Starbucks or impulse Amazon purchases – your financial freedom is worth it.

And finally, **celebrate your wins along the way**. Completing your Chapter 13 plan is no easy feat, so give yourself a pat on the back when you hit milestones. Treat yourself to a fancy dinner or take a mini vacation – just make sure it’s within your budget, of course.

Seeking Legal Assistance to Navigate the Chapter 13 Bankruptcy Process

So you’ve found yourself knee-deep in the murky waters of Chapter 13 bankruptcy. Don’t worry, you’re not alone. Navigating this complex process can feel like trying to solve a Rubik’s Cube blindfolded.

But fear not, brave soul! With the help of a skilled legal team, you can tackle this challenge head-on and come out victorious on the other side. Think of them as your trusty sidekick, guiding you through the treacherous terrain of bankruptcy law.

From filling out mind-numbing paperwork to deciphering confusing legal jargon, these legal experts have got your back every step of the way. They’ll help you craft a rock-solid repayment plan that works for your unique financial situation, ensuring you can emerge from bankruptcy stronger than ever.

So don’t go it alone! Seek out the legal assistance you need to conquer Chapter 13 bankruptcy like the fearless warrior you are. With a little help, you’ll be dancing your way out of debt in no time.

FAQs

How can I make my Chapter 13 repayment plan more manageable?

One strategy is to carefully assess your financial situation and accurately calculate your living expenses. Be sure to prioritize necessary expenses such as housing, food, and transportation. By creating a realistic budget, you can ensure that your repayment plan is sustainable and manageable.

Are there any tips for negotiating with creditors in a Chapter 13 bankruptcy?

A great tip is to be proactive and communicate openly with your creditors. Offer to make reasonable payments based on your income and expenses. By being upfront about your financial situation and showing a willingness to cooperate, you may be able to reach more favorable repayment terms.

How can I stick to my Chapter 13 repayment plan without feeling overwhelmed?

One strategy is to set up automatic payments to ensure that you stay on track with your repayment plan. Additionally, creating a visual reminder, such as a progress chart, can help you stay motivated and focused on your financial goals. Remember, small steps lead to big achievements!

What are some common pitfalls to avoid when crafting a Chapter 13 repayment plan?

A common pitfall is underestimating your living expenses or overestimating your ability to make payments. It’s essential to be realistic about your financial situation and seek professional advice if needed. Additionally, avoid taking on new debt or making large purchases while on a repayment plan to prevent further financial strain.

Are there any resources available in New Jersey to help with crafting a Chapter 13 repayment plan?

Yes! New Jersey offers various resources, such as credit counseling services and legal aid organizations, that can assist with creating a manageable repayment plan. These resources can provide valuable support and guidance throughout the bankruptcy process, ensuring a smoother financial journey.

Get Crafting and Crush Your Chapter 13 Repayment Plan!

Congratulations, you’re now armed with all the NJ strategies you need to tackle your Chapter 13 repayment plan like a boss. From negotiating with creditors to budgeting like a pro, you’ve got this in the bag.

So get out there and start crafting your perfect repayment plan. Remember, it’s not about how you start – it’s about how you finish. And with these strategies in your arsenal, you’ll be crossing the finish line in style.

Now go forth, conquer your debt, and show New Jersey just what you’re made of!