Welcome to the perplexing world of New Jersey Municipal Court direct transaction costs - a journey full of mystery, confusion, and perhaps a touch of absurdity. As you navigate through the labyrinth of fees and fines, you may find yourself scratching your head, questioning your sanity, and ultimately wondering if this is all just an elaborate prank. But fear not, dear reader, for we are here to decode the enigmatic realm of NJMCdirect transaction costs, unraveling the mysteries that lie within and shedding light on the bizarre world of municipal court payments. So grab your magnifying glass and get ready to delve into the bewildering world of New Jersey’s court system – you never know what surprises might await you!

Understanding NJMCdirect Transaction Fees

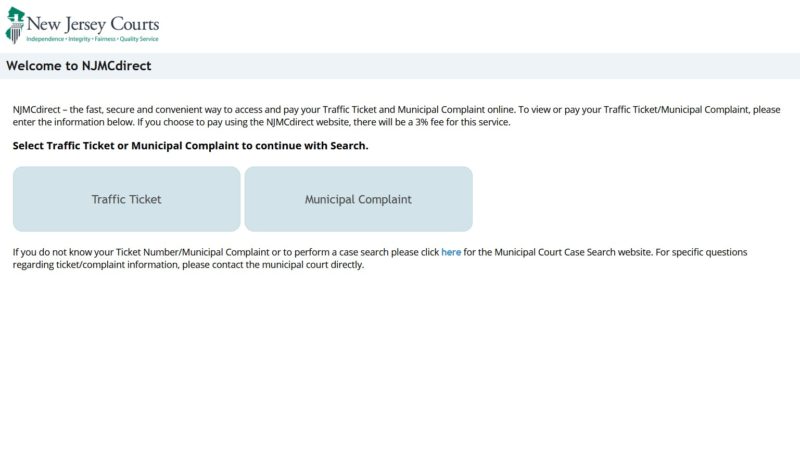

So you’ve found yourself needing to pay a pesky traffic ticket online through NJMCdirect. But wait, what’s this? Transaction fees? You mean I have to pay even more money on top of the fine? Say it ain’t so!

Don’t fret, dear ticket payer, for I am here to shed some light on these sneaky transaction fees. It’s like going to the grocery store for a gallon of milk and ending up with an entire shopping cart full of items you never intended to buy. But hey, at least you’re getting those air fresheners for your car, right?

- Let’s break it down, shall we? These transaction fees are essentially a small price to pay for the convenience of handling your ticket online. Think of it as a convenience fee for not having to wait in line at the DMV behind that guy who keeps arguing about his expired registration.

- But in all seriousness, these fees help cover the costs of processing your payment and maintaining the NJMCdirect website. So that’s a good thing, right? You’re supporting the digital infrastructure of the New Jersey Municipal Court system. You’re practically a tech hero!

So the next time you see those transaction fees pop up on your screen, just take a deep breath and remember that you’re doing your part to keep the wheels of justice turning (pun intended). And hey, maybe next time you’ll stick to the speed limit and avoid those pesky fines altogether. But let’s be real, we all know that’s not gonna happen.

Breaking Down Processing Costs

So you thought processing costs were just a boring topic for accountants and financial analysts? Think again! Let’s break down these sneaky little costs that can eat away at your bottom line faster than you can say “credit card transaction fee”.

First up, we have the infamous merchant fees. These bad boys can range anywhere from 1-3% of each transaction, depending on your provider. It’s like a little tax on every sale you make – who knew making money could be so expensive?

Next, we have the joy of chargeback fees. Remember that customer who swore they never received their order, even though tracking shows it was delivered? Well, now you get to pay the price for their forgetfulness with a lovely chargeback fee.

And let’s not forget about the cost of PCI compliance. It’s like paying a membership fee to a club you never wanted to join in the first place. But hey, at least you get a shiny certificate to hang on your wall, right?

Unpacking Service Charges

Picture this: you’ve just moved into your new place, excited to start this new chapter. But as you start unpacking, you realize you’ve got a mountain of boxes to sort through. And then it hits you – you’ve also got a mountain of service charges to unpack!

Let’s break it down, shall we? Here’s a little glimpse into the world of service charges:

- HOA fees – Because who doesn’t love paying extra for that community pool you never use?

- Trash removal fees – Because apparently, your trash can’t just magically disappear.

- Utility charges – Because God forbid you try to live without electricity.

But fear not, dear friend! With a little bit of creativity and a whole lot of budgeting, you’ll be able to navigate these service charges like a pro. Just remember – deep breaths, lots of coffee, and the occasional cursing under your breath. You’ve got this!

Analyzing Convenience Fees

So you’ve decided to dig into the mysterious world of convenience fees, huh? Well, buckle up because we’re about to embark on a wild ride through the land of hidden charges and unexpected expenses.

First off, let’s address the elephant in the room – what exactly is a convenience fee? Basically, it’s a sneaky little surcharge that businesses tack on to your final bill for the “convenience” of using a certain payment method or service. Sneaky, right? But don’t worry, we’re here to help you navigate through the murky waters of convenience fees and come out on top.

Now, onto the fun part – analyzing those pesky convenience fees. Here are a few things to keep in mind as you dissect your next bill:

- Check for hidden convenience fees disguised as shipping charges or processing fees

- Compare prices across different platforms to see if one has lower convenience fees

- Ask the company directly about their fee structure - they might be willing to negotiate or waive certain charges

Remember, knowledge is power when it comes to understanding convenience fees. So don’t be afraid to ask questions, do your research, and most importantly, keep your sense of humor intact as you navigate this confusing world of hidden charges. Good luck, fee sleuths!

Evaluating Payment Options

When it comes to deciding on a payment option, you want to make sure you’re getting the most bang for your buck (or lack thereof). Here are a few things to consider when evaluating your payment options:

- Interest Rates: Watch out for those sneaky little numbers that can creep up on you when you least expect it. Always double check the fine print to make sure you’re not getting bamboozled by high interest rates.

- Rewards Programs: Who doesn’t love a good rewards program? Whether it’s cash back, airline miles, or free swag, make sure you’re taking advantage of all the perks your payment option has to offer.

- Fees: Ain’t nobody got time for hidden fees. Make sure you’re fully aware of any and all fees associated with your payment option so you’re not caught off guard when it’s time to pay up.

At the end of the day, choosing the right payment option is all about finding the perfect balance between convenience and cost-effectiveness. So take your time, do your research, and remember: it’s not just about how you pay, it’s about getting the last laugh when that bill comes due.

Comparing Price Structures

So you’ve decided to compare price structures, huh? Strap in folks, because we’re about to dive into the thrilling world of pricing!

First up, let’s talk about the age-old debate between flat rate pricing and hourly pricing:

- Flat Rate Pricing: Ah, the beloved flat rate pricing – the knight in shining armor for those who love predictability! With flat rate pricing, you always know exactly how much you’re going to pay, no surprises here. It’s like ordering pizza – you know the price upfront, and you can relax without constantly checking the clock, waiting for the meter to rack up.

- Hourly Pricing: On the other hand, we have hourly pricing – the mysterious stranger in the pricing world. Hourly pricing keeps you on your toes, never knowing exactly how much you’re going to pay until the job is done. It’s like going on a blind date – you might end up pleasantly surprised, or you might be running for the hills before the dessert even arrives.

Next, let’s discuss tiered pricing versus a la carte pricing:

- Tiered Pricing: Ah, tiered pricing – the buffet of pricing structures! With tiered pricing, you get to pick from a selection of options, each packed with its own set of goodies. It’s like choosing from a menu at a fancy restaurant – you can have the basic dish, or you can splurge for the deluxe option with all the bells and whistles.

- A La Carte Pricing: And then we have a la carte pricing – the DIY pricing structure. With a la carte pricing, you get to pick and choose exactly what you need, paying for each individual item separately. It’s like building your own sundae – you can skip the nuts, add extra fudge, and top it all off with a cherry on top.

FAQs

Why does it seem like the transaction costs on NJMCdirect are so confusing?

Because the folks over at NJMCdirect like to keep things interesting! Just kidding. In reality, the transaction costs can vary depending on the violation and payment method you choose. It’s a real-life Choose Your Own Adventure, but with fewer dragons and more fines.

Do I have to pay additional fees when using NJMCdirect?

Ah, fees. The bane of our existence. While NJMCdirect does have transaction costs for online payments, the fees are clearly outlined before you finish your transaction. So no surprises here – unless you consider paying fines a surprise.

Why do transaction costs vary for different violations?

Because not all traffic violations are created equal. Some are like speeding tickets – a minor inconvenience. Others are more serious, like forgetting to use your turn signal. The severity of the violation can impact the transaction costs, so try to follow the rules of the road, folks.

Is there a way to avoid high transaction costs on NJMCdirect?

If you’re looking to save some cash, you can always opt to mail in your payment instead of using NJMCdirect. Just be prepared to wait a bit longer for your payment to process. Patience is a virtue – especially when it comes to paying those pesky fines.

Stick it to the Man!

And there you have it, folks! You’ve cracked the code on those sneaky NJMCdirect transaction costs. So next time you’re hit with a fee that makes you scratch your head, just remember – knowledge is power. And armed with the knowledge of how these costs are calculated, you can feel like a superhero, fighting the forces of bureaucracy one payment at a time. Keep up the good fight, and may your wallet forever remain unscathed.