Oh, New Jersey – the land of boardwalks, Bruce Springsteen, and seemingly never-ending toll booths. But one thing you definitely don’t want to be stuck navigating in the Garden State? Bankruptcy and back taxes. Trust me, it’s a maze even GPS can’t guide you out of. So, buckle up and get ready to embark on a wild ride through the murky waters of financial distress in the land of the Turnpike. Welcome to the ultimate survival guide for tackling bankruptcy and back taxes in New Jersey – because sometimes, you’ve got to laugh to keep from crying.

Understanding Bankruptcy in New Jersey

So, you’ve found yourself in a bit of a pickle in New Jersey and bankruptcy seems to be the only way out. Don’t worry, you’re not alone! Let’s break down what bankruptcy actually means in the Garden State.

First off, there are two main types of bankruptcy in New Jersey: Chapter 7 and Chapter 13. Think of Chapter 7 as the Marie Kondo of bankruptcies – it’s all about decluttering your debts and getting rid of the stuff that doesn’t spark joy anymore. On the other hand, Chapter 13 is like going on a strict diet – you’ll still have to pay back some of your debts, but it’s all about getting back on track and regaining financial stability.

When you file for bankruptcy in New Jersey, you’ll have to deal with a trustee. No, not the Hogwarts kind - this trustee is a real person who will oversee your case and make sure everything is done by the book. They’re like the financial babysitters you never knew you needed!

Just remember, bankruptcy is not the end of the world. It’s a fresh start, a chance to hit the reset button and get your finances back on track. So, take a deep breath, grab a slice of pizza (because, let’s be real, pizza makes everything better in New Jersey), and tackle bankruptcy head-on. You’ve got this!

Types of Bankruptcy Options Available

So, you’ve found yourself in a financial pickle, huh? Well, don’t fret! There are some bankruptcy options available to help you out of this mess. Let’s dive into the different types of bankruptcies you can choose from:

- Chapter 7: Ah, the classic choice. This one involves liquidating all of your assets to pay off your debts. It’s like a yard sale, but way less fun.

- Chapter 13: This option allows you to keep most of your assets while creating a payment plan to slowly chip away at your debt. It’s like a never-ending installment plan, but without the interest.

- Chapter 11: Ah, the fancy choice for businesses. This one allows a business to restructure its debts and continue operating. It’s like a makeover for your finances.

So, when life throws lemons at you, don’t make lemonade – file for bankruptcy instead! Just kidding, please drink water and call a lawyer. But remember, bankruptcy doesn’t have to be the end of the world. It’s just a fresh start to your financial journey. Embrace it, learn from it, and maybe next time, invest in Bitcoin. Kidding again. Maybe.

Criteria for Filing for Bankruptcy in New Jersey

So you find yourself drowning in debt in the Garden State, huh? Don’t worry, you’re not alone. But before you go ahead and file for bankruptcy in New Jersey, there are some criteria you need to meet.

First and foremost, you must reside in New Jersey for at least 91 days before filing for bankruptcy. So if you were thinking of moving to the state just to file, think again!

Secondly, you must pass the means test, which basically checks if your income is low enough to qualify for Chapter 7 bankruptcy. If you’re making it rain on a regular basis, bankruptcy might not be an option for you.

Lastly, you need to complete a credit counseling course from an approved agency within 180 days before filing for bankruptcy. It’s like going to school, but for your financial future!

Back Taxes in New Jersey”>

Back Taxes in New Jersey”>

Navigating Back Taxes in New Jersey

So, you’ve found yourself in a bit of a pickle with your taxes, huh? Don’t worry, we’ve all been there – can feel like trying to find your way out of a corn maze blindfolded. But fear not, we’re here to help guide you through the tangled web of financial woes.

First things first, take a deep breath. It’s not the end of the world – just the end of your bank account if you don’t get things sorted out. Here are a few tips to help you navigate those murky waters:

- Don’t ignore the problem – the IRS won’t magically forget about your back taxes

- Get organized – gather all your documents and receipts, you’ll need them

- Consider hiring a tax professional – they can help you navigate the complex world of tax laws in New Jersey

Remember, you’re not alone in this. Thousands of people face back tax issues every year, and most of them come out the other side in one piece (albeit a lighter wallet). So take a deep breath, put on your big boy pants, and let’s tackle those back taxes together!

Options for Dealing with Back Taxes

So you’ve found yourself in a bit of a pickle with some back taxes, huh? Don’t worry, we’ve got some options for you to consider. Here are a few ways to tackle that pesky problem:

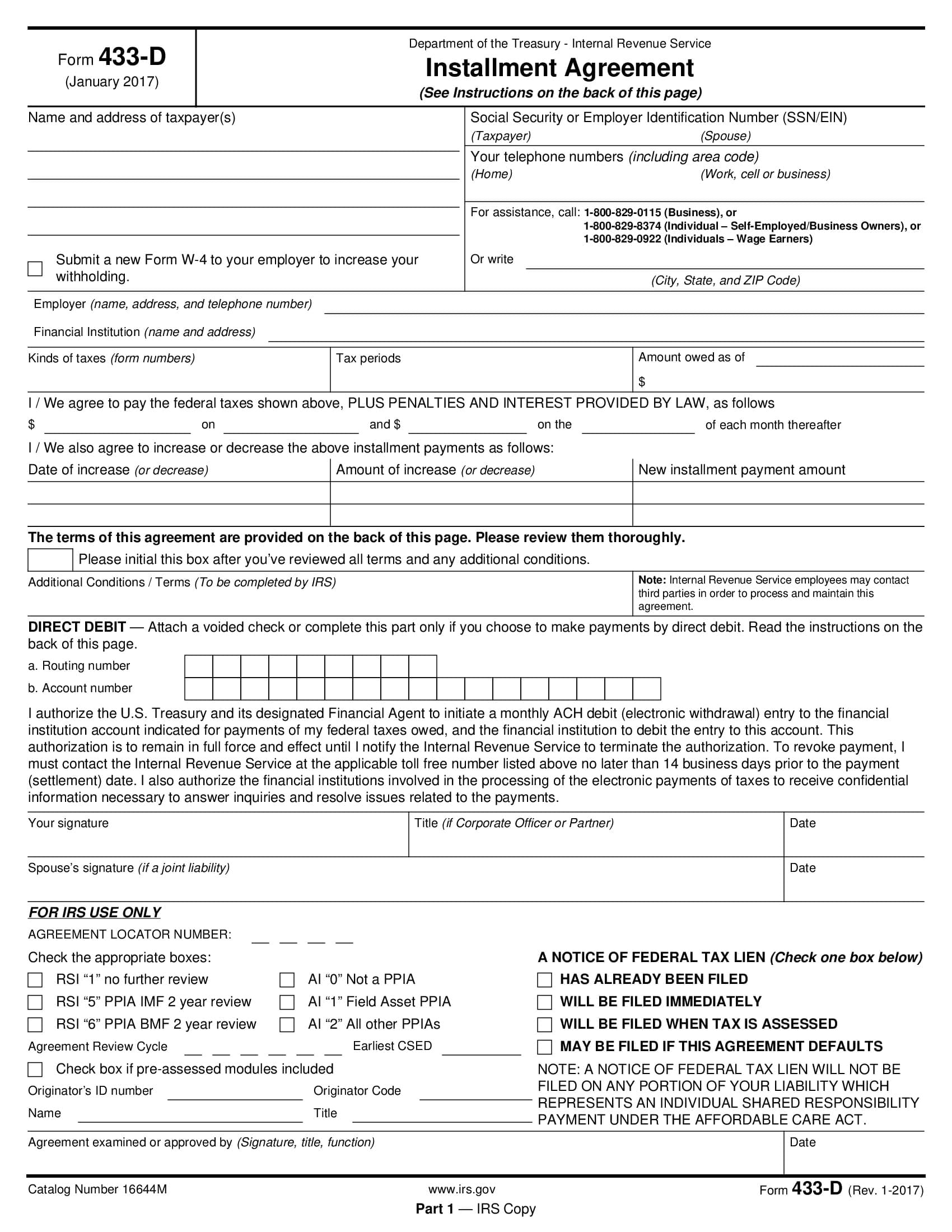

- Payment Plan: The good ol’ classic way to chip away at those back taxes. Set up a payment plan with the IRS and slowly but surely work your way out of debt. Just remember, the longer you take to pay, the more interest and penalties you’ll rack up. Yikes!

- Offer in Compromise: Feeling lucky? Try your hand at negotiating with the IRS for a lower settlement amount. It’s like haggling at a flea market, but way less fun. Just be prepared to prove your financial hardship and be ready to fork over a chunk of change upfront.

- Tax Relief Services: If you’re feeling fancy, you can hire a professional tax relief service to handle the dirty work for you. They’ll navigate the murky waters of back taxes, negotiate on your behalf, and hopefully get you a better outcome. But be warned, this luxury service comes with a price tag.

Whichever option you choose, just remember to face those back taxes head-on. Ignoring them will only make things worse. So put on your big boy pants (or big girl pants) and tackle those taxes like a boss!

Important Deadlines and Procedures for Filing Taxes

Alright tax procrastinators, listen up! April 15th is fast approaching and you don’t want to be scrambling at the last minute to get your taxes filed. Here are some important deadlines and procedures to keep in mind:

Deadlines:

- April 15th is the deadline for filing your federal tax return. Don’t forget!

- If you need more time, you can file for an extension, but remember that this only extends the deadline to file, not the deadline to pay any taxes owed.

Procedures:

- Make sure you have all of your paperwork in order before you sit down to start your taxes. W-2s, 1099s, receipts – the whole shebang.

- Consider hiring a professional tax preparer if your taxes are particularly complicated. They can help you navigate the confusing world of tax deductions and credits.

So there you have it, folks! Don’t let Tax Day sneak up on you this year. Get those taxes filed on time and avoid any unnecessary stress. Trust me, your future self will thank you!

Seeking Professional Assistance for Financial Challenges

So you’ve hit a bit of a rough patch in the financial department, huh? Don’t worry, we’ve all been there. Whether you’re drowning in debt, struggling to save for a rainy day, or just need some help managing your money, seeking professional assistance might just be the ticket to getting back on track.

Think of a financial advisor as your own personal cheerleader (minus the pom-poms). They’re there to provide expert guidance, help you set achievable goals, and hold you accountable for your spending habits. Plus, they’ve probably seen it all before, so no need to be embarrassed about that impulse purchase of a unicorn onesie.

With their knowledge and expertise, a financial advisor can help you create a personalized budget that actually works for you. Say goodbye to those sleepless nights stressing about money and hello to financial freedom and a newfound sense of control.

So why wait? Take the leap and reach out to a professional for help. Your future self will thank you for it. And who knows, with a little bit of guidance, you might just end up with enough savings to finally splurge on that yacht you’ve been eyeing. Hey, a girl can dream, right?

FAQs

Can I file for bankruptcy to eliminate my back taxes in New Jersey?

While bankruptcy can help eliminate some types of debt, back taxes are generally not dischargeable in bankruptcy. It’s important to consult with a tax professional or bankruptcy attorney to explore your options.

What are some alternatives to bankruptcy for dealing with back taxes in New Jersey?

There are several alternatives to bankruptcy for dealing with back taxes in New Jersey, such as setting up a payment plan with the IRS, applying for an Offer in Compromise, or seeking penalty abatement. These options may help you resolve your tax debt without having to file for bankruptcy.

How can I prevent back taxes from accruing in the future?

To prevent back taxes from accruing in the future, make sure to file your tax returns on time, pay any taxes owed in full and on time, and keep accurate and up-to-date financial records. If you’re struggling to pay your taxes, consider setting up a payment plan with the IRS to avoid falling behind.

Is it possible to negotiate with the IRS to reduce the amount of back taxes I owe in New Jersey?

Yes, it is possible to negotiate with the IRS to reduce the amount of back taxes you owe through an Offer in Compromise. This involves making an offer to the IRS to settle your tax debt for less than the full amount owed. However, the IRS will only accept an Offer in Compromise if they believe it is the most they can expect to collect from you.

What are the consequences of not addressing back taxes in New Jersey?

If you fail to address your back taxes in New Jersey, the IRS may take actions such as placing a tax lien on your property, garnishing your wages, or seizing assets to satisfy the debt. It’s important to address back taxes as soon as possible to avoid these consequences.

Don’t Let Bankruptcy and Back Taxes Hold You Back in the Garden State!

You may feel like you’re in a financial pickle, but remember, every great Jersey success story starts with a little setback. So put on your metaphorical boxing gloves and knock out those debts like the champ you are! With the right guidance and a little bit of elbow grease, you’ll be back on your feet and fist-pumping on the Jersey shore in no time. Remember, when life throws you lemons, make some jersey shore lemonade!