Navigating the murky waters of bankruptcy laws in New Jersey can feel like trying to find your way out of a corn maze at night while wearing a blindfold. But fear not, intrepid readers, for I am here to be your guiding light in this dark and treacherous journey through the land of financial distress. Join me as we unravel the complexities of bankruptcy laws in the Garden State, armed with wit, wisdom, and maybe a little bit of luck. So grab your compass (metaphorical, of course) and let’s venture forth into the wild world of Chapter 7 Bankruptcy in NJ: A Path to Financial Independence”>debt relief in the land of Taylor Ham and fist-pumping.

Understanding Bankruptcy Laws in New Jersey

So, you’ve found yourself in a bit of a financial pickle, huh? Don’t worry, you’re not alone. Many people in New Jersey have faced the same situation and come out on the other side just fine. The key is understanding the bankruptcy laws in the Garden State!

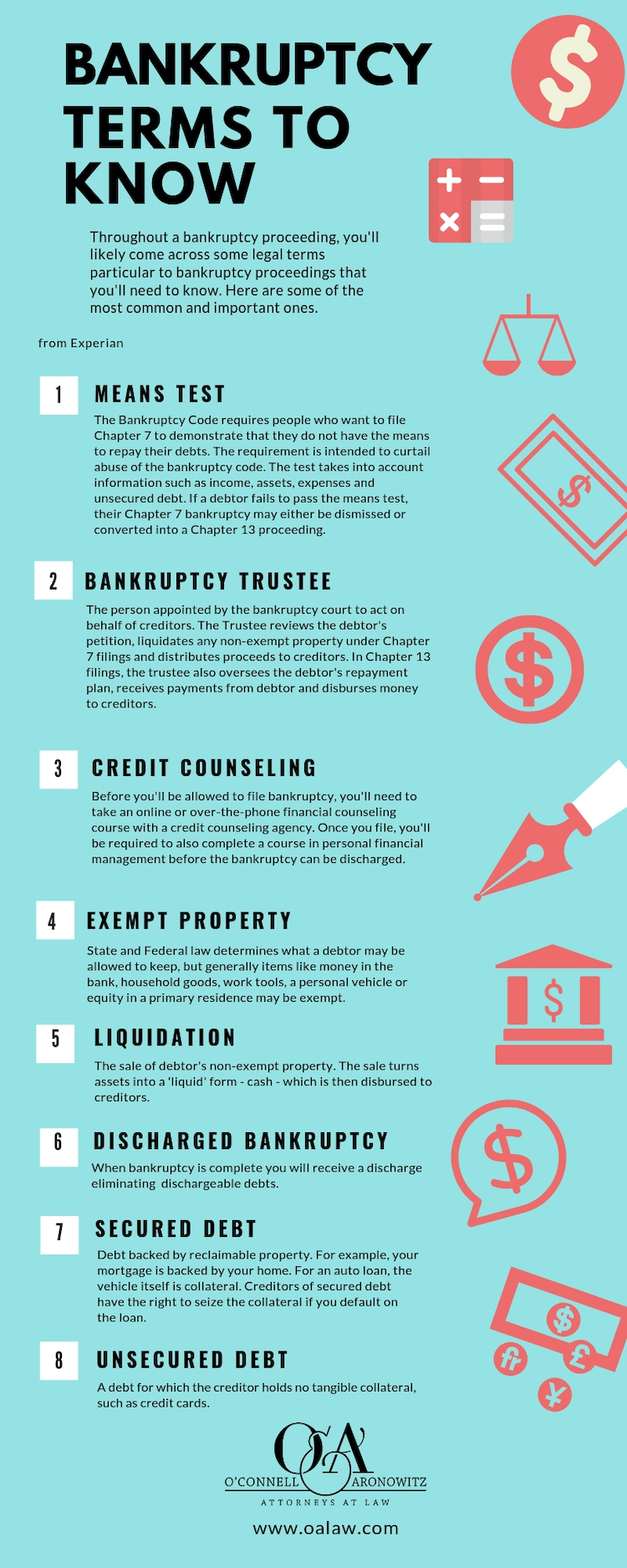

First things first, you need to know that there are two main types of bankruptcy in New Jersey: Chapter 7 and Chapter 13. Think of them as the Batman and Robin of the bankruptcy world – except not as cool. Chapter 7 is like a swift kick in the pants, wiping out most of your debts and giving you a fresh start. Chapter 13, on the other hand, is more like a strict diet plan, helping you repay your debts over time.

Now, before you start dancing a jig thinking all your financial troubles will disappear, there are a few things you should know. Bankruptcy is not a magic wand that will make everything better overnight. It takes time, effort, and a few sacrifices along the way. But hey, at least you’ll have some legal protection while you work through your financial mess!

Remember, bankruptcy laws can be as twisty and turny as a rollercoaster at Six Flags. That’s why it’s important to seek out the help of a knowledgeable bankruptcy attorney in New Jersey. They’ll be your trusty sidekick, guiding you through the murky waters of bankruptcy and helping you come out on top. So, buckle up and get ready for the adventure of a lifetime!

Different Types of Bankruptcy Available

So you’ve hit some financial rock bottom and are considering bankruptcy, eh? Well, lucky for you, there are different types of bankruptcies available to choose from. Let’s break it down for you in a way that’s a bit less soul-crushing, shall we?

First up, we have good ol’ Chapter 7 Bankruptcy. This is the one where you get to wipe the slate clean and start fresh. It’s basically like hitting the reset button on your finances, except without the risk of accidentally deleting your entire life like you did on your computer that one time. Plus, you get to ditch most of your debts, so it’s a win-win!

Next on the list is Chapter 13 Bankruptcy. This is kind of like going on a financial diet – you get to restructure your debts and come up with a payment plan to slowly chip away at what you owe. It’s all about that slow and steady wins the race mentality. Plus, you get to keep your assets, so you won’t have to say goodbye to your collection of Beanie Babies just yet.

And let’s not forget about Chapter 11 Bankruptcy, the bankruptcy for the big shots. This is like the VIP section of bankruptcies, where businesses and high rollers can reorganize their debts and keep the party going. It’s like hitting pause on your financial obligations while you figure out how to bounce back and make it rain again. Who said bankruptcy couldn’t be glamorous?

Qualifying for Bankruptcy in New Jersey

So you’ve found yourself in a financial pickle in the Garden State, eh? Fear not, my friend, for bankruptcy may be your golden ticket to financial freedom. But before you start dreaming of wiping the slate clean, let’s first determine if you actually qualify for bankruptcy in New Jersey.

First off, you must meet certain income requirements to qualify for bankruptcy in New Jersey. The court will look at your average income over the past six months and compare it to the median income for a household of your size in the state. If your income falls below this threshold, you may be eligible to file for bankruptcy. If you’re rolling in dough like a mob boss, well, bankruptcy may not be in the cards for you.

Next, you’ll need to complete a credit counseling course within 180 days before filing for bankruptcy. It’s like going to financial therapy, but without the awkward silences and judgmental looks from a therapist. Once you’ve completed this course, you’ll receive a certificate of completion that you’ll need to include in your bankruptcy filing.

Lastly, before you can hop on the bankruptcy bandwagon, you must pass the means test. No, it’s not a quiz on how many ways you can spend money frivolously—it’s a calculation that compares your income and expenses to determine if you have enough disposable income to repay your debts. If you pass the means test with flying colors, congratulations, you’re one step closer to bankruptcy bliss!

The Process of Filing for Bankruptcy

Filing for bankruptcy can seem like a daunting task, but fear not! It’s not as scary as it sounds. Here’s a breakdown of the process:

First things first, gather all of your financial documents together. You’ll need things like bank statements, tax returns, and any outstanding debts. Think of it as a game of financial hide and seek – except this time, you want to find all the skeletons in your financial closet.

Next, you’ll want to research different types of bankruptcy and decide which one is right for you. It’s like choosing a flavor of ice cream – except instead of chocolate or vanilla, your options are Chapter 7 or Chapter 13. And instead of enjoying a sweet treat, you’re dealing with your financial woes. Yum.

Once you’ve decided on the type of bankruptcy, it’s time to fill out the paperwork. This is where having a sharp pencil and a bottle of white-out can really come in handy. Remember, bankruptcy forms are like a crossword puzzle – except instead of finding the missing words, you’re detailing your financial demise. Happy filling!

Navigating Bankruptcy Court Proceedings in New Jersey

So, you find yourself navigating the treacherous waters of bankruptcy court proceedings in the lovely state of New Jersey. Fear not, brave soul, for I have some tips to help you survive this bureaucratic nightmare!

First things first, make sure you have a trusty lawyer by your side. They will be your guide through the maze of legal jargon and paperwork that lies ahead. Don’t skimp on this – a good lawyer is worth their weight in gold (or at least in legal fees).

Next, prepare yourself for a marathon, not a sprint. Bankruptcy court proceedings can drag on for months, even years. Stay calm, stay patient, and keep chipping away at that mountain of debt. Remember – slow and steady wins the race!

- Be sure to gather all your financial documents and organize them neatly. The court will appreciate your diligence, and it will make your lawyer’s job a whole lot easier.

- Attend all court hearings and meetings promptly. Punctuality is key, and you don’t want to anger the legal gods by showing up late.

- Don’t be afraid to ask questions. The legal system can be confusing, but ignorance is not bliss in bankruptcy court. Speak up, seek clarification, and don’t be afraid to advocate for yourself.

Dealing with Creditors During Bankruptcy

So, you find yourself in the unfortunate position of declaring bankruptcy. But hey, don’t fret! We’re here to help you navigate through the murky waters of dealing with those pesky creditors.

First things first, communication is key. Keep those lines open with your creditors and let them know what’s going on. Be honest about your situation and explain that you’re taking the necessary steps to get back on your feet.

Next, it’s time to prioritize your debts. Make a list of all your creditors and prioritize them based on the type of debt and the interest rate. **Focus on tackling those high-interest debts first** to avoid drowning in a sea of interest charges.

Lastly, don’t be afraid to negotiate. **Get creative with your payment plans** and see if you can come to a mutually beneficial agreement with your creditors. After all, it’s in their best interest to work with you to ensure they receive at least some of what they’re owed.

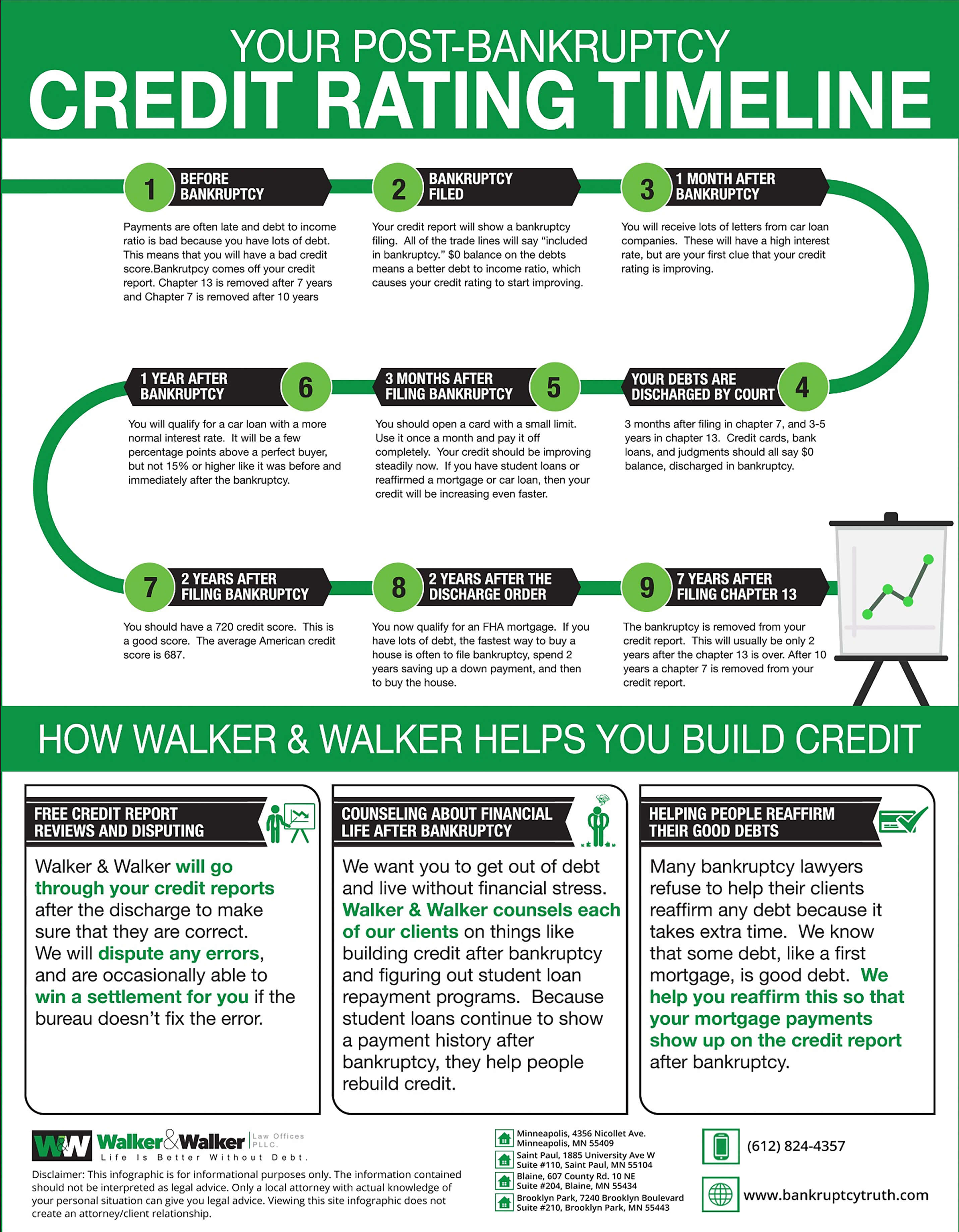

Life After Bankruptcy: Rebuilding Your Financial Health in New Jersey

So, you’ve declared bankruptcy in the Garden State, huh? Don’t worry, everyone’s been there - even Jersey Shore’s Snooki probably declared bankruptcy after all those gym, tan, and laundry expenses! But now that you’ve hit rock bottom financially, it’s time to climb your way back up and rebuild your money empire.

First things first, start by creating a budget. Yes, I know, budgets are about as fun as sitting in Parkway traffic during rush hour, but trust me, it’s necessary. Calculate your income, list your expenses, and prioritize what needs to be paid off first. Make sure to set aside some funds for emergencies too – you never know when a random toll booth fee might pop up!

Next, work on improving your credit score. It’s like trying to get an A+ in financial responsibility class. Pay your bills on time, keep your credit card balances low, and consider applying for a secured credit card to slowly build up your credit history. Before you know it, you’ll be back to having a credit score higher than the tallest roller coaster at Six Flags.

Lastly, don’t be afraid to seek help. There are financial advisors and credit counseling services available in Jersey that can assist you in navigating the murky waters of post-bankruptcy life. Remember, you’re not alone in this journey – after all, isn’t it comforting to know that even Snooki had to tighten her Gucci belt a few notches at some point?

FAQs

Can I still keep my car if I file for bankruptcy in New Jersey?

Oh, you fancy huh? Well, in New Jersey, you may be able to keep your car depending on the value of the vehicle and if you’re up to date on your car payments. Don’t worry, you won’t have to start hitchhiking to work just yet.

Will all of my debts be wiped clean if I file for bankruptcy?

Not quite, my friend. While filing for bankruptcy can help eliminate some of your debts, not all of them will magically disappear. Things like child support payments, student loans, and certain taxes will still be hanging around like that annoying friend who never leaves your house.

Can I file for bankruptcy on my own or do I need a lawyer?

Sure, you can try to navigate the murky waters of bankruptcy laws on your own, but wouldn’t you rather leave it to the professionals? It’s like trying to perform surgery on yourself – it may be possible, but it’s probably best to leave it to someone who actually knows what they’re doing.

What are the different types of bankruptcy I can file for in New Jersey?

Ah, the age-old question. In New Jersey, you have the option of filing for Chapter 7 bankruptcy, where most of your debts are wiped clean like a fresh slate, or Chapter 13 bankruptcy, where you’ll need to come up with a plan to repay your debts over time. It’s like choosing between a shot of tequila or a nice glass of wine – either way, you’re gonna feel some type of way.

Will filing for bankruptcy ruin my credit score forever?

Listen, filing for bankruptcy may put a little dent in your credit score, but it definitely won’t ruin it forever. Think of it as a bad breakup – it may sting for a bit, but eventually, you’ll be back out there swiping right on new credit opportunities. So chin up, buttercup!

And Remember, It’s Just Bankruptcy, Not the End of the World!

So there you have it, navigating bankruptcy laws in New Jersey doesn’t have to be a daunting task. Just remember to stay informed, seek help when needed, and keep a sense of humor throughout the process. After all, it’s just money – not your first-born child! So take a deep breath, follow the guidelines, and before you know it, you’ll be back on your feet and laughing all the way to the bank. Peace out, bankruptcies!