Welcome to the turbulent waters of New Jersey‘s tax system, where navigating the treacherous seas of property taxes can make anyone feel like they’re lost at sea. But fear not, for there is a beacon of hope in the form of ANCHOR Tax Relief. So grab your compass, hoist the mainsail, and prepare to set sail on a journey through the murky waters of tax relief in the Garden State. Let’s dive in and discover how you can keep your financial ship afloat with NJ’s ANCHOR Tax Relief program.

Understanding the ANCHOR Tax Relief Program

So, you’ve heard about the ANCHOR Tax Relief Program and you’re curious what all the buzz is about? Well, let me break it down for you in the most entertaining way possible.

First and foremost, the ANCHOR Tax Relief Program is like a magical unicorn that swoops in to save the day for property owners who are feeling the financial pinch. It’s basically a little gift from the government to help ease the burden of those pesky property taxes.

Picture this: you’re sitting at home, minding your own business, when suddenly you remember that hefty property tax bill looming over your head like a dark cloud. But fear not, my friends, because the ANCHOR Tax Relief Program is here to turn that frown upside down!

With the ANCHOR Tax Relief Program, you can say goodbye to those sleepless nights worrying about how you’re going to pay your property taxes. It’s like having a guardian angel looking out for your financial well-being, ensuring that you can keep your hard-earned cash where it belongs – in your pocket!

Eligibility Requirements for ANCHOR Tax Relief

Qualifications for ANCHOR Tax Relief

So you want to know if you qualify for the coveted ANCHOR Tax Relief program, huh? Well, you’re in luck because we’re about to break it down for you in plain old (kind of) English. Brace yourself, my friend.

First things first, you gotta be a homeowner. Yep, that means no renters allowed. Sorry, but we’re all about keeping those anchors firmly in place, if you catch my drift. Second, your property has to be your primary residence. We’re not in the business of giving tax breaks to people who have more vacation homes than they do regular homes.

Next up, you have to be a resident of the town where you own the property. We don’t care if you’re besties with the mayor or if you bribe us with free cookies, you gotta live there, plain and simple. And last but not least, you gotta be current on all your property taxes. No skipping out on Uncle Sam, got it?

So there you have it, the lowdown on the qualifications for ANCHOR Tax Relief. If you meet all the requirements, congratulations! If not, well, better luck next time, sailor. Keep your anchor steady and your taxes low!

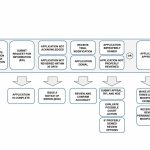

How to Apply for ANCHOR Tax Relief in New Jersey

So you’ve decided you want to take advantage of the sweet, sweet tax relief offered by ANCHOR in New Jersey. Congratulations, you’re about to feel like a financial superhero!

First things first, make sure you meet the requirements for ANCHOR tax relief. You need to be a homeowner in New Jersey, have a household income below a certain threshold, and be up-to-date on your property taxes. If you check all those boxes, you’re ready to rock!

Next, gather all your necessary documents. Think of it like a scavenger hunt, but instead of finding hidden treasures, you’re collecting W-2 forms, property tax statements, and any other financial paperwork that proves you’re a responsible adult. It’s not as fun, but hey, tax relief awaits!

Now that you’ve got all your paperwork in order, it’s time to fill out the application. Be honest, be thorough, and cross your fingers for good luck. Remember, ANCHOR tax relief is like a magical spell that can make your financial worries disappear. Who said taxes had to be boring?

Benefits of Participating in the ANCHOR Tax Relief Program

Are you tired of drowning in a sea of tax debt? Say goodbye to financial stress and hello to the ANCHOR Tax Relief Program! Participating in this program comes with a plethora of benefits that will make you want to jump ship from your tax woes.

With the ANCHOR Tax Relief Program, you can expect:

- Lowered Stress Levels: No more sleepless nights worrying about how you’re going to pay off your tax debt. Our program will help alleviate that burden and give you peace of mind.

- Expert Guidance: Our team of tax professionals will guide you through the process, ensuring you understand your options and making sure you get the best outcome possible.

- Financial Freedom: Say hello to extra cash in your pocket! By participating in the ANCHOR Tax Relief Program, you can save money on penalties and interest, allowing you to finally take that vacation you’ve been dreaming of.

Don’t let tax debt weigh you down any longer. Cast your worries aside and sign up for the ANCHOR Tax Relief Program today!

Key Considerations for NJ Property Owners Applying for ANCHOR Tax Relief

When applying for ANCHOR tax relief in New Jersey, property owners need to keep several key considerations in mind to ensure their application goes smoothly. Here are some important tips to help you navigate the process:

- Make sure you meet the eligibility requirements: Before applying, double-check that your property meets the criteria for ANCHOR tax relief. Don’t waste your time filling out paperwork if your property doesn’t qualify!

- Prepare all necessary documents: Gather all the required paperwork, such as proof of ownership, income statements, and any other documentation requested. Being organized will save you time and headaches down the road.

- Check for any deadlines: Don’t procrastinate! Be aware of any deadlines for submitting your application. Missing the deadline could mean missing out on potential tax relief.

Remember, applying for ANCHOR tax relief can be a bit of a slog, but the benefits are well worth it. So roll up your sleeves, gather your paperwork, and dive in! And who knows, you might just save enough money to treat yourself to a nice dinner out once it’s all said and done.

Navigating the ANCHOR Tax Relief Appeals Process

So, you’ve found yourself caught in the tangled web of the ANCHOR Tax Relief Appeals Process. Don’t worry, you’re not alone! Navigating this bureaucratic maze can be like trying to find your way out of a corn maze blindfolded. But fear not, intrepid taxpayer! With a little patience, a lot of caffeine, and perhaps a sacrificial offering to the IRS gods, you just might make it through unscathed.

First things first, make sure you have all your ducks in a row. And by ducks, I mean paperwork. Lots and lots of paperwork. In fact, you might want to invest in a filing cabinet just for all the forms, receipts, and notarized documents you’ll need to wrangle. Remember, the ANCHOR Tax Relief Appeals Process is not for the faint of heart (or the disorganized).

Next, familiarize yourself with the key players in this drama. From the stern-faced IRS agent who insists your deductions are “unsubstantiated” to the flustered secretary who can never seem to find your file, getting to know the cast of characters in the ANCHOR Tax Relief Appeals Process can give you a leg up. Remember, it’s all about charm and perseverance (and maybe a little bit of bribery).

And finally, don’t forget to schedule regular therapy sessions to keep your sanity intact. Dealing with the ANCHOR Tax Relief Appeals Process can be a test of your mental and emotional fortitude. But stay strong, brave taxpayer! The light at the end of the tunnel may be just a few more tax forms away.

FAQs

How can I qualify for NJ’s ANCHOR Tax Relief?

To qualify for ANCHOR Tax Relief in New Jersey, you must meet certain criteria such as being a resident of the state, owning a primary residence, and having a household income below a certain threshold. So basically, be a broke New Jerseyan.

Are there any specific documents I need to apply for ANCHOR Tax Relief?

Yes, you’ll need to gather your tax returns, proof of income, proof of residents, and any other documentation that proves your eligibility for the program. Just remember, no forged documents – unless you’re a master forger.

How much money can I expect to save with ANCHOR Tax Relief?

The amount of tax relief you receive will depend on your household income and property taxes. The savings can be significant, so it’s definitely worth looking into. And hey, who doesn’t love keeping a little more money in their pockets?

What happens if I don’t meet the eligibility requirements for ANCHOR Tax Relief?

If you don’t meet the eligibility requirements for ANCHOR Tax Relief, unfortunately, you won’t be able to participate in the program. It’s like trying to crash a fancy party without an invitation – you’ll just have to watch from the sidelines.

Don’t Get Lost in Tax Season, Set Your Course with ANCHOR Tax Relief!

Ahoy there, taxpaying sailors! With the treacherous waters of tax season ahead, don’t let yourself get shipwrecked in a sea of confusion and financial stress. Let NJ’s ANCHOR Tax Relief be your guiding light through the murky waters of tax obligations.

So hoist your sails, chart your course, and navigate towards smooth seas ahead. With ANCHOR Tax Relief at your side, you’ll be steering clear of any tax-related storms and steering straight towards your financial goals.

Fair winds and following seas, my fellow taxpayers! And may the winds of tax relief be forever in your favor.