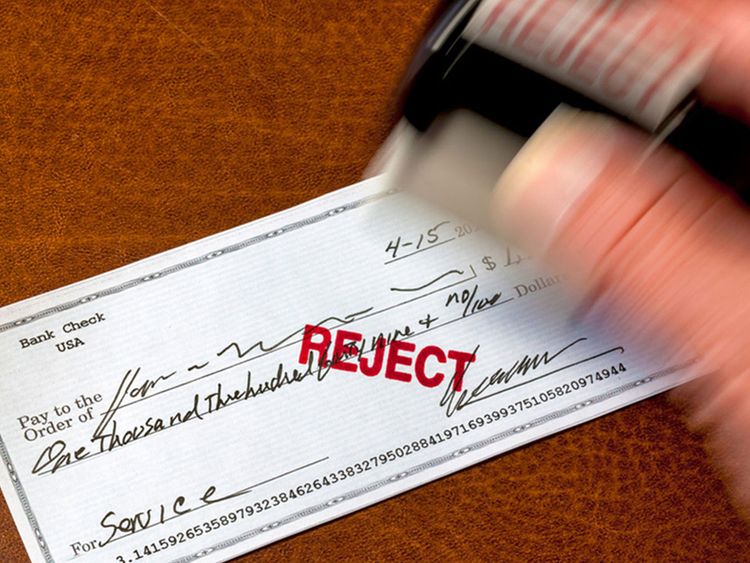

In the thrilling world of personal finance, few things strike fear into the hearts of New Jerseyans quite like the dreaded New Jersey's Hot Check Laws and Penalties”>bad check. Like a ninja assassin lying in wait, it strikes when you least expect it, leaving a trail of bounced checks, overdraft fees, and shattered dreams in its wake. But fear not, dear reader, for in this article we will navigate the treacherous waters of bad checks in the Garden State with wit, charm, and a healthy dose of self-deprecation. So grab your checkbook, fasten your seatbelt, and prepare to embark on a wild ride through the penalties of bad checks in NJ. Let the adventure begin!

Understanding the Legal Definition of a Bad Check in New Jersey

So, you’ve found yourself in a bit of a pickle, huh? You wrote a check that bounced higher than a trampoline at a circus. Well, fear not, my friend. Let’s break down the nitty-gritty of what exactly constitutes a bad check in the great state of New Jersey.

First off, a bad check in New Jersey is basically a check that bounces faster than a kangaroo on Red Bull. In legal terms, it’s a check that is dishonored by the bank due to insufficient funds, a closed account, or some other reason that makes your money no good. In simpler terms, it’s like promising someone a golden ticket to Willy Wonka’s chocolate factory and then handing them an expired bus pass.

Now, let’s get into the juicy details. According to New Jersey law, in order for a check to be considered bad, it must meet the following criteria:

- The check must be issued without reasonable expectation that it will be honored.

- The check must be dishonored by the bank due to insufficient funds or another valid reason.

- The check must be presented for payment within 180 days of the issue date.

So, the next time you’re thinking of writing a check that’s as reliable as a $3 umbrella in a hurricane, just remember these key points. And always keep your funds in check, or else you might find yourself in some hot water faster than you can say “legal mumbo jumbo.”

Potential Penalties for Writing a Bad Check in New Jersey

So, you tried to get a little creative with your finances and decided to write a bad check in New Jersey. Well, my friend, buckle up because you’re in for a wild ride of potential penalties and consequences. Here’s a glimpse of what could happen if you get caught in this sticky situation:

First off, let’s talk about the legal repercussions. If you’re caught writing a bad check in New Jersey, you could be facing criminal charges. Yes, that’s right – you might find yourself in front of a judge explaining why you thought it was a good idea to bounce a check. And trust me, judges don’t usually have a great sense of humor about these things.

Next up, let’s talk about fines. Oh boy, get ready to open up that wallet because writing a bad check in New Jersey could cost you a pretty penny. The state does not mess around when it comes to financial fraud, and you could end up paying a hefty sum to make things right.

And last but certainly not least, let’s not forget about the damage to your reputation. Word travels fast, especially in small towns, and writing a bad check could earn you a spot on the local gossip circuit. So, if you’re okay with being known as the person who can’t be trusted with a checkbook, go right ahead and keep writing those bad checks.

Steps Taken by Merchants and Businesses After Receiving a Bad Check

So, you’ve received a bad check from a customer. Don’t fret! Here are some hilarious steps you can take to handle the situation like a boss:

- **Frame the bad check:** Hang it on the wall as a reminder that not all customers are as honest as they claim to be.

- **Turn it into origami:** Get creative and fold the bad check into a beautiful origami masterpiece. Turn that negativity into art!

- **Use it as a coaster:** Have a good laugh every time you place your coffee mug on the bad check. Who knew a bad check could be so functional?

Remember, handling a bad check doesn’t have to be all gloom and doom. With a little creativity and a touch of humor, you can turn this negative experience into a funny anecdote to share with your peers. Embrace the chaos and show that bad check who’s boss!

Defending Yourself Against Accusations of Writing a Bad Check

So, you find yourself in the not-so-fun situation of being accused of writing a bad check. Don’t fret, my friend! I’ve got some tips and tricks up my sleeve to help you navigate through this sticky situation with ease.

First things first, ensure that you have proof of payment for the check in question. Whether it’s a receipt, bank statement, or a carrier pigeon that delivered the payment, make sure you have something concrete to prove your innocence.

Secondly, it’s time to put on your detective hat and do some sleuthing. Investigate the details of the check – was it actually your signature? Is the amount accurate? Was there any funny business going on with the check number? Get to the bottom of it and gather all the evidence you can to support your case.

Finally, if all else fails, it’s time to bring out the big guns. Hire a lawyer who specializes in check fraud cases to help defend your honor. Let them do the legal mumbo jumbo while you sit back and sip on a margarita. Hey, being accused of writing a bad check doesn’t have to be all doom and gloom!

Consequences of Ignoring Penalties for Writing Bad Checks in New Jersey

So you thought you could get away with writing a bad check in New Jersey, huh? Well, think again! Ignoring the penalties for this serious offense could land you in some hot water, my friend. Let me break it down for you:

First off, you could face some hefty fines. We’re talking about a fine of up to $1,000 for a first offense, and up to $5,000 for subsequent offenses. Ouch! That’s a lot of money that could’ve gone towards something way more fun than paying off your bad check debt.

And let’s not forget about the possibility of jail time. Yup, you read that right. If you continue to ignore those penalties and keep on writing bad checks, you could end up behind bars. Do you really want to spend your nights in a cramped cell instead of Netflix and chilling on your couch? I didn’t think so.

Oh, and did I mention that this offense stays on your record? That’s right, your little bad check writing escapade could haunt you for years to come. Good luck trying to explain that to future employers or landlords. Talk about a major buzzkill on your future prospects.

FAQs

What is considered a bad check in NJ?

A bad check in NJ is a check that is written with insufficient funds in the account to cover it. In other words, it’s like buying a round of drinks at the bar with an empty wallet – not a good idea!

What are the penalties for writing a bad check in NJ?

If you get caught writing a bad check in NJ, you could face hefty fines, criminal charges, and even jail time. So, unless you want to become BFFs with your local prison guards, it’s best to steer clear of writing bad checks.

How can I avoid writing bad checks in NJ?

To avoid the embarrassment and legal consequences of writing a bad check in NJ, make sure you always have enough funds in your account before writing a check. It’s also helpful to keep track of your expenses and account balance to prevent any accidental overdrafts.

What should I do if I receive a bad check in NJ?

If you receive a bad check in NJ, you should contact the person who wrote the check and ask them to make it right. If they refuse or are unable to do so, you can report the bad check to the authorities and potentially take legal action against the check writer.

Don’t Get Checked Out by Bad Checks in NJ!

So, dear readers, remember: bouncing checks may give you a little thrill, but the consequences can be a real buzzkill. Whether you’re dealing with late fees, embarrassment at the checkout counter, or even legal trouble, it’s best to steer clear of writing bad checks in NJ. Just like your high school crush, it’s always better to play it safe and stick to cash or card. Stay out of the penalty box and keep your checkbook in check!