Picture this: you’re minding your own business, sipping on your morning coffee, when suddenly you receive a letter in the mail from the dreaded tax man. You open it up, only to discover that your bank account has been levied, leaving you with nothing but a few measly pennies to your name. Sound like a nightmare? Well, fear not, dear reader. In this article, we’ll explore the world of New Jersey 101″>bank levies in the Garden State and share some savvy strategies for shielding your assets from those pesky creditors. So grab a cup of coffee (or maybe something a little stronger) and let’s dive into the wild world of defending against bank levies in NJ.

Understanding Bank Levies in New Jersey

So, you got a bank levy in New Jersey, huh? Sounds ominous, doesn’t it? Don’t worry, it’s not the end of the world. Let’s break it down for you:

First things first, a bank levy is essentially when a creditor freezes your bank account and snatches up your hard-earned cash to pay off a debt. It’s like that friend who always conveniently forgets their wallet when you go out to dinner, except way less cute.

Now, before you start panicking and envisioning yourself living off ramen noodles for the rest of your life, take a breath. Here are a few key points to remember:

- Bank levies in New Jersey can only be enforced by court order, so at least there’s some semblance of due process involved. Phew!

- Not all funds in your bank account are fair game for the creditors. Certain exemptions apply, like social security benefits, child support payments, and disability benefits. So, there’s still hope for that dream vacation to the Bahamas.

Remember, a bank levy may seem like a major inconvenience, but it’s not the end of the world. Stay calm, know your rights, and maybe treat yourself to some retail therapy to ease the pain. After all, life’s too short to stress about money all the time, right?

Legal Process for Bank Levies in NJ

So, you didn’t pay your debts and now the bank is coming for you? Don’t worry, we’ve got all the juicy details on what happens next in the legal process for bank levies in New Jersey!

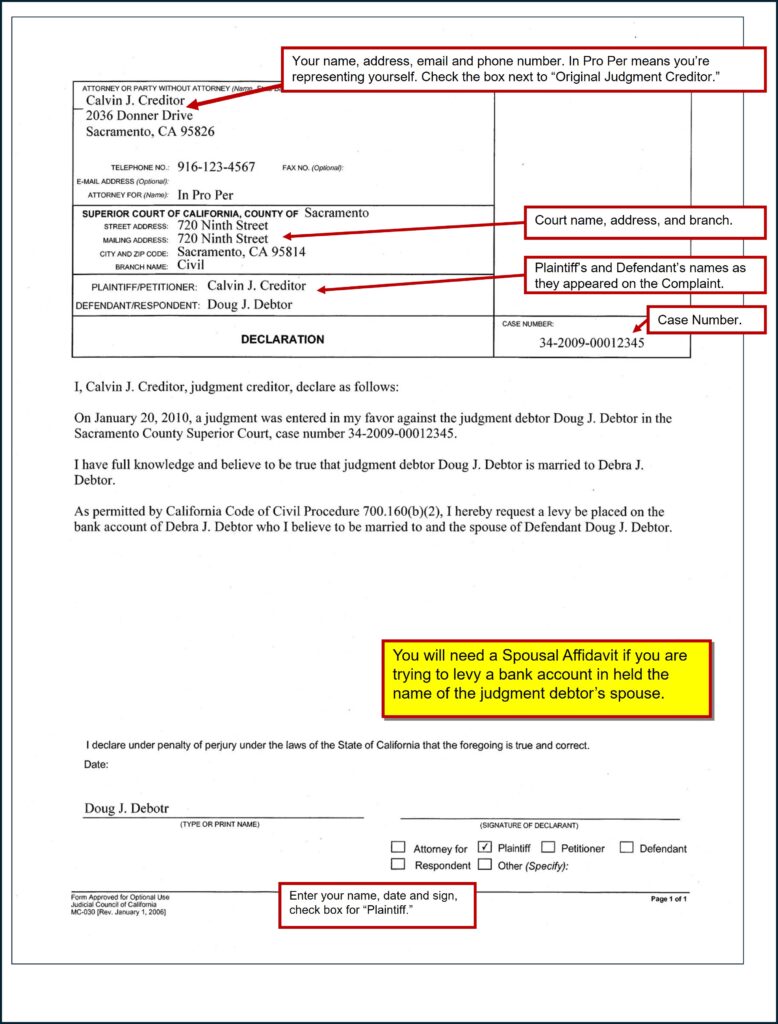

First things first, the creditor has to obtain a judgment against you in court. Once they have that, they can then serve a notice of levy on your bank. That means your precious funds are about to be snatched faster than you can say “lawsuit.”

Once your bank receives the notice, they are legally required to freeze your account and hold onto those funds for a certain period of time. During this time, you can say goodbye to your shopping sprees and fancy dinners – your money is on lockdown, baby!

But don’t worry, you still have a chance to fight back! You can file for an exemption to try and protect some of your assets, but let’s be real – the odds are not in your favor. So, buckle up, buttercup – it’s going to be a wild ride through the !

Strategies for Protecting Your Assets

When it comes to protecting your assets, you need to be like a ninja in the night – stealthy and strategic. Here are some top tips to help you keep your hard-earned money safe and sound:

- Invest in Insurance: Insurance is like having a safety net for your assets. Make sure you have the right policies in place to protect yourself from any unexpected disasters.

- Diversify Your Portfolio: Don’t put all your eggs in one basket. Spread your investments across different asset classes to minimize risk.

- Keep Your Information Secure: In this digital age, it’s more important than ever to protect your personal and financial information. Use strong passwords and be wary of phishing scams.

Remember, protecting your assets is not just about building a fortress around your wealth. It’s also about being smart and proactive in your financial decisions. By following these strategies, you can sleep easy knowing that your money is safe and sound.

Navigating Exemptions and Protections

So you’ve found yourself in the treacherous waters of , huh? Well, fear not, brave adventurer! With a little bit of wit and wisdom, you’ll be able to steer your ship through these choppy seas with ease.

First off, let’s talk about exemptions. Ah, exemptions – the golden ticket to getting out of sticky situations. Remember, not all exemptions are created equal. Some are like hidden treasure chests just waiting to be discovered, while others are more elusive than a mermaid in the deep blue sea. Keep your eyes peeled and your wits about you as you search for these precious exemptions.

Now, when it comes to protections, think of them as your trusty crew members, always there to watch your back and fend off any dangers that come your way. From legal shields to magical spells, protections can come in many forms. Make sure to familiarize yourself with the ones that will best suit your needs and keep them close at hand.

Remember, in the world of exemptions and protections, knowledge is power. So, study up, stay sharp, and don’t be afraid to ask for help along the way. With a little bit of luck and a whole lot of perseverance, you’ll be able to navigate these tricky waters like a true captain of the high seas. Good luck, matey!

Working with Legal Professionals to Defend Against Bank Levies

Legal professionals can be your best allies when facing bank levies. With their expertise and knowledge of the law, they can help navigate through the complexities of defending against this financial burden. Here are a few ways they can assist you:

- Legal Expertise: Attorneys specializing in bank levies know the ins and outs of the legal process. They can help you understand your rights and options, and formulate a plan to protect your assets.

- Negotiation Skills: Legal professionals are skilled negotiators who can work with creditors to come up with a solution that is fair and manageable for you. They can help you explore alternatives such as payment plans or settlements.

- Court Representation: In case your case goes to court, having a legal professional by your side can make a world of difference. They can argue on your behalf and present your case in the best possible light.

So, when it comes to bank levies, don’t hesitate to reach out to legal professionals for assistance. They can be your knights in shining armor, fighting off those pesky creditors and helping you protect your hard-earned money!

Mitigating the Impact of Bank Levies on Your Finances

So you’ve been hit with a bank levy, huh? That’s a tough pill to swallow, but fear not! There are ways to soften the blow and minimize the impact on your finances. Here’s a handy guide to help you navigate this tricky situation:

First things first, assess the damage. Take a good look at your bank account and see how much has been taken. It’s like ripping off a Band-Aid – better to just get it over with and face the damage head-on.

Next, it’s time to tighten those purse strings. Here are some creative ways to make up for the loss:

- Cut back on unnecessary expenses – do you really need that daily latte?

- Sell some of your stuff – one person’s junk is another person’s treasure

- Start a side hustle – maybe it’s time to dust off that Etsy shop you’ve been neglecting

Lastly, don’t forget to keep a sense of humor about the situation. After all, laughter is the best medicine, right? Plus, it’s way cheaper than therapy. So chin up, buttercup – you’ll get through this!

FAQs

How can I protect my assets from a bank levy in New Jersey?

Well, you could try hiding all your money under your mattress like a squirrel hoarding nuts. Just kidding! The best way to protect your assets from a bank levy in New Jersey is to create a trust or establish a limited liability company (LLC) to hold your assets.

Can a creditor just swoop in and freeze my bank account?

Oh, they can certainly try, but not if you’re prepared! If a creditor gets a judgment against you, they can seek a bank levy to freeze your account. However, if your assets are held in a trust or an LLC, they will be protected from such shenanigans.

What should I do if I receive notice of a bank levy in New Jersey?

First things first, don’t panic! Take a deep breath and promptly contact an experienced attorney who can help you navigate the tricky waters of dealing with a bank levy. They can help you explore your options and come up with a plan to shield your assets from those pesky creditors.

Can I still access my money if my account is frozen due to a bank levy?

Forget about withdrawing money to buy that fancy new yacht you’ve been eyeing. Once your account is frozen due to a bank levy, you won’t be able to access those funds until the matter is resolved. That’s why it’s crucial to take proactive steps to protect your assets beforehand.

What are some common strategies to defend against bank levies in New Jersey?

Think of it as a game of chess, where you’re the grandmaster protecting your assets from creditors who are trying to checkmate you. Common strategies include setting up a trust, creating an LLC, or transferring assets to a spouse or family member (but make sure it’s all done legally and above board).

Don’t Let the Bank Levy Blues Get You Down!

So there you have it, folks! Protecting your assets from those pesky bank levies in NJ doesn’t have to be a daunting task. With a little bit of know-how and a strategic plan in place, you can shield your hard-earned money from falling into the wrong hands.

Remember, when it comes to defending your assets, knowledge is power. So arm yourself with the information you need to keep those bank levies at bay. And hey, who knows? Maybe one day you’ll be the one levying the banks instead!

Stay savvy, stay protected, and most importantly, stay one step ahead of those sneaky bank levies. And if all else fails, just remember: there’s always a mattress or a piggy bank with your name on it.

Until next time, keep those assets safe and secure!