Buckle up, New Jersey drivers, because we’re about to take a wild ride through the chaotic world of traffic violations and their impact on your insurance premiums. From speeding tickets to reckless driving charges, every infraction comes with its own price tag – and we’re not just talking about fines. So grab your rearview mirror and prepare to navigate the treacherous terrain of insurance costs in the Garden State, where one wrong turn could send your premiums soaring faster than a lead-footed commuter on the Parkway. Let’s buckle up and hit the gas on this lucrative (and often hilarious) journey into the influence of traffic violations on NJ insurance costs.

Understanding Traffic Violations in New Jersey

So, you’ve found yourself in a pickle in the Garden State, huh? Before you start panicking and making plans to flee to another state, let’s break down some traffic violations in New Jersey for you.

First things first, if you’re thinking about driving away from your problems, think again. New Jersey takes its traffic laws seriously. Here are some common violations that might land you in hot water:

- Speeding – You might think you’re on the Jersey Turnpike, but that doesn’t give you the right to channel your inner race car driver.

- Running a red light - We get it, you’re in a hurry to get to the next Taylor Ham sandwich spot, but breaking this rule will get you into a pickle.

- Not yielding to pedestrians – In Jersey, pedestrians have the right of way. Yes, even if they’re jaywalking to get to Dunkin’ Donuts.

Now, let’s talk about the consequences of these violations. Besides potentially having to cough up some dough, you might end up with points on your license or worse, a suspended license. And let’s face it, taking the NJ Transit just isn’t as glamorous.

Impact of Traffic Violations on Insurance Premiums

So, you’ve been caught speeding again, huh? Well, buckle up because it’s not just your wallet that’s going to take a hit. Traffic violations can have a major impact on your insurance premiums too. And trust me, your insurance company isn’t going to let you off easy!

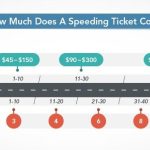

First off, let’s talk about speeding tickets. Those little slips of paper can add up quickly, and before you know it, you’re looking at some serious rate increases. Your insurance company sees you as a high-risk driver, and they’re going to make sure you pay for it. So next time you feel the need for speed, maybe just slow it down a notch. Your insurance premium will thank you!

And let’s not forget about those lovely red light violations. Running a red light isn’t just dangerous, it’s also a surefire way to see your insurance rates soar. Your insurance company wants drivers who follow the rules of the road, not those who treat traffic signals like suggestions. So unless you want to see your wallet empty faster than a drive-thru on a Friday night, maybe start paying attention to those stoplights!

Remember, your insurance premium is like a delicate flower – easily wilted by the harsh glare of traffic violations. So the next time you’re tempted to ignore the rules of the road, just think about the impact it could have on your insurance rates. Slow down, drive safely, and keep that premium as low as possible!

Common Traffic Violations and Their Impact on Insurance

So, you’ve been caught red-handed committing one of the most common traffic violations. Not only did you have to fork over some hard-earned cash for the ticket, but now you have to deal with the repercussions it has on your insurance. Let’s break down a few of these violations and the impact they can have on your rates.

First up, we have Speeding. We’ve all been guilty of putting the pedal to the metal from time to time. While it may feel exhilarating in the moment, it can be a real buzzkill when your insurance premiums shoot through the roof. So next time you feel the need for speed, remember that keeping a safe driving record is cheaper than owning a sports car.

Next, we have Running a Red Light. Sure, it may have seemed like a good idea at the time, but the aftermath can be a real headache. Running a red light not only puts you and others in danger, but it also puts a big red flag on your driving record. And we all know that insurance companies don’t take too kindly to reckless drivers.

And last, but certainly not least, we have Driving Without Insurance. This is like going to a potluck without bringing a dish – just plain rude. Not only is it illegal to drive without insurance, but it can also have serious consequences on your rates. So do yourself a favor and make sure you’re covered before hitting the road.

How Insurance Companies Calculate Premium Increases

So you want to know how insurance companies come up with those sneaky premium increases, eh? Well, buckle up, because I’m about to spill the beans on their top-secret formula. It’s like cracking the Da Vinci code, but with more paperwork and less Tom Hanks.

First things first, let’s talk about your driving record. If you’ve been tearing up the roads like Vin Diesel in the Fast and Furious movies, then expect your premiums to skyrocket faster than a SpaceX rocket. So slow down, Speed Racer, or you’ll be paying out the nose for insurance.

Next on the list is your credit score. Yep, you heard me right. Insurance companies will happily dig into your financial history faster than a nosy neighbor gossiping over the back fence. So if you’ve got a lower credit score than a limbo champion, you can bet your bottom dollar that your premiums are going up.

And let’s not forget about those fancy schmancy actuarial tables. These bad boys are like the insurance company’s crystal ball, predicting your future claims like a carnival fortune teller. So if you fall into a high-risk category, you might as well start building a money fort because those premium increases are coming for you.

Steps to Reduce Insurance Costs After Traffic Violations

So, you’ve recently had a little run-in with the law and your insurance rates have soared higher than a hot air balloon. But fear not, dear reader! There are steps you can take to bring those costs back down to earth.

1. Shop around for quotes: Don’t settle for the first insurance provider that comes knocking at your door. Take the time to compare quotes from different companies to find the best deal for your specific situation.

2. Defensive driving course: Sure, you may think you’re already a pro behind the wheel, but a defensive driving course can not only help improve your skills, but also help reduce your insurance premiums. Plus, who doesn’t want an excuse to wear those sweet driving gloves?

3. Consider raising your deductible: I know, I know. The thought of paying more out of pocket in case of an accident is a scary one. But by raising your deductible, you could potentially lower your monthly premium – just don’t forget where you hid that emergency cash stash!

The Importance of Safe Driving to Maintain Affordable Insurance Rates

Driving safely is crucial if you want to keep your insurance rates from skyrocketing faster than a rocket ship blasting off into outer space. Trust me, your wallet will thank you!

When you drive recklessly, not only are you putting yourself and others in danger, but you’re also putting a dent in your bank account. Those little fender benders and close calls can really add up when it comes time to renew your insurance policy. So, buckle up, keep your eyes on the road, and save yourself some cash!

Remember, insurance companies are always watching. They know when you’ve been naughty and when you’ve been nice behind the wheel. So, make sure to follow the rules of the road, avoid those pesky speeding tickets, and keep your record clean. Your insurance rates will thank you!

And hey, who doesn’t want to save money on insurance? Think of all the things you could buy or do with those extra dollars in your pocket. So, the next time you hit the road, remember: Safe driving equals affordable insurance rates. It’s a win-win for everyone!

FAQs

What exactly counts as a traffic violation in New Jersey?

Well, my dear reader, a traffic violation in the Garden State can range from something as harmless as a rolling stop at a stop sign to the more dramatic act of drag racing down the Turnpike. Basically, if you’re not following the rules of the road, you could be looking at a violation.

How do traffic violations affect my insurance costs in New Jersey?

Ah, the age-old question that plagues us all. Let me tell you, my friend, these violations are like little black marks on your driving record that insurance companies just love to see. The more violations you have, the higher your risk of getting into an accident, and the higher your insurance costs will be. It’s like a vicious cycle of bad driving leading to even more bad driving. Yikes!

Can I do anything to lower my insurance costs if I have traffic violations?

Of course, there’s always a way to try and wiggle your way out of those high insurance premiums. You could take a defensive driving course to show your insurance company you’re serious about being a safer driver. Or you could just drive like a grandma for a while until those violations drop off your record. The choice is yours!

How long do traffic violations stay on my driving record in New Jersey?

Ah, the eternal question of time. Most traffic violations will stay on your driving record for about three years in New Jersey. That’s three whole years of paying those higher insurance rates. But hey, look on the bright side – it’s only three years, right? Right?

Are there any specific traffic violations that have a bigger impact on insurance costs?

Oh, absolutely! Some violations, like DUIs or reckless driving, will send your insurance costs through the roof faster than you can say “speeding ticket”. These are the types of violations that make insurance companies break out in a cold sweat. So, if you want to keep your insurance costs down, maybe steer clear of those ones, okay?

Well, Buckle Up!

By now, you should have a clear understanding of just how much of an impact traffic violations can have on your New Jersey insurance costs. Remember, driving carefully isn’t just about avoiding tickets – it’s also about keeping your premiums down. So, do yourself a favor and stay on the right side of the law (and your insurance company)! Happy driving!