Have you ever felt like you were being hit with wave after wave of financial obligations, leaving you drowning in a sea of debt? Well, if you’ve experienced the dreaded unpaid surcharges in the state of New Jersey, you know exactly what I’m talking about. These sneaky little fees may seem small at first, but trust me, they have a way of creating a tidal wave of financial consequences that can leave even the most financially savvy individual gasping for air. So grab your life jacket and hold on tight as we dive into the murky waters of the ripple effect of unpaid NJ surcharges.

The Impact on Financial Stability

When it comes to financial stability, it’s like a game of Jenga – one wrong move and the whole tower can come crashing down. Just like how your financial decisions can either build a sturdy foundation or leave you in a precarious position.

Here’s how your financial stability can be impacted:

- Unexpected expenses – whether it’s a flat tire, a broken phone, or a surprise medical bill, these unexpected expenses can throw a wrench in your financial plans faster than you can say “oh no!”

- Debt accumulation – from student loans to credit card debt, owing money can feel like a never-ending cycle that keeps piling up faster than dirty laundry. And we all know how overwhelming that can be!

- Market fluctuations – just when you think you’re on top of your investments, the market decides to take a nosedive, leaving you wondering if you should have just buried your money in the backyard instead.

But fear not, dear reader! With a little bit of planning, budgeting, and maybe a sprinkle of luck, you can navigate the treacherous waters of financial stability and come out on top like a boss. So remember, when life throws you a financial curveball, just take a deep breath, roll up your sleeves, and show that money who’s boss!

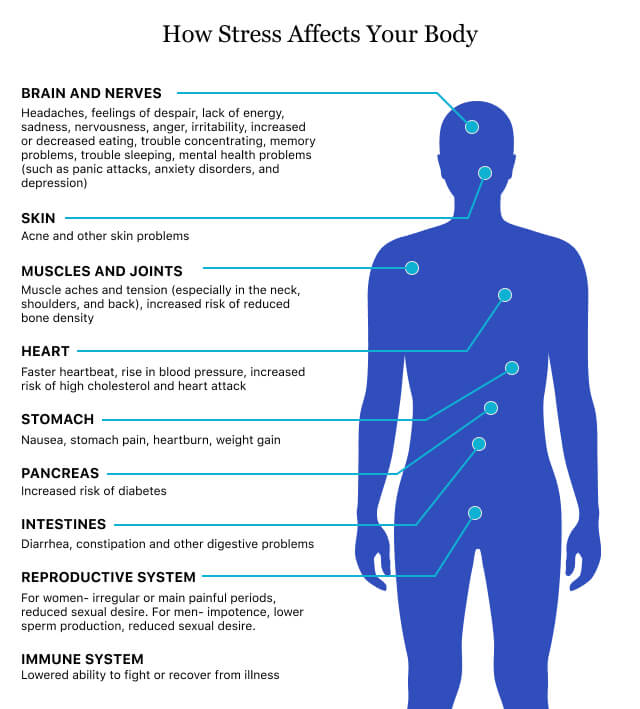

Increased Stress and Anxiety Levels

Do you often find yourself sweating like a sinner in church during your Monday morning meetings? Is your heart racing faster than a cheetah on caffeine every time your boss calls your name? Congratulations, you might just be experiencing ! And no, don’t worry, it’s not just all in your head – it’s in your entire body now too!

So, what can you do to combat these pesky little stress monsters wreaking havoc on your mental peace? Well, fear not, dear friend, for I bring you a few tried and tested tips that may or may not work (but hey, at least they sound good, right?):

- Breathe in, breathe out: Take a deep breath, count to ten, and repeat until you forget what you were stressed about in the first place. Warning: if this does not work, try counting backwards from ten while standing on one leg. No guarantees though.

- Embrace your inner yogi: Strike a warrior pose or downward dog at your desk to show your stress who’s boss. Bonus points if your coworkers join in and create a spontaneous office yoga flash mob.

- Laugh it off: Laughter is the best medicine, they say. So, watch a funny cat video or two, crack a joke with your colleagues, or simply belly laugh at the absurdity of it all. Who said stress couldn’t be fun?

Remember, stress and anxiety are just temporary visitors in your mind – don’t let them set up permanent residence! So go ahead, face them head-on, armed with a smile, a deep breath, and maybe a ridiculous stress ball shaped like a unicorn. You got this!

Potential Driver’s License Suspension

So you’ve found yourself in a bit of a sticky situation, huh? It seems like your driving skills have landed you on the radar of the license suspension squad. Fear not, dear reader, for all hope is not lost! Here are a few reasons why your license could be in jeopardy:

- Excessive speeding: If you’re treating the road like a NASCAR track, it’s only a matter of time before the authorities catch wind of your need for speed.

- Too many road rage incidents: If you find yourself yelling obscenities at every driver who dares to cut you off, it might be time to tone down the aggression behind the wheel.

- Failure to pay parking tickets: Those pesky parking tickets have a way of adding up, and if you ignore them for too long, you could be facing some serious consequences.

But fret not, my friend! There are ways to prevent this impending doom from becoming a reality. Here are a few tips to keep your license safe and sound:

- Follow the rules of the road: It may sound like common sense, but following traffic laws is the easiest way to avoid any potential suspensions.

- Pay your fines: As much as we all hate parting with our hard-earned cash, paying those parking tickets on time will save you from a world of hurt.

- Take a defensive driving course: Brush up on your driving skills and show the authorities that you’re serious about becoming a safer driver.

So there you have it, folks! Keep these tips in mind, and you’ll be cruising down the road without a care in the world. Just remember, a suspended license is no joke, so drive safely and responsibly!

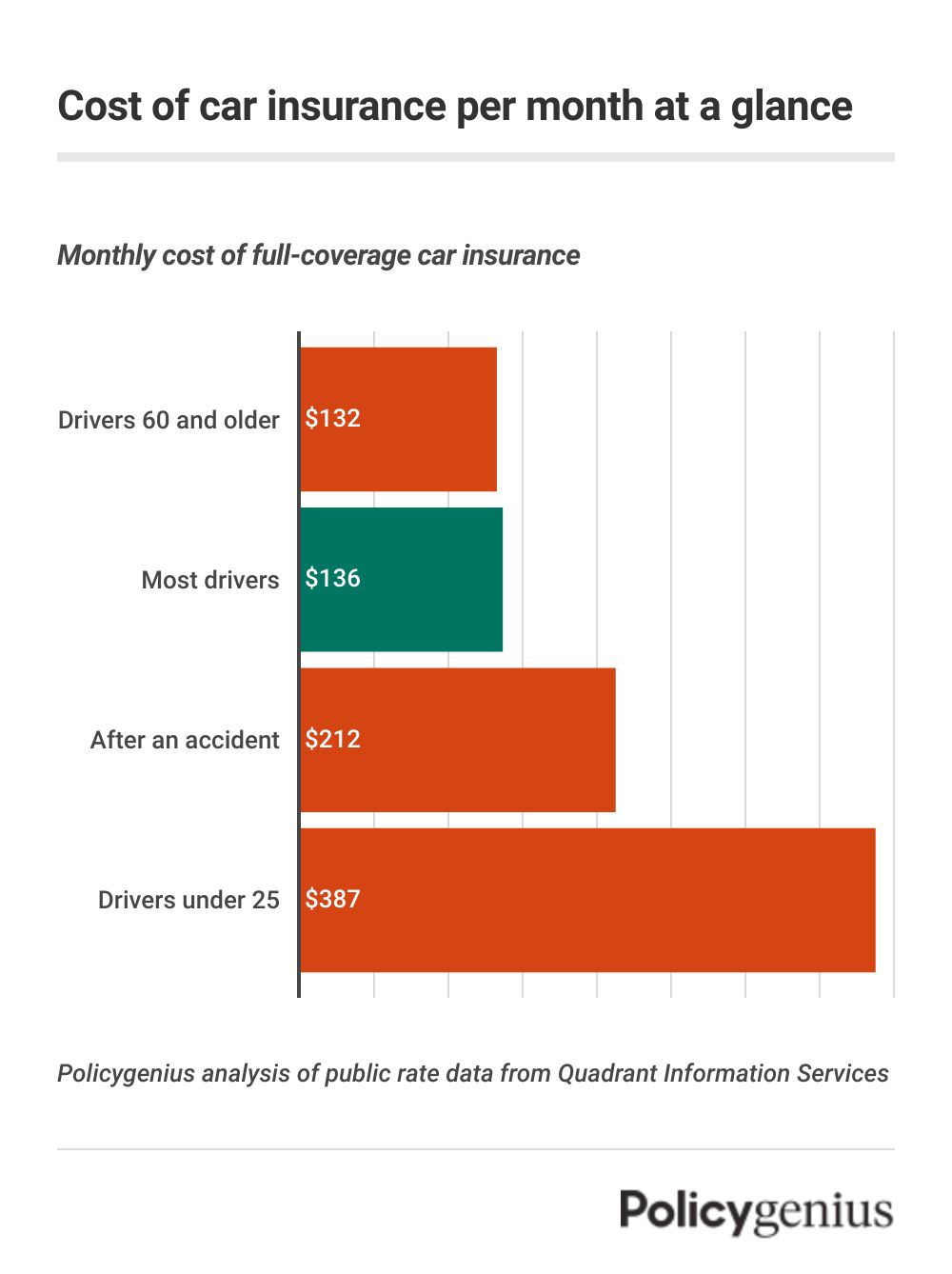

Difficulty Obtaining Car Insurance

So, you’ve found yourself in a bit of a bind trying to secure car insurance, huh? Trust me, you’re not alone. It seems like the insurance gods are playing a cruel joke on us all. But fear not, for I have some helpful tips to navigate this treacherous insurance landscape.

First off, if you’re getting the run-around from insurance companies, don’t sweat it. They make the process intentionally difficult to test our patience and perseverance. It’s like a twisted game of insurance hide-and-seek. But hey, at least you’re getting a crash course in persistence, right?

When dealing with insurance agents, remember to speak their language. Throw in some fancy insurance jargon like “premiums,” “deductibles,” and “policy endorsement.” It may not get you any closer to getting insured, but at least you’ll sound like you know what you’re talking about. Fake it ’til you make it, right?

And finally, if all else fails, just take a deep breath, put on your lucky insurance-themed socks, and keep on truckin’. Remember, you’ll eventually hit the jackpot and find that coveted car insurance policy. And when you do, make sure to celebrate with a victory lap around the block (safely, of course).

Long-Term Consequences on Credit Score

Forget about finding a pot of gold at the end of a rainbow – trying to repair your credit score after a major financial fumble can feel like hunting for a unicorn. But before you resign yourself to a lifetime of financial mediocrity, let’s delve into the long-term consequences of a poor credit score.

So, what exactly can happen if your credit score takes a nosedive? Allow me to paint you a not-so-pretty picture:

- Your dreams of owning a luxurious mansion will remain just that - dreams, as your chances of securing a mortgage will be as slim as a toothpick.

- Say goodbye to those fancy rewards credit cards with all the perks – you’ll be stuck with the equivalent of a credit card that grants you 10% off your next purchase of unscented candles.

- Need a new car? Sure, you can get one! But be prepared to pay enough in interest to fund a small European country.

But fear not, dear reader – all hope is not lost! By taking steps to improve your credit score (yes, it is possible), you can start to rebuild your financial reputation and inch your way back toward unicorn-status creditworthiness. So, put on your metaphorical financial boxing gloves and get ready to knock out that credit score debt monster once and for all!

Strain on Relationships and Family Dynamics

It’s no secret that family dynamics can sometimes resemble a soap opera – drama, tears, and unexpected plot twists included. Throw in a little strain on relationships, and you’ve got yourself a recipe for some quality reality TV material. Here are a few ways that tension can manifest in your relationships and family life:

- Communication breakdown: Ever had a conversation with your partner that ended in a shouting match? Or maybe a seemingly harmless joke that somehow turned into a full-blown argument? Yeah, that’s what we’re talking about.

- Passive-aggressive gestures: Who needs verbal communication when you can just give your brother the silent treatment for not doing the dishes? It’s a time-honored tradition in family dynamics everywhere.

- Boundary issues: Privacy? Personal space? Never heard of ’em! From nosy parents to meddling in-laws, boundaries can be a foreign concept in some family circles.

But fear not, dear reader! Remember that every family has its quirks and challenges. Embrace the chaos, laugh at the absurdity, and remember that at the end of the day, love (and maybe a good sense of humor) conquers all.

FAQs

What exactly are NJ surcharges?

NJ surcharges are like those pesky little leeches that just won’t go away. They’re additional fines that the state slaps on top of your existing traffic violation fees, just to add insult to injury.

How do unpaid NJ surcharges affect me?

Oh, you mean besides draining your bank account faster than a kid in a candy store? Well, unpaid surcharges can result in a suspended license, which means say goodbye to your freedom and hello to relying on public transportation or hitching rides from friends.

Can unpaid surcharges affect my credit score?

Oh, absolutely! Just when you thought those surcharges couldn’t get any worse, they go ahead and do a number on your credit score. So if you enjoy paying higher interest rates and having your financial reputation tarnished, then by all means, leave those surcharges unpaid.

Is there any way to get rid of unpaid NJ surcharges?

Well, you could always try ignoring them and hoping they magically disappear. But in all seriousness, your best bet is to consult with a lawyer who can help negotiate a payment plan or possibly even reduce the amount you owe. It’s better to face the music now than have those surcharges haunting you for years to come.

Don’t Let Surcharges Sink Your Ship!

So, there you have it folks! The ripple effect of unpaid NJ surcharges is no joke. It’s like that annoying friend who just won’t go away, lingering in the background and messing things up for everyone. But fear not, dear reader, for you now have the power of knowledge on your side. Armed with this information, you can navigate the treacherous waters of surcharges and avoid being dragged down by their weight. So next time the surcharge monster comes knocking, just give it a little wink and a smile, and say “Not today, buddy!” Stay savvy, stay informed, and may your bank account be forever in the black. Cheers!