Welcome to “Understanding Bank Levies in New Jersey 101”, where we will dive into the wild and wacky world of bank levies in the Garden State. So grab your seatbelt and hold on tight as we navigate through the confusing and often frustrating process of having your hard-earned money snatched away faster than you can say “what the heck just happened?”. From unexpected withdrawals to frantic phone calls to your bank, we’ll cover it all with a healthy dose of humor and a sprinkle of sarcasm. So sit back, relax, and get ready to be schooled on all things bank levies in New Jersey!

What is a Bank Levy?

So, you wake up one day to find that your bank account has been unexpectedly drained. What gives? Well, it could be that you’re the lucky winner of a bank levy!

When the IRS or another creditor wants to get their hands on your hard-earned cash, they can slap a bank levy on your account faster than you can say “I thought that money was mine.” This means they have the legal authority to swoop in and take a chunk of your funds to cover whatever debt you owe. And trust me, they’re not just taking spare change.

Once a bank levy hits, prepare to say goodbye to that vacation you’ve been dreaming of, or those new shoes you had your eye on. Your bank account is now on lockdown, and you’ll have to kiss those funds goodbye faster than you can say “broke.”

Before you know it, you’ll be looking at your bank statement like, “Who knew my account could go from hero to zero so quickly?” So, remember to pay your debts on time, or you might find yourself facing the dreaded bank levy. It’s enough to make even the most fearless spender break out in a cold sweat!

How Does a Bank Levy Work?

So, you’ve found yourself in a bit of a financial pickle, huh? And now the big bad bank is coming after you with a levy? Don’t worry, my friend. I’m here to break it down for you in a way that won’t have you reaching for the Tylenol.

First things first – a bank levy is basically when a bank takes money directly from your account to cover a debt that you owe. It’s like when you’re at a potluck and someone takes the last slice of pizza before you can even grab a plate. Rude, right?

Now, how does this whole bank levy thing actually work? Well, it’s not as glamorous as you might think. It’s not like a bank employee comes in wearing a cape and declares, ”I am here to levy your account!” Nope, it’s much less dramatic than that. The bank simply freezes the funds in your account and usually notifies you about it after the fact. It’s like a surprise party, but without the confetti.

So, what can you do to avoid a bank levy? Unfortunately, there’s not much you can do once the levy train has left the station. But hey, at least you can learn from your mistakes and maybe start a piggy bank collection under your mattress. Who needs a bank anyway, am I right?

Understanding the Legal Process of Bank Levies in New Jersey

So, you woke up one day to find out that the bank has levied your account. Before you start panicking, let’s break down the legal process of bank levies in New Jersey for you.

First things first, a bank levy in New Jersey is when a creditor (the person or entity you owe money to) gets a court order to freeze your bank account and take out money to cover your debts. Pretty harsh, right? But before they can do this, they need to follow a specific legal process:

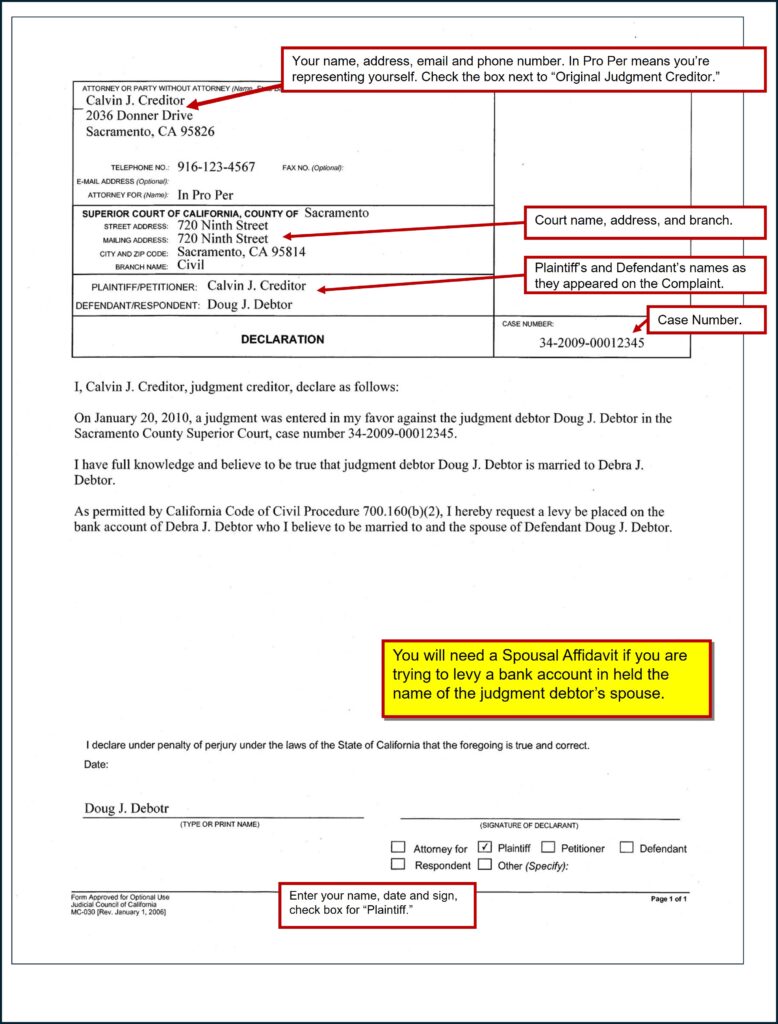

- File a lawsuit: The creditor needs to take you to court and win a judgment against you. If you lose, they can request a bank levy.

- Obtain a writ of execution: This is basically the paper that allows the creditor to go after your bank account. Think of it as a golden ticket, but way less fun.

- Send a notice to your bank: Once they have the green light, the creditor will send a notice to your bank telling them to freeze your account. Cue the dramatic music.

Remember, you do have rights during this process. You can challenge the levy in court, claim exemptions on certain funds (like social security benefits or child support), or negotiate a payment plan with your creditor. So, don’t lose hope just yet! And who knows, maybe this whole ordeal will make for a great story to tell at parties (if you’re into that kind of thing).

Common Reasons for Bank Levies in New Jersey

When it comes to bank levies in New Jersey, there are a few common reasons why you may find yourself in hot water with the IRS. Let’s break down some of the top offenders:

- Unpaid Taxes: The most obvious reason for a bank levy is failing to pay your taxes. Uncle Sam doesn’t take kindly to being shortchanged, so make sure you’re up to date on your payments to avoid any unwelcome surprises.

- Outstanding Debts: If you’ve been dodging calls from debt collectors, they may take matters into their own hands by seeking a bank levy. It’s hard to hide from your financial responsibilities in the digital age – trust us, they’ll find you.

- Court Judgments: Get on the wrong side of the law, and you could find yourself facing a bank levy faster than you can say “objection!” Whether it’s a civil lawsuit or criminal case, failing to fulfill your legal obligations could lead to some serious financial consequences.

Remember, it’s always better to play it safe and stay on top of your financial obligations to avoid any unexpected bank levies. Unless, of course, you enjoy the thrill of a surprise audit – in that case, carry on!

Consequences of Ignoring a Bank Levy

So you thought you could just ignore that pesky bank levy, huh? Well, buckle up because here come the consequences!

First off, you can say goodbye to that hard-earned cash in your account. The bank is legally required to freeze the funds that are subject to the levy, meaning you won’t be able to access a single penny. It’s like the bank version of a force field around your money.

Not only will your funds be frozen, but you’ll also likely incur some hefty fees. Banks aren’t exactly in the business of doing things for free, so expect to see some charges added to your account for the trouble you’ve caused.

And if you still think you can just sweep this whole thing under the rug, think again. Ignoring a bank levy can lead to some serious legal trouble. You could end up facing fines, judgments, and even potential criminal charges. Talk about a financial hangover!

How to Release a Bank Levy in New Jersey

So, you woke up this morning to find out that the bank has placed a levy on your account in New Jersey. Don’t worry, it’s not the end of the world! Here are some tips to help you release that pesky bank levy:

First things first, contact the bank and find out why they placed the levy on your account. It could be a mistake that can easily be rectified with a simple phone call. If it’s not a mistake, then you’ll need to take some further steps.

Next, gather all the necessary paperwork to prove your case and show that you don’t owe that amount of money. Organize your documents neatly and present them to the bank in a clear and convincing manner. Remember, banks love paperwork!

If the bank still refuses to release the levy, you may need to seek legal help. Find a good lawyer who specializes in bank levies and let them do the talking for you. Sometimes, a sternly worded legal letter is all it takes to scare the bank into releasing the levy.

FAQs

What is a bank levy?

A bank levy is like when someone swoops in and takes all your money, kind of like a financial ninja.

How does a bank levy work in New Jersey?

A bank levy in New Jersey works by someone getting a court order to freeze your bank account and seize the funds to satisfy a debt you owe. It’s like having your bank account go on a sudden diet.

Can I stop a bank levy in New Jersey?

Well, you could try hiding your money under your mattress, but that might not work. Your best bet is to work out a payment plan with your creditor or seek legal help to challenge the levy.

What kind of debts can lead to a bank levy in New Jersey?

Any debt could potentially lead to a bank levy in New Jersey, from unpaid taxes to unpaid parking tickets. It’s like getting a financial slap on the wrist for being a little too lax about paying your bills.

Are there any exemptions from bank levies in New Jersey?

Yes, there are some exemptions from bank levies in New Jersey, such as certain types of government benefits and child support payments. It’s like having a few safe havens for your money in the stormy sea of debt.

Now you’re Bank Levy-savvy!

Congratulations on making it to the end of our crash course on Bank Levies in New Jersey! You’ve successfully navigated through this murky world of frozen assets and legal jargon, and we hope you’re feeling more confident about protecting your hard-earned money. Remember, knowledge is power when it comes to your finances, so keep learning and stay one step ahead of those sneaky levies! Until next time, happy banking and may your accounts always be levy-free!