Buckle up, New Jersey drivers, because we’re about to take a wild ride through the world of auto insurance thresholds! Whether you’re a seasoned pro or a newbie behind the wheel, understanding the ins and outs of these mysterious thresholds can save you from a major fender-bender with your finances. So grab your coffee and get cozy, because we’re diving deep into the world of NJ auto insurance – and trust us, it’s a thrill ride you won’t want to miss!

Common Types of Auto Insurance Thresholds in NJ

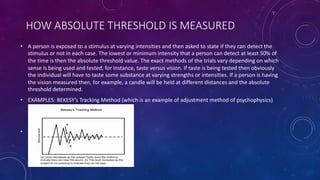

When it comes to auto insurance in New Jersey, there are several common types of thresholds that you need to be aware of. These thresholds can affect how much coverage you have, how much you’ll pay for your premiums, and even the type of benefits you’ll receive in the event of an accident.

One type of threshold you might come across is the verbal threshold. This threshold requires that you have a certain level of injury in order to receive benefits from your insurance company. It’s like they’re saying, “no pain, no gain!”

Another common threshold is the dollar threshold, which limits the amount of money you can receive in benefits for certain types of claims. It’s like having a spending limit on your credit card, except it’s for your insurance coverage!

And then there’s the medical threshold, which requires that you have a certain level of medical treatment before you can receive benefits. It’s like getting a prescription from your insurance company for coverage!

Determining No Threshold, Verbal Threshold, and Limitation on Lawsuit Threshold

So you’ve found yourself in a fender bender and now you’re trying to navigate the confusing world of insurance thresholds. What a time to be alive! Let’s break it down, shall we?

First up, we have the No Threshold option. Basically, this means that you can sue for any damages, no matter how small. It’s like having a never-ending buffet of insurance money – who wouldn’t want that? Just be prepared for some eye rolls from the insurance company when you hit them with your laundry list of damages.

Next, we have the Verbal Threshold, which sounds like some kind of mystical incantation, but alas, it’s just a fancy way of saying that you have to meet specific criteria in order to sue. Maybe your injuries need to be “serious” or “permanent.” It’s like trying to get into an exclusive club where the bouncer is a grumpy insurance adjuster.

And last but not least, we have the Limitation on Lawsuit Threshold. This one is like the Verbal Threshold’s stricter older sibling. Not only do you have to meet certain criteria, but they’re even more intense. It’s like trying to navigate a maze blindfolded while juggling flaming torches – good luck with that!

Key Differences Between Each Threshold Type

So you think you know all about threshold types, huh? Well, buckle up because you are about to be schooled on the key differences between each one!

First off, let’s talk about the Pain Threshold. This is the point at which you start feeling uncomfortable and can’t take any more. It’s like that moment when your boss asks you to stay late on a Friday – pure agony. Now, the Loud Noise Threshold is a whole different ball game. This is the level at which your ears start bleeding and your neighbors threaten to call the cops. It’s basically every Metallica concert ever.

Next up, we have the Food Threshold. This is the amount of pizza slices you can eat before you regret all your life choices. And finally, the Fun Threshold. This is the point at which you’ve had enough fun for one day and need to Netflix and chill. Or just chill. Because let’s face it, who has the energy for Netflix after a long day of threshold testing?

Factors that Impact the Cost of Auto Insurance Premiums Based on Thresholds

Ever wonder why your auto insurance premiums seem to be going up every year? Well, there are a few factors that can impact the cost of your premiums based on certain thresholds. Let’s dive into the nitty-gritty of what goes on behind the scenes in the insurance world.

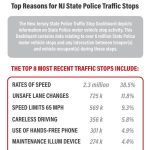

One of the biggest factors that can drive up your premiums is your driving record. If you have a history of speeding tickets, accidents, or other traffic violations, insurance companies see you as a high-risk driver and will charge you more for coverage. It’s like they have a secret radar that goes off every time you hit the gas pedal a little too hard. So, if you want to keep your premiums from skyrocketing, try to keep those traffic violations to a minimum.

Another factor that can impact your premiums is the type of car you drive. Insurance companies have a hierarchy of vehicles, with sports cars and luxury cars at the top of the list. If you’re cruising around town in a flashy convertible, expect to pay a pretty penny for insurance. It’s like they think you’re James Bond or something, always on the run from bad guys in fancy cars.

Lastly, where you live can also have a big impact on your premiums. If you reside in a high-crime area or a city with heavy traffic, insurance companies will see you as more susceptible to accidents or theft. It’s like they think every car in the city is a target for carjackers or reckless drivers. So, if you’re looking to lower your premiums, consider moving to a sleepy little town where the biggest crime is the occasional stolen garden gnome.

How New Jersey Auto Insurance Thresholds Affect Personal Injury Claims

So you’ve found yourself in a fender bender in the Garden State, huh? Well, buckle up and let’s talk about how those New Jersey auto insurance thresholds can really throw a wrench in your personal injury claim.

First off, New Jersey is a no-fault state, which means you better believe every little scratch and bruise is going to be scrutinized to the max. This can make it tough to prove you really do need that massage chair to recover from your whiplash.

And oh boy, don’t even get me started on the verbal threshold. Here’s a quick breakdown for you in case your head is spinning like a car tire stuck in a pothole:

- It’s like having a VIP pass to the injury club. Basically, you need to have a serious injury in order to sue for pain and suffering.

- But don’t think you can just waltz in with any old injury. New Jersey has a laundry list of specific injuries that qualify, so you better hope one of them matches your situation.

So, if you’re feeling a little sore after that accident, just remember – navigating those New Jersey auto insurance thresholds is like trying to parallel park in Times Square. It’s a tight squeeze, but with a bit of perseverance and maybe a little luck, you might just come out on top. Good luck out there, and watch out for those aggressive drivers!

Navigating Auto Insurance Thresholds When Filing a Claim in NJ

So you’ve found yourself in a fender bender in the Garden State – no worries, it happens to the best of us! But before you start stress-eating a bag of pork roll and crying about your poor car, let’s talk about navigating those pesky auto insurance thresholds when filing a claim in NJ.

First things first, make sure you understand the different thresholds that come into play when filing a claim in New Jersey. You’ve got your Verbal Threshold, your Zero Threshold, and your Limitation on Lawsuit Threshold. It’s like trying to understand the plot of a mob movie - confusing, but once you get the hang of it, you’ll be golden.

Now, let’s talk about how these thresholds can affect your claims process. With the Verbal Threshold, you better be prepared to prove your injuries are serious. It’s like trying to convince your Italian grandmother that you’re too sick to eat her meatballs - not an easy task! And don’t even get me started on the Zero Threshold – if you want to sue for pain and suffering, you better have some serious injuries or you’ll be out of luck faster than you can say “bada bing, bada boom.” And the Limitation on Lawsuit Threshold? Let’s just say it’s like trying to get a good slice of pizza in Times Square – nearly impossible!

So, when it comes to filing a claim in the great state of New Jersey, just remember to do your homework, hire a good lawyer, and pray you don’t get stuck in traffic on the Garden State Parkway. Because navigating those auto insurance thresholds can be just as tricky as parallel parking in Hoboken!

FAQs

What are the different thresholds for auto insurance in New Jersey?

Well, for starters, there’s the verbal threshold, the limitation on lawsuit threshold, and the no limitation on lawsuit threshold. Kind of like a choose your own adventure, but with insurance.

What is the verbal threshold?

The verbal threshold is like a picky eater at a buffet – it only covers specific injuries that are deemed serious enough to warrant a lawsuit. If your injuries meet the criteria, congrats! You can sue. If not, sorry, better luck next time.

What is the limitation on lawsuit threshold?

The limitation on lawsuit threshold is like going to a theme park with height restrictions – you can only sue for damages if your injuries are on the approved list. If your injuries don’t make the cut, tough luck. Time to suck it up and pay those medical bills.

What is the no limitation on lawsuit threshold?

The no limitation on lawsuit threshold is like a free-for-all – you can sue for any and every type of injury, no questions asked. Just make sure you have a good lawyer on speed dial, because things are about to get messy.

Which threshold should I choose?

That’s like asking which flavor of ice cream is the best - it’s all subjective. If you’re a risk-taker, go for the no limitation on lawsuit threshold. If you prefer a more structured approach, the limitation on lawsuit threshold might be more your style. Just remember, choose wisely – your wallet and peace of mind depend on it.

Until Next Time… Drive Safe and Stay Covered!

Thanks for diving into the murky waters of NJ auto insurance thresholds with us! We hope this article has shed some light on this often confusing topic. Remember, understanding your coverage is key to staying protected on the roads. So buckle up, keep your eyes on the road, and may your insurance premiums stay low!

Until next time, happy driving, and remember – don’t let your insurance coverage be the one thing that drives you up a wall!