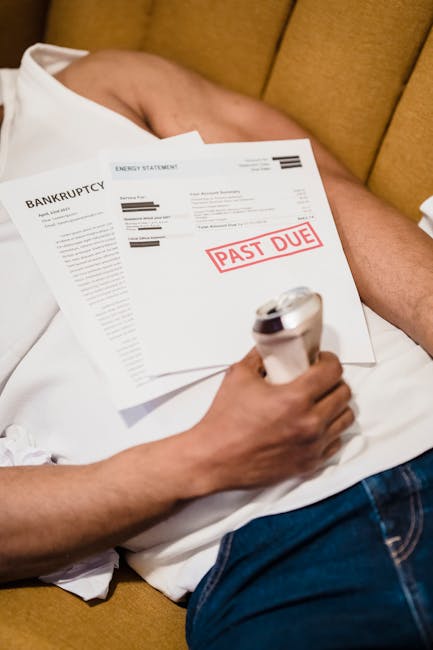

Taxes. Bankruptcy. Two words that can strike fear into the hearts of even the bravest souls. But fear not, dear reader, for we are here to guide you through the treacherous maze of New Jersey back taxes and bankruptcy like a wise-cracking tour guide leading you through a haunted house. So buckle up, because we’re about to unlock the secrets of financial chaos and emerge victorious on the other side.

Understanding New Jersey Back Taxes

So you thought you could outrun the tax man, huh? Not in New Jersey, my friend. The Garden State doesn’t mess around when it comes to collecting those back taxes. But don’t worry, I’m here to help you navigate through this muddy (financial) waters.

First things first, you need to understand what exactly constitutes back taxes. It’s basically the money you owe the state for not paying your taxes on time. Simple, right? Now, let’s dive into how to deal with this pesky problem like a champ.

Here are some tips to help you come out of this tax mess smelling like roses:

- Take it seriously: Ignoring those back taxes won’t make them disappear. Trust me, I’ve tried.

- Communicate: Reach out to the lovely folks at the New Jersey Division of Taxation and let them know you’re ready to tackle this issue head-on.

- Set up a payment plan: Don’t have a lump sum to pay off your back taxes? No worries! You can work out a payment plan that fits your budget.

Remember, facing your back taxes is like ripping off a Band-Aid – it may sting for a bit, but it’s better to get it over with quickly. So put on your big boy (or girl) pants and let’s tackle those New Jersey back taxes together!

Options for Resolving Outstanding Tax Debt

So, you find yourself in a bit of a pickle with the tax man, huh? Don’t worry, we’ve got your back! Here are a few options for resolving that pesky outstanding tax debt of yours:

- Payment Plan: One option is to set up a payment plan with the IRS. This allows you to pay off your debt in manageable monthly installments. It’s like going on a payment diet – no more splurging, just slow and steady wins the race!

- Offer in Compromise: Another option is to submit an offer in compromise, where you can settle your tax debt for less than the full amount owed. It’s like haggling with the IRS – just without the awkward back-and-forth negotiation.

- Bankruptcy: If all else fails, you could consider filing for bankruptcy. This isn’t the most ideal option, but hey, desperate times call for desperate measures, right? Just think of it as hitting the financial reset button.

Remember, the key is to take action and not bury your head in the sand. Ignoring your tax debt will only make matters worse. So, pick an option that suits your situation best and start working towards resolving that outstanding tax debt!

The Process of Filing for Bankruptcy in New Jersey

So you’ve found yourself in financial trouble in the Garden State, huh? Looks like it’s time to bite the bullet and file for bankruptcy in New Jersey. But fear not, we’ve got the lowdown on the process so you can navigate it like a boss. Here’s what you need to know:

First things first, you’ll need to determine which type of bankruptcy you’re filing for – Chapter 7 or Chapter 13. Think of it like choosing between a Snooki and a Springsteen concert; both have their perks, but one might be a better fit for your situation. Consult with a bankruptcy attorney to figure out which route is best for you.

Next, you’ll need to gather up allllll your financial documents. We’re talking bank statements, tax returns, pay stubs – the whole shebang. Organize them into a neat little pile, or at least try to make it look like you have your act together. Presentation is key, people.

Once you’ve got all your paperwork in order, it’s time to fill out those pesky bankruptcy forms. It’s like doing your taxes, but with more crying and less chance of a refund. Don’t worry, you’ll get through it – just remember to double-check everything and for the love of Bon Jovi, PLEASE proofread before you submit. Spelling errors don’t look good in bankruptcy court, trust us.

Navigating the Complex Interplay Between Back Taxes and Bankruptcy

It’s a tricky dance, folks. Back taxes and bankruptcy can make for a complicated tango that can leave you feeling like you’re doing the cha-cha through a legal minefield. But fear not! With a little guidance and a whole lot of determination, you can navigate your way through this complex interplay like a pro.

First things first, you’ve got to understand the rules of the game. Uncle Sam doesn’t mess around when it comes to taxes, so make sure you’ve got a handle on what you owe and to whom. It’s like trying to keep track of your crazy exes – you never know when they’re going to pop up and demand their pound of flesh.

Next, you’ll want to explore your options. Bankruptcy can be a lifeline for those drowning in debt, but it’s not a magic bullet. **Consider the following:**

- Chapter 7 vs. Chapter 13 – which one is right for you?

- Can back taxes be discharged in bankruptcy?

- Are there any alternative repayment plans available?

And remember, you’re not alone in this. Seeking out the advice of a professional can make all the difference. Think of them as your financial Sherpa, guiding you through the treacherous terrain of back taxes and bankruptcy with expertise and a smile (hopefully).

Strategies for Successfully Eliminating Tax Debt Through Bankruptcy

So, you’re drowning in tax debt and bankruptcy seems like the only way out? Fear not, my friend! Here are some strategies that will help you eliminate that pesky tax debt and start fresh:

First things first, make sure you hire a reputable bankruptcy attorney to guide you through the process. Trust me, you don’t want to try to navigate this complex legal system on your own. Let the professionals handle it while you focus on more important things, like binge-watching your favorite TV show.

Next, gather all your financial information and organize it like your life depends on it – because it kind of does. Make a list of all your assets, debts, and expenses. This will help you and your attorney come up with a solid plan of action to tackle that tax debt head-on.

Don’t forget to explore all your options when it comes to filing for bankruptcy. There are different types of bankruptcy, each with its own set of rules and consequences. Your attorney will help you decide which one is the best fit for your situation, so listen to their advice and try not to second-guess them too much.

Seeking Professional Guidance for Managing Back Taxes and Bankruptcy

If you’re drowning in back taxes and bankruptcy is knocking on your door, fear not! It’s time to seek professional guidance to help navigate these stormy financial waters. Here’s why you should consider reaching out:

- Expertise: Tax professionals and bankruptcy attorneys are like financial wizards, casting spells to make your money troubles disappear (or at least become more manageable).

- Peace of Mind: Instead of losing sleep over dreaded letters from the IRS or creditors, let professionals handle the heavy lifting while you catch up on some Z’s.

Remember, seeking help doesn’t mean you’re waving the white flag – it means you’re taking control of your financial future. So, don’t be afraid to pick up the phone, schedule a consultation, and start the journey to a brighter, debt-free tomorrow!

FAQs

Can I discharge my NJ back taxes in bankruptcy?

Absolutely! As long as you meet the criteria for discharging tax debts, you can include your NJ back taxes in your bankruptcy filing. Just make sure you have all the necessary documentation and consult with a bankruptcy attorney to ensure everything is in order.

What type of bankruptcy should I file for with NJ back taxes?

When it comes to dealing with NJ back taxes through bankruptcy, Chapter 13 is usually the way to go. This allows you to create a repayment plan over several years while still protecting your assets. However, every situation is unique, so it’s best to consult with a bankruptcy attorney to determine the best course of action for your specific circumstances.

Will I lose my property if I file for bankruptcy with NJ back taxes?

Not necessarily! Depending on the type of bankruptcy you file for and the exemptions available to you in New Jersey, you may be able to keep your property while still resolving your tax debts. It’s important to work with a knowledgeable bankruptcy attorney who can help you navigate the maze of back taxes and bankruptcy to ensure the best possible outcome for your situation.

Can I negotiate with the NJ Department of Revenue to settle my back taxes instead of filing for bankruptcy?

Yes, you can certainly try to negotiate with the NJ Department of Revenue to settle your back taxes outside of bankruptcy. However, this can be a tricky process and may not always be successful. If negotiations fail or if you’re facing overwhelming debt, bankruptcy could be a viable option to help you get back on track financially. Consulting with a bankruptcy attorney can help you weigh all your options and make an informed decision.

Don’t Get Lost in the Jersey Tax Jungle!

Whew! Navigating the maze of New Jersey back taxes and bankruptcy can be like trying to find your way out of a cornfield with a blindfold on. But with the right guidance and a sense of humor, you can make it through unscathed.

Remember, the key is to stay calm, ask for help when you need it, and keep pushing forward. And hey, if all else fails, just remember that at least you’re not lost in the actual New Jersey Turnpike traffic – now THAT’s a maze we wouldn’t wish on anyone!

So take a deep breath, buckle up, and get ready to conquer those back taxes and bankruptcies like the Jersey warrior you were meant to be. Good luck – we’ll see you on the other side!