New Jersey may be known for its beautiful beaches, delicious pizza, and colorful accent, but one thing it’s definitely not known for is its traffic fines. Ah, yes, the infamous New Jersey traffic ticket – a rite of passage for residents and out-of-state drivers alike. But what many don’t realize is that these pesky citations can do more than just drain your wallet – they can also wreak havoc on your car insurance rates. So buckle up, my fellow Garden State travelers, as we take a joyride through the wild world of New Jersey traffic ticket insurance impact.

Factors that Determine Insurance Impact of a Traffic Ticket in New Jersey

So, you got a traffic ticket in the Garden State, huh? Well, it’s not exactly a walk in the park. Your insurance rates are about to take a hit harder than a Jersey Shore fist-pump. But just how much damage will this little slip-up do to your wallet? Let’s break it down.

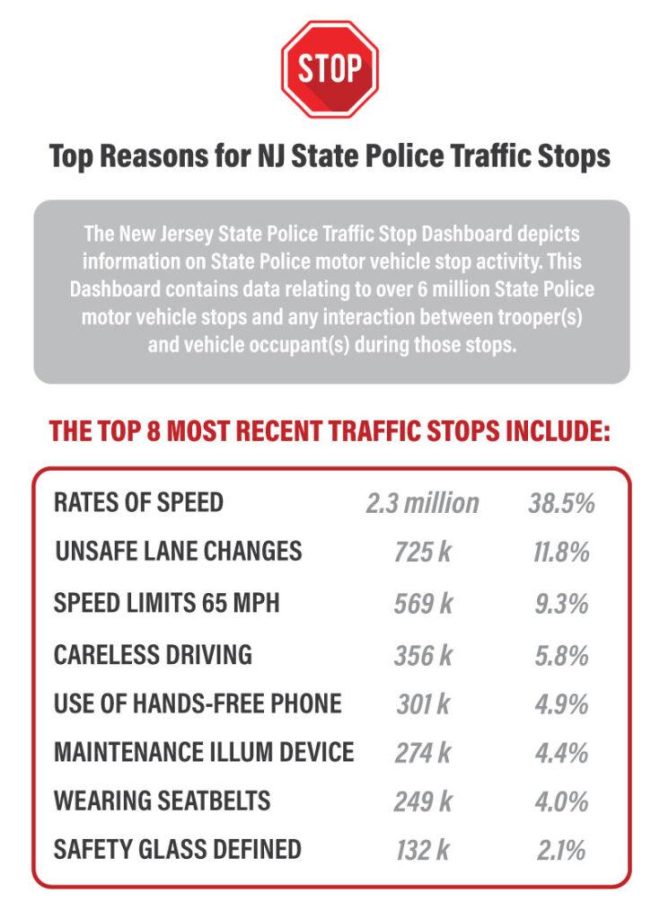

First off, **the type of violation** you received plays a huge role in determining how much your insurance rates will increase. From speeding tickets to running red lights, each offense carries its own weight. And trust me, your insurance company is keeping score.

Next up, **your driving record** is under a microscope. Have you racked up a laundry list of tickets in the past? Well, buckle up, because your insurance company is going to see that history and make you pay for it. It’s like having a permanent scarlet letter on your driving record.

Lastly, **the severity of the violation** can make or break your insurance rates. Did you cause a fender-bender or were you caught street racing? The more serious the offense, the more serious the impact on your insurance. Kiss those low rates goodbye.

Types of Traffic Violations that Can Increase Insurance Rates

So, you thought getting a ticket for going 5 mph over the speed limit was no big deal? Think again! Here are some types of traffic violations that can seriously drive up your insurance rates:

Speeding Tickets: Going fast and furious may be thrilling in the movies, but it’s not so fun when you’re slapped with a speeding ticket. Your insurance company sees you as a speed demon who’s just itching to cause an accident.Driving Under the Influence: Whoops, did you have a few too many at that party last night? Driving under the influence not only puts lives at risk, but it also puts a huge dent in your wallet. Say hello to those skyrocketing insurance premiums!Reckless Driving: Weaving in and out of traffic like a NASCAR driver may seem cool, but it’s a one-way ticket to higher insurance rates. Your insurance company will see you as a liability on the road and make you pay for it.

Remember, every time you break the rules of the road, your insurance company is watching. So, drive safe, obey the law, and maybe you won’t have to take out a second mortgage to pay for your insurance premiums!

How Insurance Companies Calculate Premiums after Receiving a Traffic Ticket

So, you’ve just received a delightful little traffic ticket that’s about to wreak havoc on your insurance premiums. How do those sneaky insurance companies come up with the magic number that will leave you crying at the bill? Let me break it down for you in the most entertaining way possible:

First and foremost, insurance companies take a good hard look at that shiny ticket you just received, and they rate it based on its level of badassery. Was it a simple speeding ticket, or did you decide to show off your Fast and Furious skills on the highway? The more outrageous the ticket, the higher your premiums will soar. It’s like their way of saying ”Nice try, Speed Racer, but we see you.”

Next up, insurance companies will check out your driving history to see if this traffic ticket was just a one-time fling or if you have a long-standing love affair with breaking the rules of the road. If you have a laundry list of violations, they’ll probably just start counting the cash already because let’s face it – you’re a liability on wheels.

And finally, insurance companies will put all this juicy information into their secret premium-calculation machine (I hear it’s powered by unicorn tears and dollar bills) and voila! Your new premium magically appears, leaving you to wonder if you should just invest in a good pair of roller skates to avoid any future tickets. But hey, at least you’ll have a funny story to tell at cocktail parties, right?

Ways to Minimize the Impact of a Traffic Ticket on Insurance Rates

So, you’ve found yourself with a pesky traffic ticket and now you’re worried about your insurance rates skyrocketing. Fear not, my friend! There are a few ways to minimize the impact of that dreaded piece of paper on your premiums.

First things first, consider taking a defensive driving course. Not only will this show your insurance company that you’re serious about becoming a safer driver, but it can also help reduce the points on your license. Plus, who wouldn’t want to spend a few hours listening to a monotone instructor drone on about the rules of the road?

Another option is to shop around for new insurance quotes. Sometimes, a different company may offer lower rates, even with a recent traffic violation on your record. It’s like trying to find the best deal on that designer handbag you’ve been eyeing – except in this case, the handbag is car insurance.

Lastly, **don’t be afraid to negotiate** with your current insurance provider. Explain the circumstances of the ticket and see if they can offer you any discounts or ways to offset the increase in rates. Who knows, maybe they’ll take pity on you and cut you some slack. It’s worth a shot, right?

Benefits of Hiring a Traffic Ticket Attorney to Fight the Charges in New Jersey

So, you’ve found yourself with a pesky traffic ticket in New Jersey? Don’t sweat it – that’s what traffic ticket attorneys are for! Here’s why hiring one to fight the charges is your best bet:

- No Courtroom Jitters: Have stage fright? No worries! Let your traffic ticket attorney take the stage for you. They’ll handle all the legal jargon and courtroom drama so you can sit back and relax.

- Expertise Galore: These legal eagles know their stuff - from traffic laws to courtroom procedures, they’ve got you covered. With their expertise, you’ll have a better chance at beating those pesky charges.

- Save Time and Stress: Who wants to spend hours poring over legal documents and stressing about court appearances? Not you! Let your attorney handle all the nitty-gritty details while you focus on more important things – like binge-watching your favorite Netflix show.

Remember, when it comes to fighting traffic tickets in New Jersey, hiring a traffic ticket attorney is the way to go. They’ll fight tooth and nail to get those charges dismissed, so you can hit the road without any legal headaches. So why wait? Call a traffic ticket attorney today and say goodbye to those pesky tickets!

Important Considerations for Drivers Facing Traffic Ticket Points and Insurance Increases in NJ

So, you got caught speeding or running a red light in the Garden State, huh? Well, buckle up and get ready for some important considerations if you want to avoid those traffic ticket points and insurance increases.

First things first, **don’t panic**! Take a deep breath and remember that you have options. Here are some key things to keep in mind:

- Defensive Driving Courses: Consider taking a defensive driving course to offset those pesky points on your driving record. It’s like going back to school, but without the cafeteria food!

- Consult with a Traffic Attorney: If you’re really in a pickle, it might be worth shelling out some dough to hire a traffic attorney. They know the ins and outs of the legal system and can help you navigate your way out of this mess.

- Appeal the Ticket: Did the cop catch you on a technicality? Challenge the ticket and see if you can get it dismissed. Who knows, maybe you’ll get lucky and the officer won’t show up to court!

Remember, getting a traffic ticket doesn’t have to be the end of the world. Stay calm, explore your options, and keep your sense of humor. After all, laughter is the best medicine – even when it comes to dealing with traffic violations in New Jersey!

FAQs

How much will my insurance rates increase after receiving a traffic ticket in New Jersey?

Well, that all depends on how much of a daredevil you were on the roads. Your insurance rates could go up anywhere from a smidge to a whole heaping pile of cash. It really just depends on the severity of the infraction and how many times you’ve been caught breaking the rules.

Can I fight a traffic ticket to prevent my insurance rates from going up?

Sure, you can try to fight it. You can whip out all the evidence you’ve got and make your case to the judge. But just remember, judges have heard every excuse in the book. So unless you’ve got a real doozy of a defense, you might be better off just accepting defeat and paying the fine.

How long will a traffic ticket impact my insurance rates in New Jersey?

Ah, the age-old question. Your insurance rates will feel the sting of that pesky traffic ticket for a good ol’ three years. That means three years of watching your hard-earned cash fly right out the window. Better start practicing your penny-pinching skills!

Is there any way to minimize the impact of a traffic ticket on my insurance rates?

Well, you could always try to sweet-talk your insurance company into cutting you a deal. Maybe if you promise to never break the law again (yeah, sure), they’ll take pity on you and give you a lower rate. It’s worth a shot, right? But don’t hold your breath – insurance companies aren’t known for their generosity.

Drive Safely and Keep Your Insurance Premiums Low!

Remember, getting a traffic ticket in New Jersey can have a big impact on your insurance rates. So, next time you’re out on the road, make sure to drive safely and obey all traffic laws. And if you do happen to get a ticket, don’t panic! Take the necessary steps to minimize the impact on your insurance premiums. With a little bit of caution and awareness, you can avoid those costly increases and keep your insurance rates low. Happy driving!