It’s a tale as old as time – you’re cruising down the New Jersey Turnpike, wind in your hair, Mariah Carey blaring on the radio, when suddenly you see those dreaded blue lights flashing in your rearview mirror. Yep, you’ve been busted for speeding, and now you’re not only facing a hefty ticket, but the dreaded spike in your car insurance rates. In this article, we’ll dive into the wild world of traffic tickets and their impact on your wallet – because let’s face it, getting pulled over is never a laughing matter… until now, that is.

Impact of Traffic Tickets on Insurance Premiums in New Jersey

So, you thought getting a traffic ticket was just a slap on the wrist? Think again! In New Jersey, the impact of traffic tickets on your insurance premiums can be more painful than stepping on a LEGO.

Here are some ways that those pesky tickets can make your insurance company reach for the Pepto-Bismol:

- Your insurance provider will see you as a bigger risk than someone who can actually parallel park without hitting the curb.

- They might raise your rates faster than you can say “I swear I didn’t see that stop sign.”

- And forget about any potential discounts – those are as elusive as a unicorn riding a tandem bicycle.

But fear not, there is a light at the end of the tunnel, or in this case, the tunnel of never-ending insurance payments. If you can prove that your ticket was a one-time slip-up, your insurance company may not raise your rates. So next time you’re cruising down the Garden State Parkway, keep your eyes on the road and your foot off the gas – your insurance premiums will thank you!

Factors Considered by Insurance Companies When Calculating Rates after Traffic Tickets

Well, well, well, you got yourself a pesky traffic ticket, huh? Don’t worry, we’ve all been there. But now it’s time to face the music – or in this case, the insurance adjusters! When insurance companies are calculating your rates after a traffic ticket, they take several factors into consideration. Here are a few of them:

- Driving Record: Your driving history speaks volumes about your risk as a driver. The more tickets you have, the higher your rates are likely to be. Think of it as a not-so-friendly reminder to ease off the gas pedal, speed racer.

- Type of Violation: Not all traffic tickets are created equal. A simple parking ticket won’t hurt you as much as a reckless driving citation. So next time you feel the urge to channel your inner Fast and Furious, maybe think twice.

- Location: Believe it or not, where you got your ticket can also impact your insurance rates. Urban areas with higher traffic congestion and accident rates are considered riskier than the calm countryside. Who knew a zip code could be so judgmental?

So there you have it – the not-so-secret sauce behind insurance companies’ rate calculations after traffic tickets. Just remember, every ticket is a learning opportunity. And hey, at least you’ll have a good story to tell at your next family dinner!

Average Increase in Insurance Premiums After Receiving a Traffic Ticket in NJ

Did you recently get a traffic ticket in the Garden State? Brace yourself for the impact it may have on your insurance premiums! The can vary depending on the severity of the offense, but one thing is for certain – it’s not going to be pretty!

For minor violations such as speeding or running a red light, you can expect to see your premiums go up by 10-20%. Not too bad, right? Well, hold your horses because if you were caught drunk driving or texting behind the wheel, you might be looking at a whopping 50-100% increase in your insurance rates!

So, next time you feel the urge to show off your need for speed or indulge in some multitasking while driving, think again! The consequences may not only be a hefty fine or points on your license, but also a significant dent in your wallet when it comes to your insurance premiums. Drive safe, folks!

Ways to Minimize the Impact of Traffic Tickets on Insurance Rates

So, you’ve gotten a pesky traffic ticket and now you’re worried about your insurance rates skyrocketing. Fear not, my friend! We’ve got some hilarious tips to help minimize the impact on your premiums.

First off, don’t just accept defeat and pay the ticket like a chump. Fight it like a warrior! Hire a traffic ticket lawyer to represent you in court. Who knows, maybe they’ll do some fancy legal jujitsu and get the ticket thrown out completely. It’s worth a shot, right?

Next, consider taking a defensive driving course. Not only will you learn how to drive like a pro, but many insurance companies offer discounts to drivers who complete these courses. Plus, you might actually have a blast dodging cones and parallel parking like a boss.

Lastly, if all else fails, consider shopping around for a new insurance provider. Some companies are more forgiving than others when it comes to traffic violations. Who knows, maybe you’ll find an insurer who appreciates your sense of adventure on the road. Or at the very least, one who doesn’t charge an arm and a leg for a silly speeding ticket.

Comparison of Insurance Rate Increases for Different Types of Traffic Violations in NJ

So you thought you could get away with that illegal U-turn, huh? Well, think again, because your insurance rates are about to take a hit harder than your car did that day. Turns out, different types of traffic violations in New Jersey can lead to some serious increases in your insurance premiums.

Let’s break it down, shall we? Here’s a little sneak peek into the world of insurance rate increases for various traffic violations:

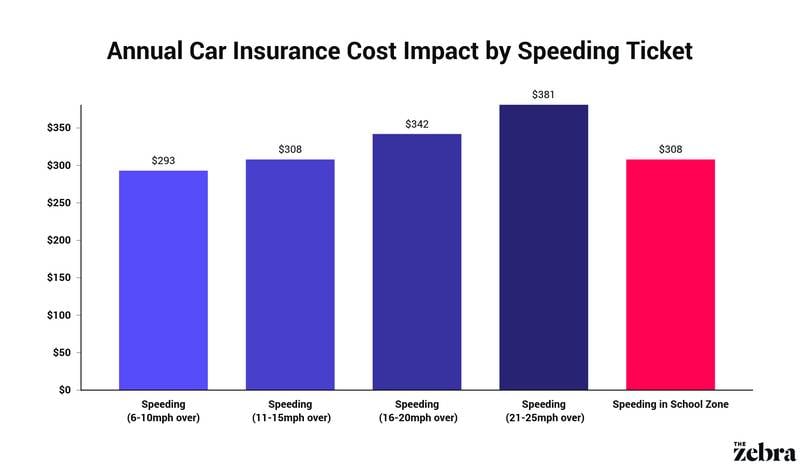

- Speeding Tickets: A classic rookie mistake. Speeding tickets can lead to an average increase of 22% in your insurance rates. So next time you’re running late, just remember that getting there a few minutes early isn’t worth the hefty price tag.

- Distracted Driving: Put down that phone! Distracted driving violations can result in a whopping 30% increase in your premiums. The only texts you should be sending are to your insurance agent asking for forgiveness.

- Driving Under the Influence: Oh boy, you really messed up this time. DUI violations can skyrocket your insurance rates by a jaw-dropping 75%. Because apparently, drunk driving isn’t just dangerous for the road, but also for your wallet.

So there you have it, folks. The next time you feel tempted to break the rules of the road, just remember that your insurance rates could end up paying the ultimate price. Drive safe and keep those premiums low!

Efforts to Keep Insurance Rates Low Despite Traffic Tickets in New Jersey

Believe it or not, getting a traffic ticket in New Jersey doesn’t have to mean the end of affordable insurance rates. There are ways to keep those premiums from going through the roof!

One way to keep insurance rates low despite traffic tickets is to take a defensive driving course. Not only will you learn valuable skills to become a better driver, but many insurance companies offer discounts for completing these courses.

Another option is to opt for a higher deductible. While it may mean shelling out more money upfront in the event of an accident, choosing a higher deductible can often lead to lower monthly premiums.

Lastly, consider shopping around for insurance quotes. Different companies have different criteria for determining rates, so you may be able to find a more affordable option by exploring your options.

Benefits of Safe Driving in Maintaining Affordable Insurance Rates in NJ

Safe driving is like a magical potion that keeps your insurance rates down and your wallet happy. Not only will you avoid costly accidents and tickets, but you’ll also impress your insurance company with your stellar driving record. It’s like being the favorite child who always colors inside the lines – you get all the rewards!

By practicing safe driving habits, you can enjoy perks like no claims bonuses and discounts on your premiums. Just imagine all the fun things you could do with the extra money you save – like treating yourself to a fancy dinner or splurging on a new pair of shoes. Who knew safe driving could be so rewarding?

Plus, driving safely means fewer headaches and heartaches on the road. No more white-knuckling it through traffic or dealing with insurance claims. It’s like being a zen master behind the wheel, calmly cruising through life with a smile on your face.

So, next time you hit the road, remember to channel your inner driving guru and reap the benefits of safe driving. Your insurance rates will thank you, and you’ll be the envy of all the reckless drivers out there. Keep calm and drive on!

FAQs

How do traffic tickets affect insurance rates in New Jersey?

Well, let’s just say that getting a traffic ticket in New Jersey is like adding hot sauce to your insurance premium – things are about to get spicy! Your insurance rates can definitely take a hit after getting a traffic ticket, especially if it’s for a serious violation like speeding or reckless driving.

Is there a difference in insurance rate increases for different types of traffic tickets?

Absolutely! Not all traffic tickets are created equal in the eyes of insurance companies. Minor offenses like a parking ticket might only give your insurance rate a little kick, while major violations like a DUI can send your premium skyrocketing faster than a New Jersey turnpike toll booth.

How long do traffic tickets affect insurance rates in New Jersey?

Like a bad ex, traffic tickets can haunt you for a while in New Jersey. Depending on the severity of the violation, it’s not uncommon for a traffic ticket to impact your insurance rates for at least three to five years. That’s a long time to pay for a momentary lapse in judgement!

Are there any ways to lower insurance rates after getting a traffic ticket?

Yes, there are a few tricks up our sleeves to try and soften the blow of a traffic ticket on your insurance rates. One option is to take a defensive driving course to show your insurance company that you’re serious about being a safer driver. You can also shop around for different insurance companies to see if you can find a better rate elsewhere – kind of like speed dating for insurance!

Any final advice for New Jersey drivers facing a traffic ticket and higher insurance rates?

Don’t lose hope, my Garden State friends! While traffic tickets can be a pain in the bumper, there are ways to bounce back and get your insurance rates back on track. Just remember to drive safely, keep an eye out for speed traps, and maybe invest in a good radar detector – it’s like having your own personal traffic cop lookout!

Slamming on the Brakes

Well, folks, it looks like getting a traffic ticket in New Jersey isn’t just a pain in the wallet – it’s a pain in the insurance rates too! But fear not, there are ways to combat those pesky increases and keep your coverage affordable. So slow down, use those blinkers, and remember – the only race worth winning is the one to lower insurance premiums!