Have you ever received a traffic ticket in the Garden State and felt like your insurance rates skyrocketed faster than a Jersey Shore fist pump? Well, fear not, because we’re here to help you navigate the murky waters of deciphering those pesky insurance increases. So buckle up, grab a cannoli, and let’s dive into the wild world of NJ traffic ticket insurance hikes.

Understanding Traffic Ticket Point System in New Jersey

So, you got yourself a lovely traffic ticket in the beautiful state of New Jersey. But what’s this about a point system? Don’t worry, we’re here to break it down for you in a way even a squirrel crossing the road could understand.

First off, each traffic violation comes with a certain number of points. The more serious the offense, the more points you’ll get. Accumulate too many points, and you might as well start packing your bags for driving school.

Now, before you start panicking and hyperventilating into a paper bag, take a deep breath. We’ve got some tips to help you steer clear of those pesky points. Avoiding those points is as easy as:

- Obeying traffic laws like it’s your new religion

- Keeping your road rage in check – no need for Mario Kart maneuvers in real life

- Being as alert as a cat in a room full of laser pointers

So there you have it, the lowdown on New Jersey’s traffic ticket point system. Just remember, a little bit of caution and common sense goes a long way on those Garden State roads. Happy driving, folks!

Effect of Traffic Tickets on Insurance Premiums

Have you ever received a traffic ticket and felt your heart sink knowing that it could potentially impact your insurance premiums? Well, you’re not alone! Traffic tickets are like little black clouds that follow you around, threatening to rain on your parade of good driving record.

So, what exactly is the , you ask? **Buckle up**, because here’s the lowdown:

- Insurance companies view traffic tickets as a red flag, signaling that you may be a high-risk driver. This means they may increase your premiums to cover the added risk of insuring you.

- Depending on the severity of the traffic violation, your insurance premiums could skyrocket faster than a speeding bullet. **Yikes!**

- But fear not, all hope is not lost! Some insurance companies offer forgiveness programs or **sweet discounts** for completing defensive driving courses to help mitigate the impact of your traffic ticket on your premiums.

So, the next time you’re tempted to ignore that stop sign or speed through a yellow light, remember that the potential consequences go beyond just a slap on the wrist. **Drive safe and keep those insurance premiums in check!**

Factors that Influence Insurance Increases After Traffic Tickets

So you got a traffic ticket, huh? You might think a little fine is the worst of your worries, but oh boy, you couldn’t be more wrong! Those pesky traffic tickets can wreak havoc on your insurance rates faster than you can say “speeding ticket.”

Here’s a sneak peek at the factors that can send your insurance premiums skyrocketing:

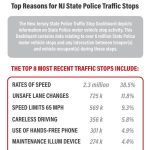

- Type of violation: Not all traffic tickets are created equal. While a simple parking ticket might barely make a dent in your premiums, getting caught speeding or texting while driving can send your rates through the roof.

- Number of violations: If you’re collecting tickets like Pokemon cards, insurance companies will take notice. The more infractions on your record, the higher the risk you pose to them – and the higher your rates will climb.

But wait, there’s more! Insurance companies also consider:

- Driving record: If your driving history reads like a horror novel, with accidents, tickets, and maybe a few car chases thrown in for good measure, expect your insurance rates to reflect that.

- Age and experience: Sorry, young drivers – insurance companies see you as a liability. Coupling that with a couple of traffic tickets, and you’ve got a recipe for some seriously inflated premiums.

How Insurance Companies Calculate Premium Increases for Traffic Violations

So, you got a little too trigger-happy with the gas pedal and now you’re facing a premium increase from your insurance company. How do those sneaky little devils calculate those pesky rate hikes, you ask? Well, buckle up, because I’m about to break it down for you.

First off, insurance companies love to play detective when it comes to your driving record. They’ll scour every last detail, from the number of speeding tickets you’ve racked up to the severity of those violations. Think of them as the Sherlock Holmes of the insurance world, but with a penchant for dinging your bank account.

Next, they’ll whip out their trusty little actuarial tables and start crunching numbers faster than a squirrel on a caffeine high. They’ll take into account things like the likelihood of you getting into an accident based on your past behavior behind the wheel. It’s like they’ve got a crystal ball that predicts your every fender-bender.

And just when you thought it couldn’t get any worse, they’ll throw in a dash of their special sauce – risk assessment. They’ll evaluate your overall risk profile, factoring in everything from your age and gender to the type of car you drive. It’s like they’ve got a secret formula that magically turns your minor infraction into a major headache.

Strategies to Minimize Insurance Rate Hikes Due to Traffic Tickets

So, you’ve got a lead foot, huh? Well, fear not! There are ways you can avoid those pesky insurance rate hikes that come with getting traffic tickets. Follow these strategies and keep your wallet happy:

First off, make sure you pay your fines on time. Don’t procrastinate (like you probably did with that speeding ticket). Late payments can result in additional fees, which will only add insult to injury. Keep track of your due dates and avoid those unnecessary charges.

Next, consider taking a defensive driving course. Not only will it help improve your skills on the road, but many insurance companies offer discounts for completing these courses. Plus, you can impress your friends with your newfound expertise in defensive maneuvers (just don’t show off too much!)

Lastly, shop around for different insurance providers. Don’t settle for the first quote you receive – compare prices and coverage options from multiple companies. You might be surprised at the savings you can find by simply doing a little research. And remember, a penny saved is a penny you can use to pay off that next traffic ticket!

Seeking Professional Help to Challenge Traffic Tickets and Insurance Increases

So, you’ve found yourself in a bit of a pickle with a pesky traffic ticket and the looming threat of insurance increases. Don’t fret, my friend! It’s time to call in the big guns and seek out some professional help to challenge these annoyances.

Picture this: you, sitting in a stuffy courtroom all by your lonesome, trying to defend yourself against a seasoned prosecutor. It’s like bringing a spoon to a knife fight! But fear not, with the help of a skilled traffic ticket attorney, you’ll have a legal gladiator in your corner ready to battle it out on your behalf.

And let’s not forget about those dreaded insurance increases. One ticket can send your rates skyrocketing faster than a squirrel scaling a tree. But with a knowledgeable insurance specialist on your side, you can potentially negotiate with your provider to minimize the damage and keep more money in your pocket.

So, why stress and sweat over traffic tickets and insurance hikes when you can enlist the help of professionals who eat, sleep, and breathe this stuff? Take a load off, sip a fancy coffee, and let the experts handle the nitty-gritty details. Trust me, your wallet and sanity will thank you!

FAQs

Why did my car insurance premium increase after receiving a traffic ticket in NJ?

Well, it’s simple really. Your insurance company sees that traffic ticket as a red flag – or maybe more of a flashing neon sign – that you might be a riskier driver than they initially thought. So, they bump up your premium to cover their bases. Basically, that ticket is like a scarlet letter for your wallet.

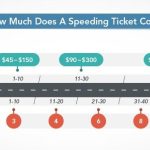

How much can I expect my insurance premium to increase after getting a traffic ticket in NJ?

That’s a tricky one. It really depends on the specific violation you committed and your insurance company’s policies. But let’s just say, you might want to start cutting back on those fancy lattes if you want to afford your new premium.

Is there anything I can do to mitigate the increase in my insurance premium after getting a traffic ticket?

Unfortunately, once that ticket is on your driving record, there’s not much you can do to make it disappear. But you could try begging, pleading, or maybe even a little bribery? Just kidding! (But seriously, don’t try bribery). Your best bet is to just suck it up and pay the higher premium. Maybe carpooling or riding a bike more often could help you save some cash, and hey, it’s good for the environment too!

Drive safely, save money!

Congratulations! You’ve now mastered the art of deciphering those pesky NJ traffic ticket insurance increases. Remember, the key to keeping your rates low is to avoid getting tickets in the first place. So put on your driving gloves, buckle up, and hit the road with confidence. And if all else fails, just blame it on the GPS!