Ah, the dreaded traffic ticket. That little piece of paper that seems to have magical powers – not only can it put a dent in your wallet, but it can also leave a lasting mark on your New Jersey“>insurance rates. In the great state of New Jersey, where traffic congestion is practically a way of life, the impact of these pesky tickets on your insurance premiums can feel like a never-ending cycle of punishment. But fear not, fellow drivers, for we are here to explore just how those pesky tickets can wreak havoc on your insurance rates in the Garden State. So buckle up and get ready for a bumpy ride through the world of New Jersey insurance rates and traffic violations!

Factors Considered by Insurers

When it comes to insurance, there are a multitude of factors that insurers take into consideration before determining your rates or coverage options. While some may seem straightforward, others may leave you scratching your head in confusion. Here are some of the top factors that insurers look at:

- Driving Record: If you’ve been known to have a lead foot or constantly get caught rolling through stop signs, insurers will definitely take notice. Remember, speed limits are there for a reason!

- Credit Score: Yes, you read that right. Your credit score can actually impact your insurance rates. So, think twice before maxing out that credit card on that fancy new gadget.

- Type of Vehicle: If you’re driving a souped-up sports car, chances are your insurance rates will reflect that. Better start saving up for those speeding tickets!

Other factors such as where you live, your age, and even your occupation can also come into play when it comes to insurance. So, the next time you’re filling out an insurance application, just remember that insurers are always watching and judging. Perhaps it’s time to start taking public transportation…

Potential Increase in Premiums

So, you know how everyone loves insurance premiums, right? Well, get ready for a potential increase in those bad boys! It’s like winning the lottery, except instead of winning money, you get the joy of paying more for insurance. How exciting!

Why might your premiums go up, you ask? Oh, just your typical reasons – like inflation, changes in industry trends, and the fact that insurance companies just really love money. But hey, look on the bright side – at least you’ll be helping keep those insurance executives in their luxury yachts!

But don’t worry, it’s not all doom and gloom. There are ways you can potentially avoid an increase in premiums. You could try driving less, not getting sick, or maybe even living in a bubble to avoid any potential risks. Remember, it’s all about that insurance company life!

So, the next time you see that letter in the mail informing you of a , just remember to smile and say “thank you” to your insurance provider. After all, who needs extra money in their bank account when you can just give it all to them instead, am I right?

Types of Traffic Tickets

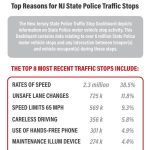

Getting a traffic ticket is almost like a rite of passage for drivers. Whether you’re guilty of speeding, running a red light, or committing some other driving sin, there’s a ticket out there with your name on it. Here are some of the most common that drivers can rack up:

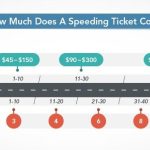

- Speeding Ticket: The classic traffic violation that every driver has likely received at least once in their lifetime. Going over the speed limit is practically a right of passage.

- Red Light Ticket: Running a red light can bring on a whole new level of shame and frustration. It’s like a spotlight showing the world your driving incompetence.

- Parking Ticket: The sneaky ticket that always seems to appear when you least expect it. Nothing ruins your day quite like finding that bright yellow slip of shame on your windshield.

And let’s not forget about the dreaded Cell Phone Ticket. Whether you were texting, talking, or taking a selfie, getting caught using your phone while driving can result in a hefty fine - and a bruised ego.

Point System in New Jersey

In the wild world of New Jersey driving, navigating the point system can feel like a daunting task. But fear not, intrepid drivers! We’re here to break it down for you in a way that’s both informative and, dare we say, fun.

First and foremost, it’s important to understand that the is like a game of Mario Kart – but instead of collecting bananas and shells, you’re racking up points for every traffic violation you commit. So buckle up, put on your driving gloves, and let’s dive into the world of New Jersey’s point system!

Now, picture this: you’re cruising down the Garden State Parkway, feeling like a true road warrior. Suddenly, you realize you’ve just run a red light. Uh oh, that’s gonna cost you a cool four points on your driving record. But fear not, dear driver - all is not lost! With a little bit of driving savvy and a whole lot of luck, you can work your way back to a clean record.

So remember, fellow road warriors, drive safe, keep your eyes on the road, and watch out for those pesky speed traps. And who knows, with a little bit of luck and some good driving karma, you might just make it to the finish line with zero points to your name. Happy driving!

Steps to Reduce Insurance Rates

So, you’re tired of those high insurance rates, huh? Well, fear not, my friend! I’ve got some top-notch tips to help you lower those pesky premiums. No need to thank me, just sit back, relax, and read on.

First things first, **shop around**, my dear. Don’t settle for the first quote you get. Compare prices from different insurance companies and see who’s offering you the best deal. It’s like online dating, but for insurance…oh, the irony!

Next up, **drive safely** or at least pretend to. Avoid getting those pesky traffic violations and accidents on your record. Your insurance company is watching your every move like a hawk, so try not to give them any reason to bump up your rates. It’s like a game of hide and seek, but with your wallet!

Lastly, **bundle up**, baby! Just like those winter clothes keeping you warm, bundling your insurance policies can save you a pretty penny. Combine your auto, home, and maybe even your pet insurance (yes, that’s a thing) with one company and watch those rates drop faster than a hot potato.

Importance of Safe Driving

Driving safely is crucial, especially if you want to avoid turning your car into a giant paperweight. Here are some reasons why safe driving is important:

When you drive safely, you decrease the chances of getting into a sketchy situation on the road. No one wants to be in a bumper-to-bumper traffic jam with a group of angry drivers. It’s like being stuck at a party where everyone is waiting for the chips and dip to arrive.

By practicing safe driving habits, you also protect yourself and the other drivers around you. It’s like creating a force field of good vibes that keeps everyone safe on the road. Plus, who doesn’t want to avoid awkward insurance claims that involve explaining how you got your car lodged in a tree?

Remember, driving safely doesn’t just mean obeying traffic laws. It also means keeping your eyes on the road and your hands on the wheel. Think of it as multitasking, but without the added stress of trying to drink coffee and answer emails at the same time. Safety first, folks!

Effects of Multiple Traffic Violations

Getting caught for multiple traffic violations can really put a dent in your day. Aside from the obvious consequences like fines and points on your license, there are some other pretty quirky effects that you might not have considered:

So you thought speeding tickets were bad? Try getting caught running a red light, not using your turn signal, and driving without your seatbelt all in the same day. The universe clearly has it out for you at this point. Next thing you know, you’ll be getting pulled over for jaywalking.

Think you can outsmart the system by avoiding paying your tickets? Think again. The karma police will find you, and they will make sure you pay – one way or another. Maybe your car will spontaneously break down on the way to work every day for the next week. Or maybe you’ll mysteriously wake up with a parking boot on your car. Who knows?

But hey, it’s not all bad. Maybe all these traffic violations are just a sign that you’re destined for a career in the Fast and Furious franchise. Vin Diesel, watch out – there’s a new driver in town, and they’re not afraid to break a few rules along the way. Just make sure to buckle up, because it’s gonna be a wild ride.

FAQs

Why do traffic tickets affect insurance rates in New Jersey?

Well, it’s because insurance companies see tickets as red flags. They think, “If this person can’t follow the rules of the road, how can they be trusted to not crash into things?”

Do all traffic tickets have the same impact on insurance rates?

No, it’s like a traffic ticket beauty pageant. Some tickets are like the Miss Congeniality of tickets – they won’t do too much damage. But then there are those tickets that are the Regina George of tickets – they’ll definitely make your insurance rates go up.

How long do traffic tickets affect insurance rates in New Jersey?

Think of it like a bad breakup – it takes time to heal. Typically, tickets have an impact on your insurance rates for about three years. So, if you get a ticket, you’ll be paying for it longer than that time you accidentally liked your ex’s Instagram photo from three years ago.

Can I do anything to lower my insurance rates after getting a traffic ticket?

Yes, you can try to sweet talk your insurance company. Send them a fruit basket with a note that says, “Please don’t raise my rates.” But in all seriousness, you could take a defensive driving course to show them you’re really trying to be a better driver. It’s like a peace offering, but for insurance companies.

Slow Down and Save Some Dough!

Well, folks, we’ve reached the end of our journey through the wacky world of traffic tickets and their impact on NJ insurance rates. Remember, speeding may get you to your destination a few minutes faster, but it’ll also cost you a few bucks more in insurance premiums. So next time you’re tempted to put the pedal to the metal, think of your wallet and hit the brakes instead. Your bank account will thank you!