Are you tired of playing a real-life version of Mario Kart every time you hit the roads in New Jersey? Well, buckle up because we’re about to break down the impact of those pesky traffic tickets on your insurance rates. Spoiler alert: it’s not as fun as collecting power-ups and dodging banana peels. So grab a snack, settle in, and let’s dive into the wild world of speeding tickets, red light cameras, and the never-ending cycle of insurance rate hikes. Let the games begin!

Factors considered by insurance companies

Insurance companies have a reputation for being picky about who they insure – it’s not just about paying your premiums on time, folks! Here are some of the factors insurance companies consider when deciding whether or not to offer you coverage:

- Age: Sorry, but there’s no getting around the fact that insurance companies see young drivers as nothing but trouble. They can smell your youthful recklessness from a mile away.

- Driving record: If you’ve racked up more speeding tickets than a NASCAR driver, don’t be surprised if insurance companies slam the brakes on your coverage.

- Location: Living in a high-crime area? You might as well just hand over your wallet to the insurance company now.

- Occupation: Don’t be fooled - insurance companies aren’t just nosy, they’re judgy too. If you’ve got a job that involves jumping out of planes or wrestling alligators, they’re going to make you jump through hoops for coverage.

How traffic tickets affect insurance rates

Traffic tickets! We’ve all been there – the dreaded flashing lights in your rearview mirror, the sinking feeling in your stomach as you realize you’ve been caught red-handed. But what you may not realize is that those seemingly innocent little pieces of paper can have a big impact on your insurance rates!

So, how exactly do traffic tickets affect your insurance rates? Well, buckle up, because we’re about to take you on a wild ride through the world of speeding fines and increased premiums!

First off, getting a traffic ticket is like ringing the dinner bell for insurance companies. They see that little piece of paper and start salivating at the thought of jacking up your rates. It’s like they have a secret hotline to the DMV that lets them know every time you get cited for rolling through that stop sign on your way to work.

But fear not, dear driver! There are ways to mitigate the damage. By keeping a clean driving record, taking a defensive driving course, or even just switching to a less aggressive insurance provider, you can avoid the worst of the rate hikes. Just remember – drive safe, and watch out for those sneaky cops hiding behind billboards!

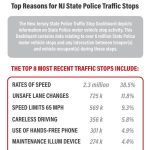

Common traffic violations in New Jersey

When driving in the Garden State, it’s essential to know some of the most common traffic violations that can land you in hot water. Here are some of the most frequent offenses you might encounter on the roads of New Jersey:

- Speeding: We’ve all been guilty of trying to beat the clock, but speeding can lead to hefty fines and points on your license. Slow down and enjoy the journey!

- Running red lights: It may seem like a good idea at the time, but running red lights is a surefire way to end up with a ticket. Remember, it’s not worth risking your safety or the safety of others just to save a few seconds.

Another common violation in New Jersey is reckless driving. We get it, sometimes you just want to let loose on the open road, but weaving in and out of traffic or driving erratically can lead to serious consequences. And let’s not forget about distracted driving – texting, eating, or putting on makeup while driving is a recipe for disaster. Keep your eyes on the road and your hands on the wheel!

So next time you hit the road in New Jersey, remember to follow the rules of the road and steer clear of these common traffic violations. Stay safe out there, and may your journey be smooth sailing!

Point system for traffic violations in NJ

In the Garden State, we take our traffic violations seriously. That’s why New Jersey has implemented a point system to keep drivers in check. So, if you’re thinking about ignoring that stop sign or speeding down the highway, think again!

Here’s how it works: every time you are convicted of a traffic violation, you’ll receive a certain number of points on your driving record. These points can add up quickly, leading to hefty fines, license suspensions, and even higher insurance premiums. To help you navigate this system, we’ve broken down some common traffic violations and their corresponding point values:

- **Running a red light**: 2 points

- **Speeding 1-14 mph over the limit**: 2 points

- **Driving with a suspended license**: 3 points

- **Distracted driving (e.g. texting while driving)**: 4 points

Remember, accumulating too many points can have serious consequences, so it’s best to drive safely and avoid those tickets altogether. Stay vigilant on the road, follow the rules of the road, and keep those points off your record!

Steps to reduce insurance rates after receiving a traffic ticket

So, you recently got caught speeding and now your insurance rates are through the roof. Before you start considering selling your car and taking up public transportation, take a deep breath and follow these steps to reduce those pesky insurance rates:

First things first, **consider taking a defensive driving course**. Sure, it may not be the most exciting way to spend a weekend, but it can show your insurance provider that you’re serious about improving your driving skills. Plus, you might just pick up some handy tips to avoid getting another ticket in the future.

Next up, **shop around for a better insurance rate**. Just because your current provider jacked up your rates doesn’t mean you have to stick with them. Take the time to compare quotes from different companies and see if you can find a better deal. Who knows, you might even end up saving some money in the process.

Lastly, **be a model driver**. It may sound simple, but following the rules of the road is the best way to prevent getting more tickets and keeping your insurance rates low. So, buckle up, use your turn signals, and for the love of all things good, stop texting while driving. Your wallet (and your fellow drivers) will thank you.

Legal options for fighting a traffic ticket in NJ

If you’ve been slapped with a pesky traffic ticket in the great state of New Jersey, fear not! There are plenty of legal options at your disposal to fight back against those highway bullies.

First off, you could consider hiring a smooth-talking lawyer to handle your case. These legal eagles are trained to navigate the treacherous waters of traffic court and will do everything in their power to get that ticket dismissed. Plus, watching them in action is like witnessing a live episode of Law & Order – except with more outrageous wigs.

If hiring a lawyer isn’t quite your style, you could always take matters into your own hands and represent yourself in court. Sure, it might be a little nerve-wracking, but think of the adrenaline rush! And who knows, you might discover a hidden talent for courtroom drama that you never knew you had.

And let’s not forget about the magical world of plea bargaining. This nifty little trick involves negotiating with the prosecution to reduce your charges or penalties in exchange for a guilty plea. It’s like striking a deal with the devil, but hey, desperate times call for desperate measures, am I right?

FAQs

Will getting a traffic ticket in NJ automatically raise my insurance rates?

No, it won’t automatically raise your rates, but it definitely won’t help. Think of it like stepping on a Lego - sure, you could walk it off, but it’s still gonna hurt for a while.

How much can I expect my insurance rates to go up after getting a traffic ticket?

Well, that really depends on the severity of the ticket. It’s like trying to predict the weather in NJ – it could be a mild drizzle or a full blown hurricane.

Is there any way to avoid a rate increase after getting a traffic ticket?

Sure, you can try to sweet talk your insurance company, maybe bake them some cookies or write a heartfelt apology letter. But let’s be real, they’re more interested in your driving record than your baking skills.

How long will a traffic ticket affect my insurance rates in NJ?

Like a bad haircut, a traffic ticket can haunt you for a while. Typically, it can stick around on your record for a few years, just waiting to remind you of that one time you thought yellow meant speed up.

Drive safe and save those dollars!

So, next time you’re on the road, remember that those pesky traffic tickets can really hit your wallet hard when it comes to your insurance rates. But fear not! Armed with this knowledge, you can now drive more cautiously, avoid those tickets, and keep your hard-earned money where it belongs - in your pocket! Stay safe out there, folks!